Weekly Review: KSE-100 surges as NATO routes reopen

Fertiliser, cement and oil sectors perform strongly during the week.

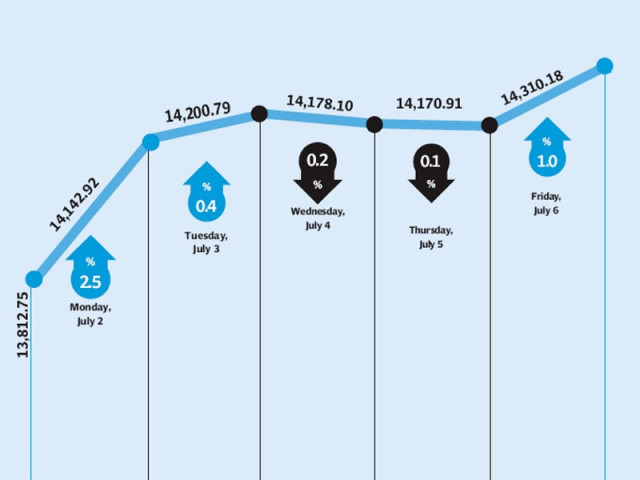

The stock market kicked off the new fiscal year in style, as investors reacted positively to thawing relations between Pakistan and the United States, helping the Karachi Stock Exchange (KSE)’s benchmark KSE-100 index climb by 509 points (3.7%) during the week ended July 6.

After months of tensions between the two countries, US Secretary of State Hillary Clinton finally issued an apology over the Salala incident, which resulted in Pakistan reopening Nato supply routes through the country. As a result, the United States has also agreed to release promised finances under the Coalition Support Fund agreements to the country.

Investors reacted positively to the news and actively participated in the market with average volumes shooting up 33% during the week. Investor sentiment was also buoyed by news that foreign inflows stood at $9.4 million for the week.

Other positive news came in the form of lower inflation figures for the month of June. The Consumer Price Index for the month stood at 11.3%, as compared to 12.3% in the previous month. Furthermore, with petrol prices decreasing twice during the month, the CPI is expected to ease further during July.

Sector-specific news also played its part in the market’s resurgence. The fertiliser sector was first to the party, after it was announced that cess on feedstock gas for the sector will remain unchanged at Rs313 per million British thermal units.

It had been earlier expected that the fertiliser sector would face from an increased levy on feedstock gas, and investors reacted positively when it did not materialise. However, towards the end of the week, the sector received a setback as rumours floated that the Economic Coordination Committee had decided that the power sector will be given priority over the fertiliser sector in gas supply.

The cement sector was next in line, after full-year sales figures were released for the sector. Sales volumes grew by 4% during fiscal 2012; which, coupled with improved prices, meant that cement manufacturers had an excellent year. The majority of cement stocks outperformed the market during the week.

Finally, the oil sector rebounded as improving international oil prices led the Oil and Gas Development Company and Pakistan Oilfields Limited to outperform the market by 2% and 0.3% respectively.

Average daily volumes stood at 92 million shares, up 33% over the previous week. Average daily values, however, surged to Rs3.88 billion, up 61% against the previous week. Market capitalisation of the KSE increased 3.6% to Rs3.64 trillion by the end of the week.

What to expect?

After a healthy start to the new fiscal year, the market is likely to be directed by further news flows on the terms of engagement between Pakistan and the United States. The upcoming results season will also create some excitement for investors, and market activity can be expected to pick up in the coming weeks.

Published in The Express Tribune, July 8th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ