Cutting the banks out: Govt wants to borrow directly from the masses

SBP set to launch campaign to encourage depositors to invest in govt securities.

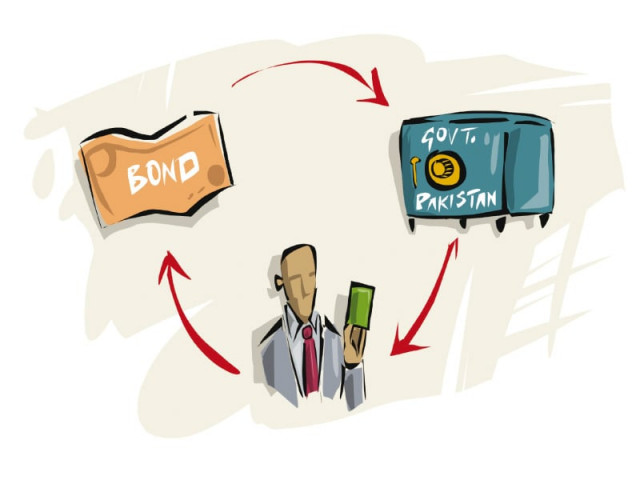

The State Bank of Pakistan (SBP) is set to launch a campaign next month to encourage individual depositors to invest in government securities through commercial banks. Through the move, the SBP wishes to reduce money in circulation and raise funds for budget financing.

The scheme will be beneficial to all stakeholders, but the major beneficiary will be the government: it will, on one hand, tap into additional resources for budget financing, and reduce money in circulation on the other. In return, depositors will have an option to receive better returns on their investment, as compared to what commercial banks are currently offering.

Depositors will be offered to invest in government securities through Investor Portfolio Securities (IPS) accounts, which have virtually been dormant as most bankers have kept their individual investors in the dark about the existence of such a scheme.

Through IPS accounts, individuals will be able to invest in debt securities like Pakistan Investment Bonds, Treasury Bills, Ijarah Sukuks and other such securities issued by the State Bank of Pakistan from time to time, on behalf of the Government of Pakistan.

The scheme has been designed by the finance ministry, and will be publicised by the SBP on behalf of the central government. The government wanted to launch the scheme from July, but was prevented from doing so for three months due to delays.

“The government’s primary aim is to reduce the money in circulation,” said Rana Assad Amin, spokesman for the finance ministry. By end June, total money in circulation in Pakistan had amounted to Rs1.67 trillion, according to the SBP.

Amin said over half of existing depositors may switch to IPS accounts once they are properly briefed about the benefits, according to some estimates. He said the IPS accounts were allowed to be opened in the 1990s, but had since been dormant as banks did not educate their depositors. Under the revival plan, the SBP will monitor the opening up of new IPS accounts and efforts put in by banks in counselling depositors. The banks will be allowed to charge a sum on profits given on the IPS accounts.

In current practice, by obtaining deposits at the minimum rate of 6%, banks invest this money in treasury papers at almost double rates, securing hefty profits. By August, the deposits of scheduled banks had grown to Rs6.3 trillion, higher by Rs912 billion or 17% over a year, according to the SBP. All scheduled banks have invested a total of Rs2.96 trillion in government securities.

The government remains the largest borrower in the country; its burgeoning expenses have outstripped revenues at an unprecedented pace. The government closed last fiscal year with a historical deficit of 8.53% of GDP, and borrowed Rs1.77 trillion to finance it.

For this year again, the estimated budget deficit is Rs1.2 trillion or 4.7% of GDP. According to the International Monetary Fund, Pakistan will require Rs7.3 trillion, or 30.3% of its GDP, to meet debt and deficit liabilities for the current financial year.

The SBP recently reduced its benchmark discount rate by 1.5%. Leading commercial banks have reportedly approached the central bank with a request to additionally reverse a decision calling for increasing the minimum deposit rate to 6% from 5%. However, the move seems baseless, as the banking spread is still around 7%: probably the highest.

Despite a cut in the discount rate, leading commercial banks have yet to reduce lending rates for car leasing, credit cards and personal loans. A senior official of a leading commercial bank confirmed that banks were still charging 18-20% on car leasing, up to 36% on credit cards and 26-30% on personal loans.

Published in The Express Tribune, September 25th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ