Weekly Review: KSE sheds 138 points; market enters consolidation phase

Profit-taking witnessed as volumes decline at bourse.

Weekly Review: KSE sheds 138 points; market enters consolidation phase

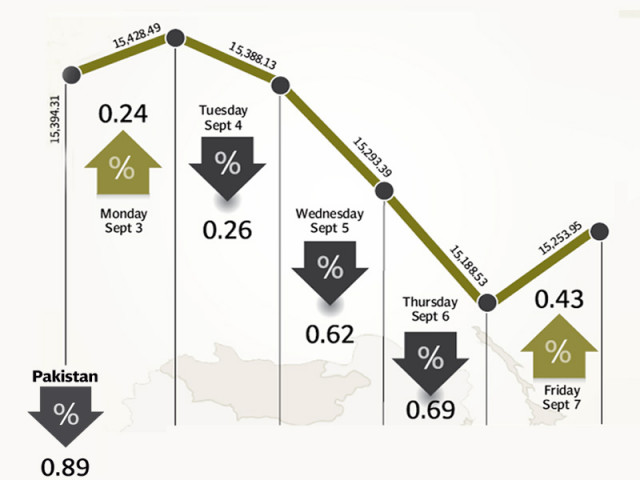

The stock market failed to sustain its post-Eid rally and entered a consolidation phase above the 15,000 points level. During the week ended September 7, the benchmark Karachi Stock Exchange (KSE)-100 index shed 138 points (0.9%) to close at 15,253 points.

Profit-taking was witnessed at higher levels throughout the week. The index would reach intra-day highs, before being clawed down by selling pressure; the index closed moderately in the red in three out of the five trading sessions of the week.

Volumes too, took a hit: average daily volumes declined by 22% to 195 million shares traded per day, reflecting reduced investor interest in the market. Similarly, foreign interest in the bourse also declined, as net inflows of only $0.3 million were recorded during the week.

There were a few positive developments during the week, which provided some excitement for investors. News about a further cut in the discount rate and the government’s decision to establish an International Clearing House Exchange (ICH) for incoming international calls created a few ripples at the bourse; but these were ultimately not enough to counter the declining trend.

Inflation figures for the month of August 2012 clocked in at 9.1%, which led to speculation that further monetary easing was on the cards. To add fuel to the speculation came news regarding the State Bank’s Treasury-bills auction, where participation was low and cut-off yields witnessed a decline of 13-14 basis points for bonds of all tenures.

The other positive news came from the Pakistan Telecommunication Authority, which announced its plans to establish an ICH for international incoming calls.

The establishment of the ICH bodes well for Pakistan Telecommunications Company (PTCL), as it will be made responsible for negotiating rates with foreign operators. Resultantly, PTCL’s stock price shot up by 14.9% during the week, and the scrip closed at Rs20.57 by the end of the week.

But all news was did not bring glad tidings: August cement off-take was down by 18.6% over the previous month, due to a seasonal decline in sales. As a result, Lucky Cement and DG Khan Cement – the two largest cement manufacturers in the country – saw their share prices fall 1.8% and 4.4% respectively.

The decline in average volumes was coupled with a decline in daily values, which stood at Rs5.21 billion traded per day – down 19% from the previous week. The KSE’s market capitalisation also declined 0.8% to Rs3.88 trillion by the end of the week.

What to expect?

The next few weeks will be interesting, as the International Monetary Fund is scheduled to assess the country’s ability to repay its loan. Furthermore, any developments regarding expected monetary easing will be watched closely by market participants. However, political tensions due to the resumption of the National Reconciliation Ordinance case could put a damper on market gains.

Winners of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is primarily engaged sporting goods including hockey sticks. It has a cricket ball manufacturing unit which produces balls with famous brand names like Duke & Sons and Gray-Nicolls.

NetSol Technologies

Netsol Technologies Limited is engaged in the development and sale of computer software and related services. The company’s services include application development and maintenance, technology outsourcing, IT consulting, software process consulting and business intelligence consulting.

Shifa International Hospitals

Principal activity of Shifa International Hospitals is to establish and run medical centers and hospitals. The hospital was conceived and incorporated in 1985 by a small group of Pakistani doctors and other healthcare professionals working in the United States.

Losers of the week

Atlas Honda

Atlas Honda Limited manufactures and markets Honda motorcycles. Honda motorcycles are by far the largest selling motorcycles in the country. It is a joint venture between the Atlas Group and Honda Motor, Japan.

Pakistan International Airlines

Pakistan International Airlines Corporation (PIA), the country’s national carrier, has been an air travel pioneer since its inception in 1955. Other activities of the company include provision of engineering and other allied services.

National Refinery

National Refinery Limited is a refining and petrochemical company. The company operates in two business segments: fuel and lube. The products the company manufactures include range of fuel products, lubes, benzene among others.

Published in The Express Tribune, September 9th, 2012.

1710175205-0/image-(9)1710175205-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ