Despite rapid growth, Pakistan’s media remains financial lightweight

Advertising revenues have grown rapidly over the past decade, especially for television channels.

Despite rapid growth, Pakistan’s media remains financial lightweight

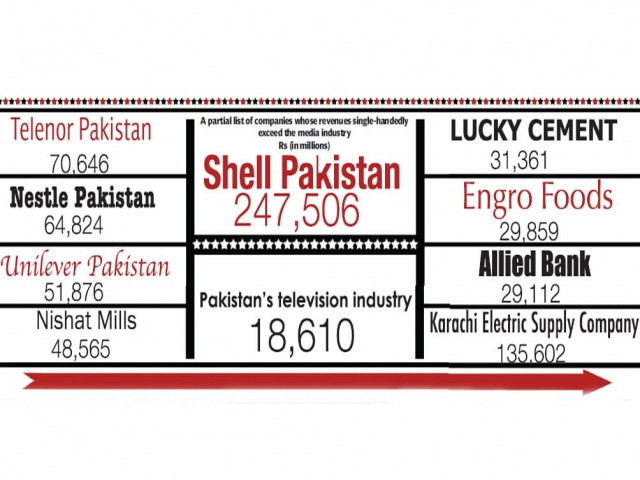

It may have massive public influence, but the media in Pakistan is not big business, a fact that can best be illustrated with a single statistic: all of Pakistan’s television stations combined – news, entertainment, sports et al – have less revenue than Nestle earns off just selling Milkpak.

Advertising, which forms nearly all of the revenues for television stations, and the bulk of revenues for print publications, has been growing very rapidly in Pakistan over the last decade. According to Aurora (an industry publication), total advertising spending in Pakistan was Rs32 billion in fiscal year 2011, a figure that has grown at an annualised average rate of 23% during the past ten years (inflation was just over 9% during that period).

A number of industry officials who The Express Tribune talked to attributed the phenomenal expansion in the ad spending largely to the mobile telecommunications and banking sectors, which served as its main engines of growth in the past decade.

According to Qamar Abbas Rawalpindiwala, executive director of the Pakistan Advertisers Society, a body of advertisers, which claims to represent 80% of the ad spend in Pakistan, the boom in advertising in the past decade was initially led by the banking sector. “More recently, however, telecoms have been on an advertising spree,” he said.

The telecom sector led the top 10 product categories on news and business channels in fiscal 2011, with a 29% share. Shampoos came second with a market share of 7%, which signifies how heavily the telecom sector spends on advertising compared to other product categories. However, after a huge rise in ad spending from early to mid-2000s, the overall share of banking has decreased, as it stood at just about 5% of the total ad spend in 2011.

According to Aurora, the share of television in the total ad spend was 58%, or Rs18.6 billion, in 2011. Quite expectedly, TV received the highest increase in ad spend over the preceding fiscal year among all mediums of advertising with a rise of up to 28%. The total ad spend in Pakistan increased by 18% in the same period.

Express News General Manager Sales Nusrat Ali says TV enjoys the largest share in ad spend mainly because of high cable penetration in the country. Although there are few official figures, industry sources say 70% of total households with a television set in Pakistan have access to satellite channels through the cable network.

While the share of television in the ad spend is increasing every year, figures show that the share of the print media is in decline. In 2011, it was worth Rs8.5 billion, with a 27% share in the total ad spend, a decrease of 5% over the preceding year.

“Reading a newspaper is a habit, and you can’t change it easily. So while the share of newspapers in the total ad spend is shrinking gradually, it’s not going to disappear anytime soon,” says Saad Hashmi, who works as group account head, client services, at Orient Advertising, an advertising agency. “If a quarter-page ad on the front page of a leading newspaper costs Rs1.2 million, a wise account manager can use the same amount to run a month-long ad campaign on radio. That makes print advertising a little less attractive.”

The share of radio in the total ad spend in 2011 was Rs1.3 billion, or 4%, up 22% from the preceding year.

Another noteworthy phenomenon in the ad industry of Pakistan is the surge in the outdoor and brand activation expense, which saw a 50% increase to Rs3 billion, or 9% of the total ad spend, in 2011. Ali says the major reason for the increase in “out of home” advertising is that people are tired of ‘clutter’ on television and want more engagement and personal interaction through brand activation events. Secondly, he adds, power breakdowns have made out-of-home advertising more reliable for advertisers.

Rawalpindiwala says the ad industry will keep growing at a significant pace in coming years. “Although final figures are yet to come out, the size of Pakistan’s ad industry for fiscal 2012 is expected to be between Rs37 billion and Rs40 billion.”

Published in The Express Tribune, July 6th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ