Pakistan Oilfields profits slump; down a billion

Attock Refinery, Attock Cement post healthy growth in earnings; 65% and 69% respectively.

Attock Group – the sole vertically integrated oil conglomerate of the country – announced financial results for the first quarter of the fiscal 2012-13 for three of the four subsidiaries – exploration, refining and cement production. Results for National Refinery and Attock Petroleum were not announced.

The exploration wing

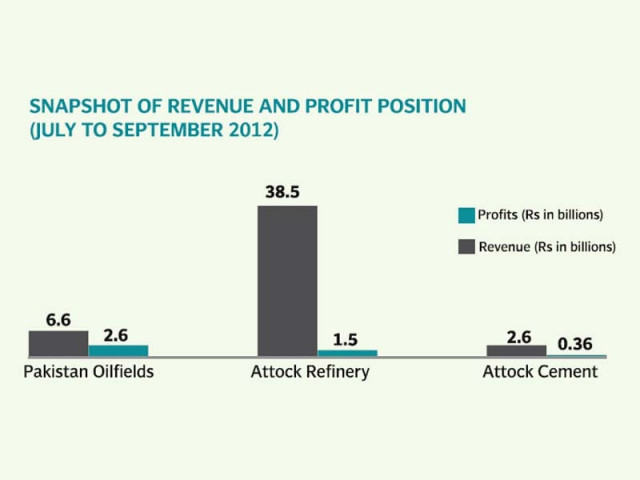

Pakistan Oilfields (POL) financial statements witnessed a 26% contraction in profits to Rs2.6 billion, against Rs3.5 billion in the corresponding quarter in the preceding year.

The decline in earnings were primarily attributed to lower sales stemming from a decrease in oil and gas production – 13% and 12%, respectively – higher operating expenses and shrinking other income, says JS Global Capital research report.

Net sales, for the period under review, shrunk 9% to Rs6.6 billion on account of a setback in oil and gas production estimated to be a decline of 13% and 12% respectively from POL’s own operated fields, namely Pindori and Bela.

However, international oil prices stood at $108 per barrel, stagnant as that of the previous year, according to Topline Securities analyst Nauman Khan.

On the other hand, an exponential increase of 370% in exploration costs hit earnings adversely. The increase in expense was on account of higher seismic activity as Attock’s exploration wing did not book any dry well. Moreover, other income registered a reduction of 9% on the back of low yield on cash balances and no dividend income from Attock Petroleum and National Refinery, which will brought to books in the next quarter. Going forward, earnings are anticipated to increase led by improvement in well-head gas prices, continuing depreciation in rupee against dollar and production enhancement specifically from Tal oil and gas block in Khyber-Pakhtunkhwa.

The refinery wing

Attock Refinery profits were boosted 65% to Rs1.5 billion compared to Rs0.9 billion in the corresponding quarter last year, mainly due to better refining margins, rising other income, lower financial charges and tax rates.

Revenues climbed 5.5% to Rs38.5 billion in the period under review whereas gross profits enhanced by 35%, mainly on the back of favourable pricing scenario which also improved gross profit margins to 5.1%, owing to better gross refining margins supported by tweak of its product mix giving its profitable products petrol and diesel a higher weight-age and 13% rise in international oil prices rendering into inventory gain.

Higher earnings were also supported by 58% increase in other income through better yields from stronger cash balance position of the refinery and decline in financial charges. Dividend income from National Refinery and Attock Petroleum will be booked in the next quarter; further boosting the profitability going forward.

More good news for the refinery wing is that it has been gaining market share in the industry, gaining lost ground by their biggest competition and market leader Pak Arab Refinery. National Refinery and Attock Refinery increased their market share to 21% and 19% respectively.

Cement wing

Attock Cement’s profits solidified at Rs0.358 billion for the quarter, climbing 69% from Rs0.211 billion in the corresponding quarter of the preceding year. The bottom-line was supported by a 19% increase in revenues to Rs2.6 billion and increase in other income to Rs0.0877 billion, an increase of 314% year-on-year. Other contributors included cost reduction due to lower coal prices in the international market coupled with new cost efficient plants resulting in stronger profit margins.

Published in The Express Tribune, October 19th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ