HBL posts modest growth in 2012

Net interest income grows 2% as margins contract.

HBL recorded an impressive growth in domestic and total deposits, which stood at Rs1.041 trillion and Rs1.215 billion respectively on December 31, 2012.

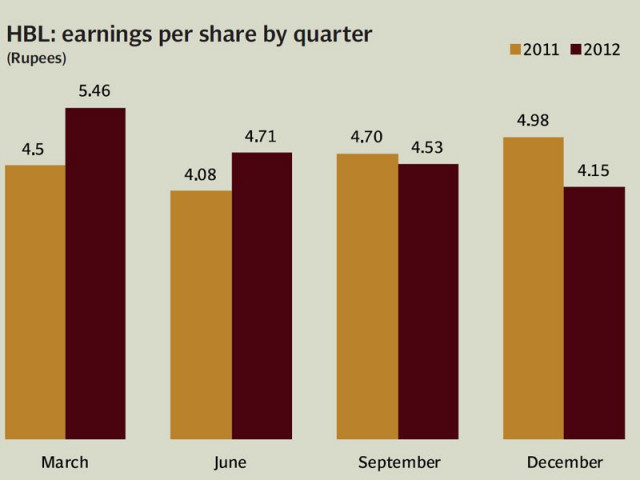

Habib Bank Limited (HBL) released its profit statement for the 2012 calendar year (CY12) on Tuesday, announcing a net profit of Rs22.26 billion for the year, nominally up from Rs22.19 billion reported in CY11. Alongside the result, HBL has announced a final dividend of Rs4 per share, bringing the full-year payout to Rs7.5 per share. It has also announced a 10% bonus issue.

During the year, HBL’s net interest income grew by a modest 2% over the previous year, with an expansion in its asset base offsetting the effect of a contraction in net interest margins following the State Bank’s monetary easing policy. HBL also recorded a 2% year-on-year (YoY) decline in provisions. Meanwhile, the bank’s non-interest income and expenses grew by 8% and 7% respectively. The bank’s non-interest income showed overall signs of improvement from the preceding year, except for its trade in foreign currencies, where profits were 32% lower than CY2011.

The bank recorded an impressive growth in domestic and total deposits, which stood at Rs1.041 trillion and Rs1.215 billion respectively on December 31, 2012 , as against Rs791 billion and Rs934 billion in the previous year. The 32% growth in domestic deposits was much above the industry’s 11% growth rate, says a press release issued by the bank.

HBL’s performance in the last quarter of the year painted a different picture: its Rs5.03 billion profit in the quarter was 22% lower than what was posted for the same period of the previous year. AKD Securities Head of Research Raza Jafri believes that this was due to higher than projected loan provisions (greater amount of unrecoverable loans).

Published in The Express Tribune, February 13th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ