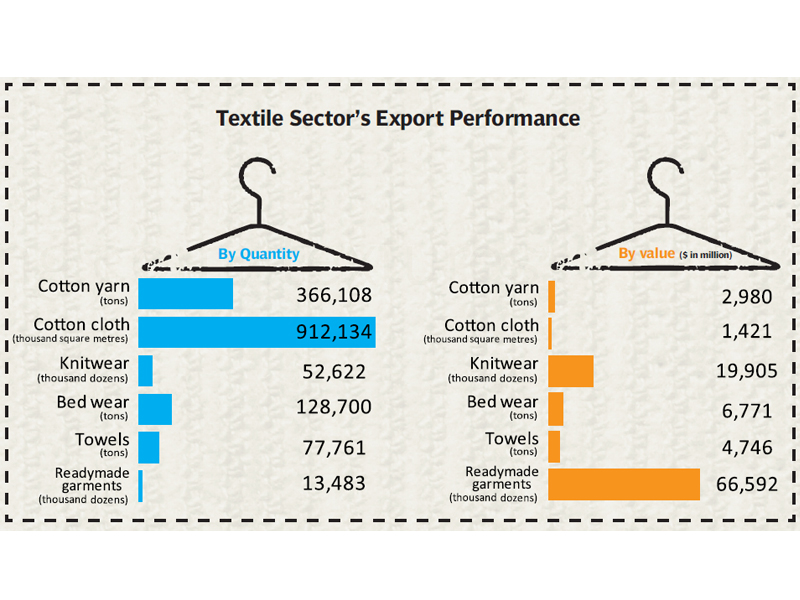

The textile sector enjoys a pivotal position in the exports of Pakistan. The contribution of this industry to total gross domestic product (GDP) is 8.5%. It provides employment to about 15 million people, 30% of the country’s workforce of about 49 million. The annual volume of total world textile trade is $18 trillion which is growing at 2.5%. But Pakistan’s share is less than one per cent.

The past few years, however, have probably been the worst ever for the textile sector in Pakistan. Some of it is obviously not their fault, but some of it is. For example the power crisis, the security situation and the lack of access to global markets has certainly had an effect on the ability of the industry to compete.

However, a lot of it is definitely the fault of the textile industry which for the most part has failed to use the decades of protectionism to its advantage and invest in value addition, in innovation and in improving technology to ensure that they move higher in the value-added chain.

For example our total exports of ready-made garments, which sit at the top of the value-added chain is just about a billion dollars or less than 10% of our total textile exports.

The country has almost zero share of branded and high-value fashion and sportswear textile in global markets, despite huge public demand for such products in Europe and the US, which is being fulfilled by our South Asian competitors, including India, China and Bangladesh. Pakistan’s total exports in this sector are barely $50 million.

Pakistan gets about $10.2 billion of its $12.5 billion textile export revenue from 20 countries. However, it accounts for merely 5.7% of the total textile imports of these 20 countries.

China is the second largest buyer of Pakistani textiles, importing $1.527 billion of textiles last fiscal. Unlike US where mostly value added textiles are imported, China buys only cotton yarn and cotton fabric from Pakistan.

And the Chinese appetite for yarn is about to go up, exponentially. China’s aggressive cotton stockpiling policy has pushed up domestic prices, forcing the world’s largest textile industry to boost imports of yarn by as much as a third in 2013, while production moves to southeast Asia, drawn by lower costs there.

Beijing’s stockpiling moves, launched in 2011 and designed to support farmers, have held domestic cotton prices about 40% above world levels as the country has built a reserve that traders estimate to stand at about 10 million tons.

Chinese textile mills are turning to neighbours such as India and Pakistan to buy cotton yarn.

China’s cotton yarn imports from September to November 2012 rose 56% year-on-year to 409,877 tons. Imports over the year to August 2012 were 1.3m tons for an annual increase of 43%, according to official customs data published by industry website cncotton.com. But traders say the actual figure could be more than twice that, if the official data is combined with cargoes imported through border trade with Vietnam.

China is expected to issue extra cotton import quotas to textile mills in April after purchases for the government’s stockpile cut domestic supplies.

The market expects Beijing to allocate as much as 800,000 tons of import quotas, most of which will be issued to textile mills that export their products. That will add to 894,000 tons of low-tariff quotas issued earlier this year.

So what does that leave Pakistan with? Frankly speaking, it leaves us with lots and lots of untapped potential. Pakistan already exports about 70% of its total yarn exports to China and Hong Kong. So if demand jumps 50% or more, the impact on Pakistan yarn exports can be huge, which coupled with falling local demand could be a lifeline for a large sector of our industry.

Pakistani textile products accounted for a meagre 3.3% or $1.07b of total UK’s textile imports in previous fiscal

Pakistan’s textile exports accounted for 12.4% or $4.61b of total Chinese textile imports in fiscal 2012

Pakistan accounted for just 2.98% or $2.98b of total US’s textile imports in the fiscal year 2011-12

Pakistani textile products accounted for a paltry 1.6% or $0.88b of total German textile imports in the fiscal year 2011-12

Pakistani textile products accounted for 0.7% or $0.888b of total Indian textile imports in fiscal 2012

Published in The Express Tribune, March 18th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (7)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732147514-0/Ellen--(1)1732147514-0-165x106.webp)

1732132039-0/Fortnite-(2)1732132039-0-165x106.webp)

it amazes me how you said that there is a lot of untapped markets/opportunities available and concluded the article... very sorry to say the writer of article doesnt even have a clue of what the textile industry of pakistan is and why it is lethal for our country! I by no means object the facts quoted, they must be 100% accurate but the writer has merely ignored the fact that a major reason the textile industry is important to us is that when pakistan produces textiles starting from exporting cotton to exporting finished garment the most number of people employed and the highest value addition done is after the yarn has been spun and is made into ready made garments which are then shipped to western countries which brings the real benefit if pakistan exports all the yarn produce and the govt. encourages that maybe pakistan can benefit on a micro level but the opportunity cost of the export is immense, as china our second biggest buyer would import the yarn, add value to it and earn a very high margin + give employment to millions of workers and make the most money of a resource produced and half processed in pakistan. being in the industry let me tell you mr. writer Pakistan is the developer of more than 60% of the types of fabrics and finishes available in the world today so lack of RnD was never there! pakistan is a cotton growing country, the way to bring the textile industry back to where it was would be to discourage exports of semi finished textiles(yarn) so only finished garments could be exported therefore the maximum revenue and employment could be acheived!

why textile looms are now adays in touble?

It always amazes me that your largest customer is viewed as your enemy in Pakistan - it's as though the man on the street has no clue that your economy is dependent on the very country you want to cut off relations with. Your best buddy China maybe a big customer but they buy low margin yarn which they spin into high margin finished products which they then turn around and compete with you for business with the USA.

@Author : . Pakistani textile products accounted for 0.7% or $0.888b of total Indian textile imports in fiscal 2012 . If US$ 0.888 Billion is 0.7 Per Cent of Total Indian Textile Imports then India's Total Textile Imports i.e. 100 Per Cent would be in Excess of US$ 126 Billion . All Figures in US$ Billion of for the Financial Year April 2011 – March 2012: . OtherTextile yarn,fabrics,etc :......1.84987 . Cotton yarn and fabrics :.............0.25602 . Made up textile articles :.............0.33011 . Ready made garments(wov.) :....0.31568 . Total Textile Imports :.................2.75168 .E. & O. E. . Basis India Importing US$ 0.888 Billion from Pakistan works out to a Figure of 32.27 Per Cent of India’s Cotton Textile Imports. . Cheers

Good article. An estimate of just how much money has been spent on textile subsidies would have been nice. On the face of it, the textile industry seems complacent. It's the "too big to fail" syndrome I suspect. Why innovate when you know the government will come help.

Excellent article due to provision of context, proper research and succinct presentation. This will prove helpful for my business activities.