Corporate results: Dry wells soak up OGDC’s otherwise strong performance

Explorer announces exceptional profit of Rs49 billion, but below market expectations.

The explorer also declared an interim dividend of Rs2 per share taking the total payout for the half year to Rs3.75.

The market mover oil and gas explorer –Oil and Gas Development Company – announced its semi-annual performance on Wednesday, which revealed negative surprises for the market as the strong performance was overshadowed by higher exploration write-offs in the second quarter.

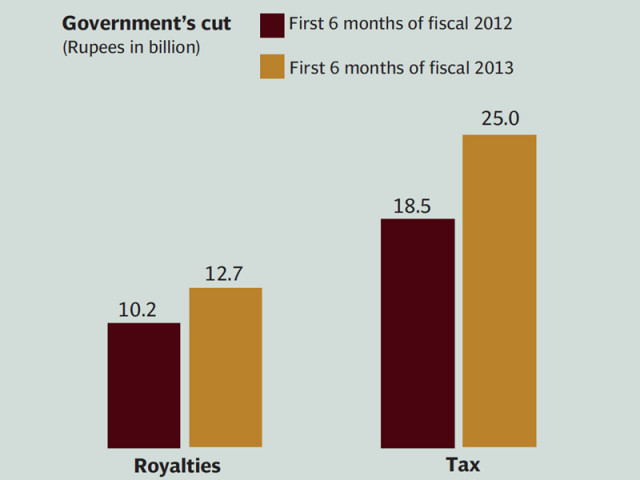

For the first half of the fiscal year 2012-13, OGDC recorded a profit of Rs49.23 billion, up 18.4% from Rs41.57 billion in the corresponding half of last year. The explorer also declared an interim dividend of Rs2 per share taking the total payout for the half year to Rs3.75.

The announcement was below the expectations as the market did not accurately quantify the impact of higher exploration costs and increased number of dry-well write-offs on the explorer’s profitability. “Decline in profitability emanated from higher than anticipated operating and exploration expenditures and a higher effective tax rate (37.6%) in the last quarter,” said Sana Abdullah, analyst at Global Securities. According to a BMA Capital analyst note, a total of five wells were written-off during the semi-annual period, of which the biggest write-off was Rs2.5 billion on Khawaja-I wells.

During the July-December period, the company discovered 11 new wells including two exploratory wells. Additionally, drilling and testing of nine ongoing wells from the previous financial year also continued during the period.

OGDC’s boosted oil and gas production, higher oil prices during the period enhanced revenues to Rs110.63 billion amidst 9% rupee depreciation against the greenback.

According to Al Habib Capital’s analyst Muhammad Ali Khan, OGDC’s net crude oil production increased 9.3% attributable to production from the Nashpa-3, and operated and non-operated joint-venture fields. Gas production climbed 5.5% mainly on account of production growth from Kunnar, Mela and Nashpa fields and joint venture fields offsetting the adverse impact on gas production due to torrential rains at the Qadirpur field. Moreover, OGDC’s liquefied petroleum gas production also climbed considerably by 62%.

Inflated realised prices of crude oil, gas and LPG, which averaged $82.78 per barrel, Rs263.83 per million cubic feet and Rs78,665 per ton respectively augmented the top-line.

Exploration and prospecting expenditures dented the earnings as they shot up two-fold (209%) to Rs5.15 billion on the back of higher number of dry-well write-offs and exploration activity.

OGDC’s other income jumped 150% to Rs6.84 billion, absorbing the shock of unanticipated climb in exploration expenses, on account of the Rs82 billion term finance certificates issued in September 2012 by the government to control the spiralling circular debt.

Operating expenses grew 16% to Rs17.93 billion on the back of increase expenditure on non-operated wells mainly in the Tal block.

Going forward

OGDC has signed a gas supply agreement with the fertiliser producers which represents a key breakthrough on resolution of a prolonged structural gas supply issue. OGDC is expected to benefit from early production flows in this win-win deal.

Moreover, Sinjhoro field had started production ahead of schedule and added 1,100 barrels per day of oil and 12 million cubic feet per day of gas to the index-heavyweight’s production.

Published in The Express Tribune, February 21st, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ