Provinces fail to mobilise resources

Release of provinces’ share in federal taxes has helped them avert a default.

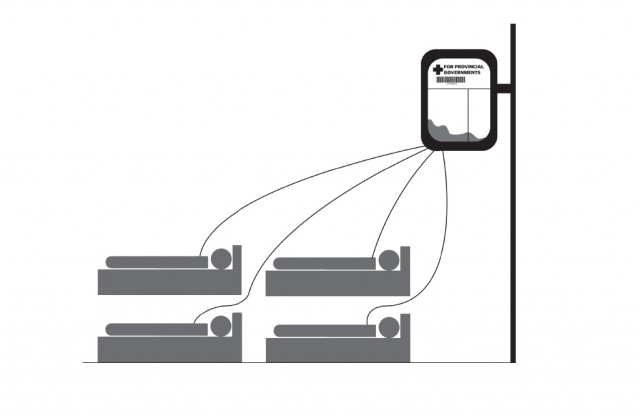

Official statistics showed that the federal government transferred Rs633.4 billion to the provinces from July 2009 to June 2010 as their share in federal taxes under the Distribution of Revenue and Grant-Aid Amendment Order 2006.

Though the transfers remained Rs22 billion short of allocations, these helped the provinces to finance 80 to 96 per cent of their budgets. The remaining financing was either received through provincial taxes, non-tax revenues, federal grants or borrowing from banks.

“One of the reasons for Pakistan’s tax-to-Gross Domestic Product (GDP) ratio to be the lowest in the world is the inability of provinces to mobilise resources,” said Dr Ashfaque Hassan Khan, a former Finance Ministry official.

He said the International Monetary Fund should also include provincial budgets in its discussions with Pakistani authorities. The tax-to-GDP ratio is less than 10 per cent.

Punjab being the most populated province could only collect Rs29.8 billion in taxes during the last financial year ended June 30, 2010. The collection was Rs7.9 billion more than the figure of 2008-09.

The Punjab government could finance 6.9 per cent of its total expenditures from its own taxes. It received Rs325 billion from the Centre which financed 81 per cent of its budget.

The Centre had allocated Rs334.4 billion for Punjab but transferred Rs9.4 billion less as the Federal Board of Revenue could not meet its annual revenue target.

Till last fiscal year, the resources between the Centre and provinces as well as among provinces had been distributed on the basis of single criterion of population. However, the historical seventh National Finance Commission Award has changed the distribution mechanism and now other indicators like resource generation, poverty and disparity are also being considered. This has shrunk the Centre’s share from 55 to 46 per cent and will help provinces to get more resources but may lead to loss of provincial taxes due to the provincial governments’ inability to net the actual potential.

Punjab’s total income, including federal share, stood at Rs401.6 billion and it incurred expenditures of Rs435.5 billion, recording a deficit of Rs33.8 billion.

Sindh, the second most populated province, got Rs188.4 billion from the Centre, which was Rs5.7 billion less than allocation. Sindh was the worst performer in terms of resource mobilisation as it collected just Rs21.6 billion in taxes, the same as in 2008-09.

Provincial taxes could only finance 8.6 per cent of expenditures and were less than 10 per cent of total revenues. It also puts a question mark on Sindh’s claim to collect sales tax on services, a cause of delay in implementation of reformed General Sales Tax.

Sindh’s budget deficit remained at Rs10.5 billion. Its total revenue amounted to Rs241 billion while expenses were Rs251.5 billion. Its 79 per cent budget was financed through receipt of federal taxes.

The Khyber-Pakhtunkhwa government could only collect Rs2.4 billion in taxes, just Rs187 million more than fiscal year 2008-09. Its taxes could only finance 1.7 per cent of total expenditures and the government heavily relied on the Centre.

The province got Rs80 billion from the federal divisible pool compared to its share of Rs85.4 billion. Its total revenue stood at Rs152.4 billion against spending of Rs142 billion, generating a surplus of Rs10.3 billion.

The Balochistan government also could not mobilise provincial resources. It collected Rs1 billion in taxes, Rs167 million more than the year 2008-09. Provincial taxes helped to finance just 1.4 per cent of expenditures. Taking into account all income sources, including non-tax revenue, the provincial government could finance just 4 per cent of expenditures, depending on the federal pool for the remaining 96 per cent.

The federal government transferred Rs40 billion to the Balochistan government against annual allocation of Rs41.5 billion. Against the income of Rs81 billion, the province spent Rs75.6 billion, generating a surplus of Rs5 billion.

Published in The Express Tribune, September 4th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ