Weekly review: KSE-100 soars on the back of improving US ties

Lucky Cement’s acquisition of ICI and lower inflation numbers featured during the week.

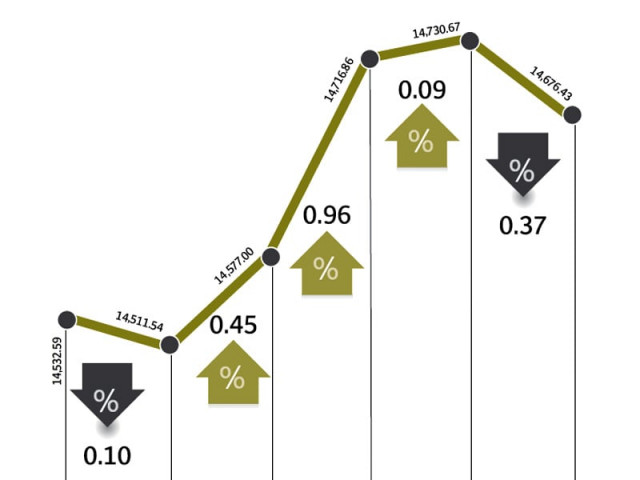

After a couple of lacklustre weeks, the stock market returned to life as improving relations with the United States boosted investor sentiment. The benchmark KSE-100 index gained 150 points (1%) during the week ended August 3.

The major news of the week was the signing of a Memorandum of Understanding between Pakistan and the United States regarding the reopening of Nato supply routes and subsequent disbursement of $1.18 billion under the Coalition Support Fund (CSF) to Pakistan.

The new deal is expected to last till the end of 2015, and will see regular CSF payments to Pakistan during its duration. The disbursement also eased pressure on the external account and resulted in a marked improvement in the country’s foreign exchange reserves.

Other major news on the macroeconomic front was that inflation numbers for the month of July 2012 clocked in at 9.6%, down from 11.3% in June. The decline was attributed to lower petroleum product prices. The single-digit inflation figure has now created excitement in the bourse regarding the possibility of a discount rate cut in the upcoming monetary policy announcement on August 10.

Further excitement was created in the market as regards the announcement by Lucky Cement regarding its acquisition (along with three other companies of the Tabba Group) of 75.81% shares of ICI Pakistan. The deal price was agreed at a 30% premium to the market price of ICI prior to the announcement.

Resultantly, ICI’s share price shot up and gained 8.7% during the week. On the other hand, Lucky Cement’s share price stumbled 1.6%, as investors now expect a lower cash payout by the company following its acquisition of the chemicals company.

Engro Corporation continued its poor performance from the previous week, following its request to banks to restructure the debt of Engro Fertilizers. Its share price dropped 8%, and the scrip was one of the worst performers during the week.

Foreigners were again net buyers during the week, purchasing $3 million worth of equity.

Average daily volumes shot up by 47% during the week over the previous week, and stood at 83 million shares traded per day as a result of positive triggers. Similarly, average daily value was also up by 54% and stood at Rs3.08 billion traded per day. The market capitalisation of the KSE soared to Rs3.75 trillion by the end of the week.

What to expect?

Investors will closely watch the monetary policy announcement in the coming week, as the lower July inflation figures have fostered a genuine feeling that a discount rate cut is on the cards. A rate cut is likely to provide a boost to the market.

However, the government-judiciary stand-off has entered a new phase with the Supreme Court striking down the new contempt of court bill, and investors will remain wary of negative developments on that end.

Published in The Express Tribune, August 5th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ