Weekly Review: Market remains in consolidation phase as volumes jump

Activity in blue-chip stocks drops to a multi-year low, small and mid cap stocks enjoy the spotlight.

Weekly Review: Market remains in consolidation phase as volumes jump

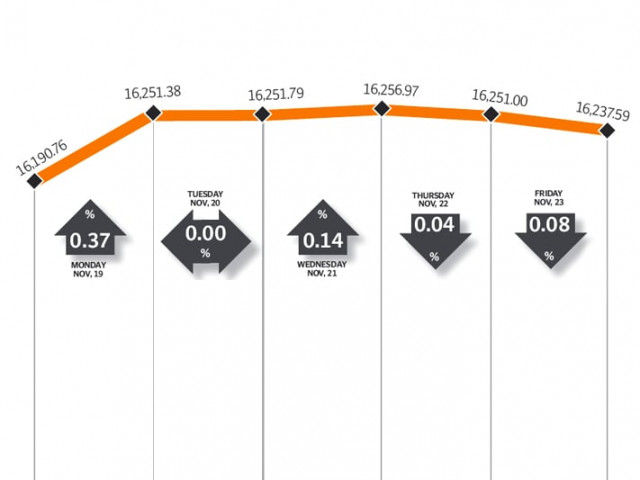

The stock market remained in consolidation mode and was range-bound throughout the week, as the benchmark KSE-100 index climbed marginally by 40 points (0.2%) during the week ended November 23.

Average daily volumes shot up by 48% to 253 million shares, as investors remained undeterred by the worsening law and order situation in the city of Karachi, and actively participated in the bourse. However, the rising volumes could not translate into a substantial gain for the index.

The increase in activity was restricted to second and third tier stocks, as the average daily values climbed by only 13.5% to Rs4.61 billion. For the past few weeks, investors focus has shifted from blue-chip to stocks with lower capitalisations.

According to a report by KASB Securities, the KSE-30 index, which comprises of 30 blue-chip companies, only contributed to 11.5% of total volumes during the week, which is a multi-year low for the index. Similarly, KSE-30’s contribution towards daily values also stood at 43.5%; another low for the index.

The index remained volatile throughout the week, and moved within a band of 158 points. After witnessing gains in the opening two sessions of the week, the index slowly crawled back in the latter half of the week, to close at 16,237 points.

There was positive news on the macro front as the current account showed a surplus of $258 million for the first four months of the current fiscal year, as compared to a deficit of $1.7 billion last year. However, this surplus is largely attributable to the receipt of $1.18 billion from the coalition support fund. Furthermore, there was a current account deficit of $177 million during the month of October.

The country’s foreign exchange reserves took another hit as Pakistan repaid a tranche of $394 million to the International Monetary Fund during the week. The reserves stood at $13.8 billion at the end of the previous week. As a result, Pakistani rupee remained under pressure throughout the week.

The automobile manufacturing sector had much to cheer about this week, as the government finally gave into their demands, and reduced the age of imported vehicles from five years to three years. Resultantly, shares of auto-makers jumped during the week, with Indus Motors and Pak Suzuki Motors both outperforming the market by 10.3% and 5.8% respectively.

Moreover, the government raised the wheat support price by Rs150 to Rs1,200 per maund, which can result in an uptick in farming activities, boding well for the fertiliser sector. However, there were also rumours of the government considering a cut in urea prices.

The market capitalisation of the exchange rose 0.7% to Rs4.07 trillion by the end of the week.

Winners of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is primarily engaged in manufacturing sporting goods including hockey sticks. It has a cricket ball manufacturing unit which produces balls with famous brand names like Duke & Sons and Gray-Nicolls.

Pace (Pakistan)

Pace (Pakistan) Limited is part of a larger conglomerate, the First Capital Group, which owns and operates a number of businesses in the financial services, real estate development, media and telecom sectors in the country and abroad.

Nishat (Chunian)

Nishat (Chunian) is a manufacturing and finishing operation consisting of five spinning units, one weaving unit, one dyeing and finishing unit and one stitching unit. NCL operates with a monthly production capacity of 7.5 million pounds of yarn and 4.0 million yards of greige fabric.

Losers of the week

IGI Insurance

IGI Insurance Limited operates in four segments: fire, marine, motor and miscellaneous. The company is a flagship organisation of the Packages Group. IGI provides comprehensive risk management facilities to a number of companies.

Jahangir Siddiqui & Company

The company is engaged in the trading of securities, maintaining strategic investments, consultancy services and underwriting. The company, together with its subsidiaries and associates, is engaged in banking, insurance, asset management, securities brokerage and principal investments.

Kohinoor Energy

Kohinoor Energy Limited owns, operates and maintains a power station of 124 megawatts in Lahore. Water and Power Development Authority is the sole customer of the company, which was in incorporated in 1994.

Published in The Express Tribune, November 25th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ