Corporate results: Engro Corp hit hard by gas crisis; incurs significant losses

Gas outages plaguing EnVen fertiliser plant wipe out Engro Corp’s profitability.

Corporate results: Engro Corp hit hard by gas crisis; incurs significant losses

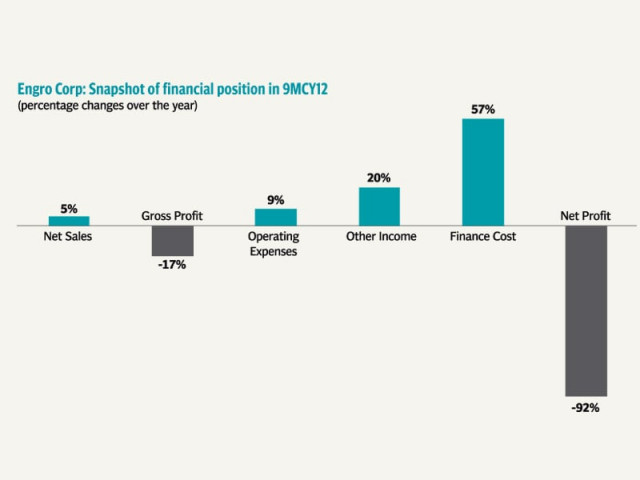

Local giant Engro Corporation announced its results for the first nine months of 2012 (9MCY12) on Wednesday, posting a net loss of Rs443 million for the period on a consolidated basis, as compared to a net profit of Rs5.59 billion in the same period of the preceding year.

The company’s overall revenues grew by 5% to Rs82 billion, whereas its cost of sales and financial charges grew by 14% and 56% to Rs64 billion and Rs11 billion respectively, said a note from Topline Securities.

On a quarter-on-quarter (QoQ) sequential basis, Engro Corp posted a loss of Rs103 million in the third quarter of 2012, down from a profit of Rs309 million recorded for the preceding quarter. For the period, the corporation’s earnings were affected most by its subsidiary Engro Fertilizers, which posted a loss to the tune of Rs1.2 billion.

This was Engro Fertilizers’ third consecutive loss owing to the suspension of gas supply to its $1.1 billion EnVen plant and a 59% year-on-year (YoY) decline in urea off-take coupled with higher financial charges for the period, said research notes received from analysts. Continuous availability of subsidised imported urea to farmers at cheaper rates than locally manufactured brands has also hit sales for the entire sector.

On the bright side, Engro Foods posted a profit of Rs601 million, higher by 13% QoQ due to lower operating costs and higher prices which improved the entity’s gross margins by nearly four percentage points. Engro Polymer and Chemicals, too, returned to profitability: posting Rs27 million in profits from stable operations, higher caustic soda sales, better margins and stable currency, said Shajar Capital analyst Raza Hamdani.

Hamdani said that the outlook for Engro Powergen also seems to remain positive: he expects the company to post a profit in the ballpark of Rs542 million, as the company has been “continuing its stable run at a load factor of 90%.”

He said that Engro Eximp is also expected to trim its losses in the quarter to Rs196 million, from a loss of Rs322 million in the previous quarter, largely due to a 4% QoQ increase in rice export prices which will lead to better margins during the period.

Outlook

Analysts remain hopeful that lower fertiliser imports during the next year will restore profitability to the sector, while growth in Engro Foods’ market share is also expected once the company embarks on its ambitious expansion plans.

Hamdani added that “the company’s debt re-profiling and an expected expansion in market share from current levels ... will prove to be the key upsides in the near term.”

Published in The Express Tribune, November 1st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ