Options tabled: Ministry turns a deaf ear to CNG industry’s pleas

Rejects proposal from CNG dealers calling for a cut in taxes.

The finance ministry has rejected the compressed natural gas (CNG) industry’s demand for a cut in taxes on CNG. In a meeting held between stakeholders on Monday, hosted by the Oil and Gas Regulatory Authority, finance ministry officials said the authority had no problems with the CNG pricing formula in use.

“We are only concerned that there be no further tax cuts which may end up affecting the government’s revenue collection,” sources quoted finance ministry officials as saying.

During the meeting, the representative of the All Pakistan CNG Association (APCNGA) had tabled different options that they said would help keep the CNG business viable.

He said the CNG sector should be charged the Gas Infrastructure Development Cess (GIDC) on a tariff equitable with what other gas consuming sectors pay; claiming that the GIDC was abnormally higher for the CNG industry because the price of CNG had earlier been linked to parity with petrol.

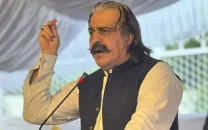

“When the CNG price has been delinked with the petrol price, the rate of GIDC should also be reverted to the level applicable in July 2012,” APCNGA’s Chairman Abdullah Ghyas Paracha asked the officials present at the meeting. He pointed out that the fertiliser sector receives gas at Rs116.27 per million British thermal units (mmbtu), and pays Rs100 in GIDC. He said that if that tariff is introduced in the CNG sector, it will bring prices down to Rs48.15 in Region 1, and Rs46.80 in Region 2.

Another option he had tabled in the meeting called for a tariff similar to what the industrial sector pays. He said that if the CNG industry is charged Rs460 per mmbtu and Rs50 as GIDC, prices can be brought to Rs69.79 in Region 1 and Rs66.63 in Region 2.

Paracha also said that private power producers receive gas for Rs460 per mmbtu and pay Rs100 in GIDC. A similar tariff will result in the price of CNG in Region 1 at Rs43.47 and Rs70.00 in Region 2.

Later, while talking to The Express Tribune, he claimed that APCNGA had not called for a strike, but that CNG stations had shut down after failing to recover their expenses.

According to the prices notified on October 25, following orders of the SC, margin on the sale of CNG has already been reduced from Rs11 to Rs6.22 per kilogram (kg).

According to the breakup of current CNG prices, out of the Rs61.63 per kg charged to consumers in Region 1, the government’s tax share is Rs35.89 per kg. Out of the tax, Rs11.57 per kg is charged under a cross subsidy, Rs7.77 per kg is charged as sales tax (at a rate of 25%), Rs13.24 per kg is charged as GIDC, while a further Rs3.31 per kg are charged as sales tax on GIDC (at a rate of 25%).

Published in The Express Tribune, November 27th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ