National Bank profits flat

Core earnings source net interest income declines 7% .

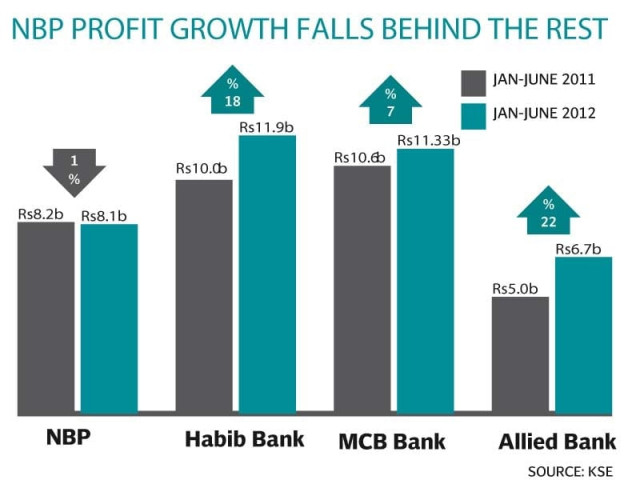

National Bank Limited reported net profit of Rs8.2 billion in January to June 2012, up by a mere 1% on a yearly basis and much below market expectation.

Higher provisioning against non-performing loans as well as reduction in value of investments are the key factors for this dismal performance, said BMA Capital analyst Nurali Barkatali.

Also, net interest income declined by 7% to Rs21 billion, whereas deferred taxation of Rs1.2 billion reduced the effective tax rate to 30%, supporting the bottom-line

Two key factors causing this decline are imposition of minimum 6% profit rate on savings accounts which accounts for 59% of the bank’s CASA and 200 basis points cut in discount rate during July to December 2012.

Although provisioning charge under both the aforementioned heads declined by 44% and 48% YoY respectively, a massive increase in the latter to Rs2.3 billion during the second quarter wiped off the reversal of Rs1.5bn booked in first quarter of 2012

NBP’s asset quality has always remained a concern. Unlike its peer banks, despite unpleasant economic landscape NBP has maintained higher than average advances to deposit ratio at 60% during the past few quarters.

The bank’s stock price fell 1.1% to close at Rs44.05 during trade at the Karachi Stock Exchange due to lower than expected result.

Outlook

In the wake of the recent cut in discount rate to 10.5%, mark-up spreads for the entire banking sector are bound to decline. BMA Capital expects NBP’s earnings to decline in the range of 6%-16% during in 2012 and 2013, respectively. However, any aggressive shift in strategy of banks to extend advances amid long haunting energy crisis can be a game changer, said an analyst.

Published in The Express Tribune, August 17th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ