Weekly Review: Bourse ends flat as earnings season kicks in

Political tensions and Moody’s downgrade keep the market in check.

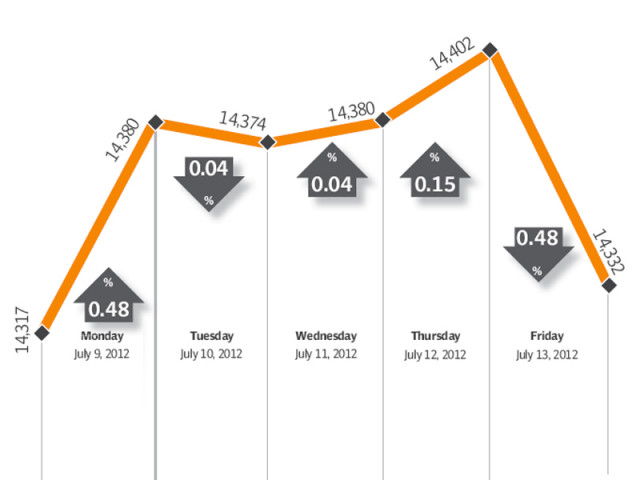

The stock market remained range-bound ahead of the flurry of corporate results for the June quarter expected to start in the upcoming week. The benchmark KSE-100 index climbed a modest 22 points or 0.2% to close at 14,332 points during the week ended July 13.

The market swung between the 14,300 and 14,400 points level throughout the week and ended with slight gains, supported by foreign buying and increased investor interest in sector-specific stocks. However, the market was gripped by political tensions throughout the week. The upward climb made in the first four days was wiped off with a 69 point fall in the final day following news of Moody’s downgrading the country’s sovereign rating by and corporate results starting on a sour note.

Fauji Fertilizer Bin Qasim started the corporate season on a dismal note by announcing lower than expected profit of Rs664 million in January to June 2012.

The political situation again took centre stage as the Supreme Court issued notices to the new prime minister to write the letters to Swiss authorities against President Asif Ali Zardari.

The refusal to do so by the previous premier Yousaf Raza Gilani, led to his disqualification.

The government, instead of complying with the Supreme Court’s directive, quickly passed the Contempt of Court Bill through the Parliament and the Senate, which would effectively provide immunity to the prime minister from disobeying the court’s directives.

These new developments again put the government and the judiciary on a collision course. All news was not negative, however, as foreign funds continued to flow into the country with foreigners buying $5.2 million worth of equity, following up on the $9.4 million inflow in the previous week. Furthermore, the remittances figure for the fiscal 2012 stood at $13.2 billion, up by 18% over the previous year.

Average daily volumes stood at 95 million shares, up by 3% over the previous week. Average daily values on the other hand declined by 2.1% as more activity was witnessed in second-tier stocks.

Published in The Express Tribune, July 15th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ