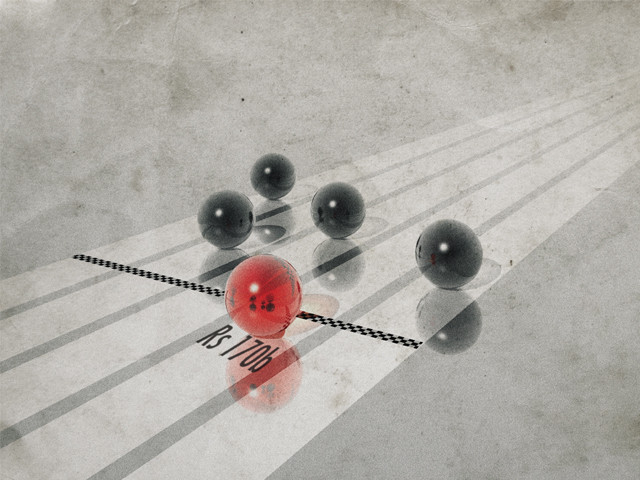

TFCs worth Rs82b issued to rein in circular debt

PSO receives Rs70 billion, IPPs also get some money.

In an attempt to control the swelling inter-corporate debt, the government on Tuesday issued term finance certificates (TFCs) worth Rs82 billion to banks, aimed at reducing debt of a host of companies that comprise the energy chain.

The amount has been arranged against security of Oil and Gas Development Company (OGDC)’s reserves.

Of the Rs82 billion, the government has provided Rs70 billion to cash-strapped Pakistan State Oil (PSO), which has been facing severe liquidity crunch due to failure of power companies to pay dues on time, officials say.

“The government has issued TFCs worth Rs82 billion to clear the circular debt,” Secretary Petroleum Dr Waqar Masood told The Express Tribune.

He said money had also been paid to the independent power producers (IPPs) to clear the way for onward payment to oil and gas suppliers. With the help of this money, he said, power, oil and gas companies would be able to mostly settle their dues.

A senior PSO official said the Rs70 billion that the company received was transferred to oil refineries for the supplies they made in the past. Now, he said, “receivables of PSO have dropped to Rs160 billion.”

However, a water and power ministry official termed the move ‘temporary’ to rein in the circular debt. In the past too, the present government floated billions of rupees worth of TFCs to clear the debt, but it emerged again with full force.

“The TFCs will also put a burden on the consumers in the form of interest payments,” he said.

In May, President Asif Ali Zardari had given the go-ahead to the TFCs in an effort to curtail the debt and improve energy supply. The plan was prepared by the petroleum ministry, which claimed that it could settle the debt amounting to Rs450 billion.

However, the TFCs were delayed as the law ministry was reluctant to vet the guarantee of OGDC reserves.

Four IPPs including Sapphire, Hamlore and Orient have already filed cases against the government for blocking their dues of Rs40 billion. They had even threatened to shut down the plants if the dues were not cleared.

Officials of the water and power ministry mainly blame power distribution companies for the mess. The recovery of power bills of these companies is very poor with persistent bad governance, leading to liquidity crunch and making it difficult to even ensure fuel supplies.

For the past few years, the government has also been delaying payment of tariff differential subsidy to the power companies, which has compounded the problem.

Transmission and distribution losses beyond Nepra’s determinations are also the major reason behind the build-up of circular debt, they say.

Published in The Express Tribune, September 12th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ