View from McLeod Road: A little more volatility than the market bargained for

Fundamentals remain strong, pre-election jitters continue to alarm traders.

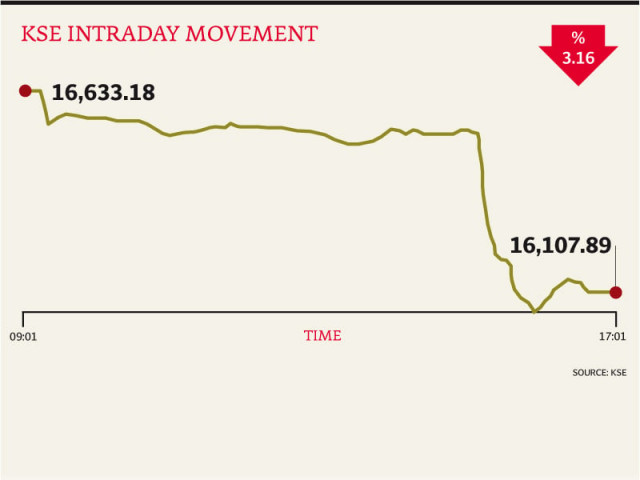

The KSE-100 index ended the day down 525 points, or 3.2% for the day.

This was never going to be a good day. But nobody thought it would be quite as bad as it was. And so stock market investors in Karachi did what their counterparts around the world always do in times like this: “When in doubt, sell.”

This morning, equity investors had gotten cautious notes from their brokerage houses telling them that while Tahirul Qadri and his long march on Islamabad were making a lot of noise, they were not to be taken too seriously as a long-term economic threat. The Karachi Stock Exchange started Tuesday on a low note, but nothing that would distinguish it from a normal down day.

Then, at 2:24 pm, as the Supreme Court announced that it had issued orders for the arrest of the prime minister, the benchmark KSE-100 index, which was already down 107 points for the day, dropped another 473 points in less than 31 minutes. The KSE-100 index ended the day down 525 points, or 3.2% for the day.

Most analysts have been expecting a short-term decline in the stock market as election season creates uncertainty with respect to policy direction. Tuesday appears to have been the first salvo of the bout of uncertainty, though it appears to have been a lot more than the market had bargained for.

“The market was already in a dicey mood, and then when you throw that big a piece of news at it, a lot of people just panicked and started selling,” said Imtiaz Gadar, a research analyst at KASB Securities, an investment bank.

So what does this mean for a long-term investor in Pakistani equities? Is this the end of a good run, or are we just hitting the turbulent phase before we continue the upward journey?

There appears to be a consensus that – as politically groundbreaking as it is – the prime minister’s arrest warrant will have no impact on corporate earnings, and therefore most companies will continue to see their net incomes rise over the coming year. That alone, however, is not a good enough reason to keep investing in stocks, because it does not take into account what might be called a “re-rating” risk.

Put simply, the price of stock is dependent upon its earnings and what multiple investors are willing to pay for it. Over the past decade, investors have been willing to pay over 9 times a company’s previous year’s earnings for Pakistani stocks. These past few years have seen a dampening of investor sentiment, with the market averaging 7 times earnings, according to JS Global Capital.

Going forward, is it possible that the market may see stock prices stagnant even as earnings grow, because investors are willing to smaller multiples for the stock? It is possible, but highly unlikely, says Gadar at KASB Securities. “It would take a lot more than today’s events to cause a re-rating,” said Gadar.

BMA Capital and AKD Securities, two leading investment banks, have already issued research reports stating that they expect pre-election volatility to cause stock prices to dip before they start rising again. BMA Capital issued a flash note to clients on Tuesday afternoon re-affirming that stance.

“With full year results expected to be accompanied by attractive dividends and bonus issues mainly in commercial banks, fertilisers along with attractive half yearly results in cements, textiles and power companies, we believe investors can capitalise this opportunity for fresh buying,” said BMA in its note.

Virtually every single investment bank continues to expect the benchmark KSE-100 index to close the year 2013 at the 19,000 level or higher. And while many investors were willing to sell today because they have already booked massive gains in 2012, today’s events do not yet warrant a sell-off for 2013.

Published in The Express Tribune, January 16th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ