With widespread consensus that Pakistan will enter into another International Monetary Fund (IMF) programme, the timing for the upcoming elections could not have been worse. As the incumbent government is expected to be replaced by a caretaker setup by March, the period up to that point will likely be marked by suspended policies and reforms.

Based on a survey conducted by AKD Securities and data analysed by The Express Tribune, both macro- and microeconomic indicators for the country remain bleak. The incoming government will definitely have a lot on its plate.

Balance of Payments position

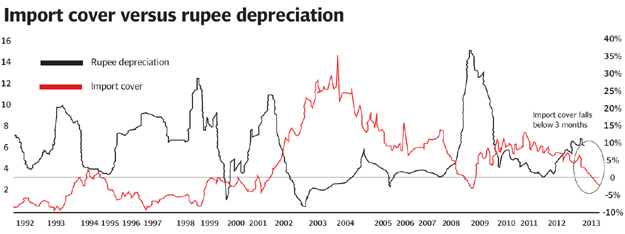

Foreign exchange reserves, according to the latest data available from the State Bank of Pakistan (SBP), currently stand at $13.4 billion, of which the SBP holds only $8.458 billion. This amount is sufficient for only approximately four months worth of imports. The AKD survey suggests that the import cover is destined to fall below three months’ worth by April this year.

Considering the obligatory IMF stand-by arrangement repayments, the external position still poses risks, even as the current account is $62 million in surplus (in the July-January period of fiscal 2013). Meanwhile, inflation figures appear not to be moving. Keeping in view this situation, there appears to be little doubt that Pakistan will be forced to retire its previous IMF loan with another one.

It seems as if that is only a matter of time. According to most fund managers, waiting until after the elections will be too late, resulting in a Balance of Payments (BOP) crisis if inflows, remittances and the Coalition Support Fund (CSF) do not materialise. Remittances have so far totalled $8.21 billion in the ongoing fiscal year, while Pakistan received $1.81 billion in CSF payments in the first seven months of the fiscal year.

Rupee depreciation

After Pakistan paid $145 million back to the IMF on February 11, the rupee touched Rs100 against the greenback. That bad news will come back to haunt the rupee, as its parity with the dollar is expected to further deteriorate to 103 by June, and to 105 by the end of this year – for a full-year depreciation of 8.1% – according to AKD Securities. The next IMF repayment of $398 million is due later this month on February 26.

Reviewing the data regarding the import cover back to the 1990s, the rupee on average depreciates 11% against the dollar every time the import cover falls below three months.

So far, the rupee has held up due to CSF inflows: but they are not expected to arrive for the rest of the year. Thus, any inadvertent delay in securing the IMF arrangement may cause Pakistan to scramble to secure finances – meaning an above-average fall in the rupee’s value against the dollar.

Monetary policy

Average inflation clocked in at 8.29% for the first seven months of fiscal 2012-13, and the central bank’s governor, during the latest monetary policy announcement, has said that the full-year consumer price index – the primary measure of inflation used in Pakistan – will range between 8-9%. However, the number to watch is core inflation – the non-food and non-energy measure – which hit 9.9% in January, with the seven-month average also at 9.9%.

That means an end to the monetary easing regime, with monetary tightening taking precedent in the SBP’s strategy framework. Brokerage firms predict that interest rates will sustain at current levels in the first half of 2013, then inch back to the double digits in the latter half.

On the macroeconomic front, the economy will stay entrenched in below-par (less than 5%) GDP growth. Pakistan’s GDP grew only 3.7% in fiscal 2012, which will keep the SBP in a catch-22 situation where, despite sluggish growth, it will opt to keep interest rates level. In view of fiscal extravagance and a weak external position, medium-term macroeconomic discipline is likely to arise only under the IMF’s ambit.

Karachi Stock Exchange

As the election process is expected to run its course more or less smoothly, Pakistan’s largest bourse – the Karachi Stock Exchange (KSE) – will remain flattish until June, say money managers.

After a steep fall on January 15 on some political drama, the market has rebounded strongly as its fundamentals are still strong. It has closed positive on 20 out of the 23 sessions since the selling frenzy. Analysts expect the market to hover around the 17,500-level till June, before embarking on another bull run to touch 18,500 by the end of 2013, implying a full-year return of 9%. The KSE posted a 49% gain in 2012 – the best return any market offered that year.

AKD Securities believes that the benchmark KSE-100 index has enough support from corporate earnings and undemanding valuations to reach 18,500 points over the next few months.

Moreover, continuing unconventional monetary policy response by balance sheet expansion from the US to Japan should see unrestricted funds flow into emerging and frontier market assets through most of 2013. In this regard, Pakistan has received positive highlights with its recent market performance, where a recent Reuters article covering Lipper of the World’s Equity Funds showed 14 funds from Pakistan ranked within 100 of the best in the worlds.

Published in The Express Tribune, February 18th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (11)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732003896-0/Zendaya-(1)1732003896-0-165x106.webp)

1731914690-0/trump-(26)1731914690-0-165x106.webp)

1732003946-0/BeFunky-collage-(70)1732003946-0-165x106.webp)

1732004108-0/Express-Tribune-(5)1732004108-0-270x192.webp)

1732000275-0/Untitled-design-(9)1732000275-0-270x192.webp)

1732002687-0/Untitled-design-(11)1732002687-0-270x192.webp)

1731749026-0/Copy-of-Untitled-(3)1731749026-0-270x192.webp)

Mirza Sb.....where is your comment on this subject..?

@p r sharma: your analysis is sane but the problem is that most of the analysts here are the pawns of sattebaaz mafia, be it the currency market, stock exchange, or the real estate..

A competent analysis. Thank you.

There are precedents for a caretaker government to take strong policy measures to stem the headlong rush to external debt default. Or put differently, they may have no choice in the matter.

This maybe the first election in Pakistan where all the major parties secretly hope they lose so they don't have to fix the mess the country is in! It is far more desirable (and safer) to be in the opposition benches after the election, content to point out the governments failings ( without offering any real solutions of course )! Just to show how bad it is going to be, I would bet that the Army wants nothing to do with any decision making going forward! Just some thoughts, of course.

I don't understand how we can label PPP's term a failure. They achieved everything they wanted to, even had turns 'achieving' their goals. Just look at their bank balances. The failure, if any, is of the Pakistani public in choosing who they chose. Replace the top crop with honest leadership and watch the difference. . Pakistan has no shortage of smart brains to make good policies, but they are all multiplied by zero when you have PPP or PMLN on top.

@p r sharma: "If current account for the period July – January 2013 is surplus there is not nuch reasons to be worried,"

It is the $8.21 billion in remittances which has kept the current account in surplus. While remittances have increased if one takes the July- Jan period in aggregate, a more granular picture shows that they have are lower in December and January compared to last year. If the remittance should be delayed or slowed down in anticipation of significant depreciation, the current account will not be positive. Remember the other part - i.e. CSF payments are also not expected until end of year. In any event, they cannot be viewed as ongoing source of funds after US exits Afghanistan next year.

"The problem remains on the front of obligatory repayment of IMF loan installment for which sufficient Forex reeve is held be SBP( $8.5 Billion) While commenting that Pakistan has Forex reserve just to cover import bills of four months export earnings and additionally inward remittance from diaspora of more than $1 billion per month is not taken into account . "

The remittance is taken into account. Otherwise the current account would not be positive. Pakistan's export is around $2 billion a month and import is $3 billion a month. http://tribune.com.pk/story/465315/trade-deficit-shrinks-7-in-july-october-over-previous-year/

DO note the imports have been undergoing forced contraction due to the forex situation. It manifests itself in situations such as reserves of oil with PSO, serious gas hortages in the country etc.

Well, that's what you get when you elect PPP and Zardari into govt. An economic crisis of the likes of late 90s beckons.

As I said, winning the election and staging the coup is the easy part; paying the salary is the hard part.

PAK needs to streamline its tax collection where paying taxes is not a burden. Whoever comes to power cannot avoid addressing this issue and the forth coming election campaign should discuss on this matter to obtain a mandate from people. Without which, all efforts will be futile and the same perpetual cycle will continue.

Unless the tax revenues increase substantially Pakistan economy will bleed.The solution get rid of the present FBR senior team which has been a gross failure.Bring in honest hard working officers who have opted out of FBR

If current account for the period July - January 2013 is surplus there is not nuch reasons to be worried, The problem remains on the front of obligatory repayment of IMF loan installment for which sufficient Forex reeve is held be SBP( $8.5 Billion) While commenting that Pakistan has Forex reserve just to cover import bills of four months export earnings and additionally inward remittance from diaspora of more than $1 billion per month is not taken into account . Fiscal year 2013- 2014 will be covered the problem lies in case export remains stagnant. Moreover budgetary deficit for FY 2013- 2014 ha to be minimized to sustain. The incoming government if unable to take unpopular economic decisions the problem will aggravate.. fortunately if law & order situation along with extremist problems improve there is possibility of some foreign investments to take care of Forex shortage.

Dollar is forecasted to be 120 Rs. Prepare yourself.