Corporate results: Pakistan Petroleum makes Rs41 billion in fiscal 2012

Oil and gas explorer sets aside Rs5 billion for asset acquisition.

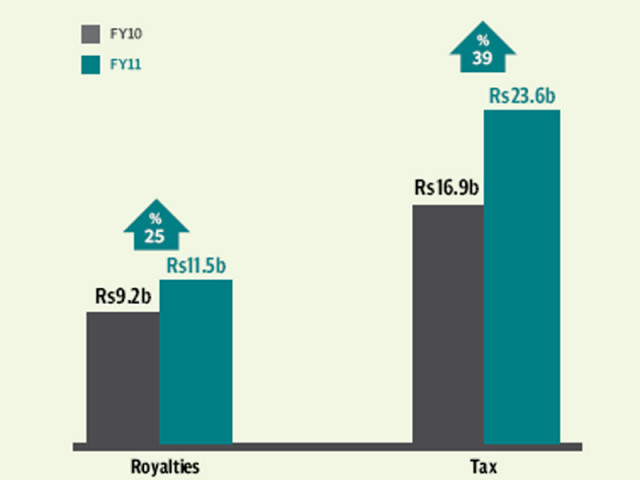

Pakistan Petroleum Limited (PPL), the country’s second largest oil and gas explorer, profits soared 30% to Rs40.9 billion in fiscal 2012 on the back of higher oil and gas volumes and its prices.

The explorer benefitted from the 19% increase in oil price and 3% to 4% jump in gas price, said BMA Capital analyst Furqan Punjani.

Pakistan is an energy deficient and natural resource rich country, the ideal working climate for oil and gas explorers, according to experts.

The explorer set aside Rs5 billion each for asset acquisition and insurance reserve, says a notice sent to the Karachi Stock Exchange on Monday. The asset acquisition reserve reached Rs25 billion with the latest addition, shows the balance sheet.

In the most recent venture, Pakistan Petroleum was awarded exploration blocks in Diyala and Wasit provinces in eastern Iraq.

Earlier, PPL and Zhenhua had entered into a joint venture to participate in Iraq, and were expected to make an investment of $200 million, however, the Chinese firm has decided not to proceed due to security issues in Iraq.

Along side the result, the board of directors in its meeting also announced a full year bonus of 25% and cash dividend of Rs6.5 per share, taking the full year dividend to 11.5 per share.

The outgoing period proved to be an eventful year for PPL where higher average oil prices coupled with incremental oil volumes from fields like Nashpa, Mela, Kandhkot surfaced as major profit drivers.

PPL’s oil production is estimated to grow 10% with the commissioning of Nashpa-2. Production from the field shot up by 58% on a yearly basis and constituted 27% of the company’s total oil production during the outgoing financial year. On the gas front, production is anticipated to rise by 2% with Kandkhot field’s rise of 30% fuelling growth.

Resultantly, the company’s revenue grew by 23% to Rs96 billion in fiscal 2012 mainly on the back of improved gas prices and dollar appreciation.

The growth in topline was well complemented by 2.6-fold increase in company’s other income to Rs11.6 billion against Rs4.5 billion last year.

Stock price reacted positively and rose its upper daily limit of 5% to close at Rs215.34 on the announcement of a strong payout.

Published in The Express Tribune, August 14th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ