Weekly Review: Activity dwindles with the onset of Ramazan

Company-specific news flows dominated the week.

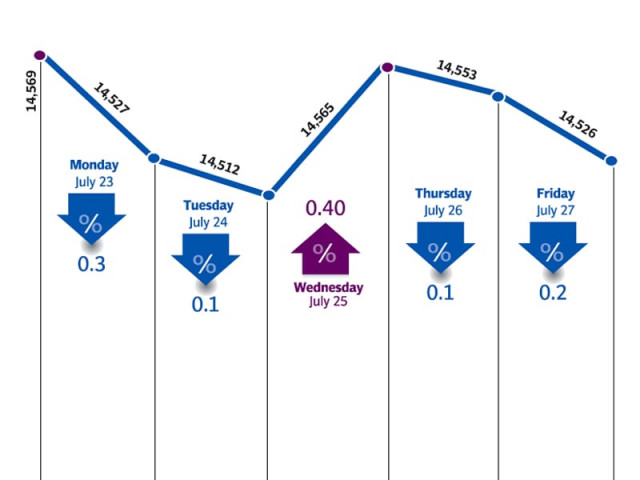

Market activity slowed down significantly with the start of Ramazan as the benchmark KSE-100 index remained range-bound throughout the week, closing down 38 points or 0.3% during the week ended July 24.

Trading hours are cut down till 2pm in Ramazan and this has historically seen activity dwindle. The KSE-100 index traded in a range of 130 points throughout the week and remained largely unaffected due to lack of major news flows.

An easing of tensions on the political front and the hopes of receiving foreign aid in the form of the Coalition Support Fund kept investors interested, but the reduced trading hours and lack of news flows meant that average volumes fell 54% to 56 million against the previous week.

Company specific news flows dominated proceedings at the bourse during the week. Fauji Fertilizer Company announced earnings of Rs5 per share for the second quarter ended June 30, and surprised investors with a cash payout of Rs5 per share. As a result, the company outperformed the index by 1.1% during the week.

However, there was glum news for the other major fertiliser producer, Engro Fertilizers, as it revealed that it received gas for 44 days in the first six months of 2012 due to shortage in the Sui Northern Gas Pipelines network.

Engro also requested banks to restructure its debt and increase the repayment period by two and a half years, for the debt incurred to set up the company’s Enven plant. Investors reacted harshly to the news and resulted in the stock underperforming the market by 1.1% during the week.

Pakistan Telecommunications Limited was also in the news during the week after it announced its second Voluntary Separation Scheme (VSS) for 16,000 employees, incurring a cost or Rs8 to 10 billion. The stock plummeted on the announcement and shed 4.9% of its value during the week.

The power and oil sector also took some limelight as the government announced it will start paying independent power producers for their electricity, which in turn would result in payment to Pakistan State Oil. The company outperformed the broader market by 1.3% as a result.

Foreigners were net buyers during the week, of $4.2 million worth of equity, but failed to make a major impact on the market. Lower volumes meant that average daily values also slumped by 50% to Rs2 billion traded per day. Market capitalisation dropped 0.2% to Rs3.70 trillion by the end of the week.

What to expect?

Market activity can be expected to remain low throughout the month of Ramazan, however the ongoing results season will keep investors interested and provide support to market volumes. The disbursement of foreign funds will also provide a boost to the market as currently the country’s foreign reserves are low.

Published in The Express Tribune, July 29th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ