Weekly Review: Subdued activity continues amid low participation

Fertiliser sector witnessed a week to forget.

Investors stayed on the sidelines as the market witnessed another week of subdued activity amid political turbulence.

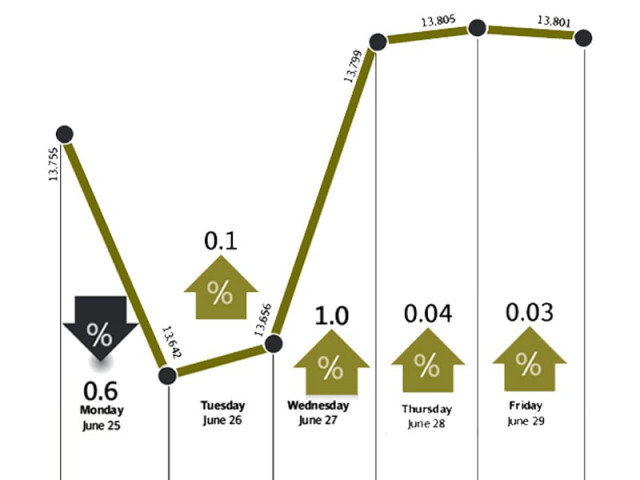

The Karachi Stock Exchange’s (KSE) benchmark 100-share index rose 0.5 per cent to end at 13,801 point level.

The end of the week also brought the curtain down on the financial year 2012. Over the course of the year, the benchmark index gained 10%, however, after adjusting the rupee decline, the gain in US dollar was only 1%, according to Topline Securities. Participation level – suffering ever since the imposition of infamous price cap rule in 2008 – slightly improved to 128 million shares compared with the preceding financial year’s 95 million shares.

Coming back to the weekly scenario, average daily volumes stood unchanged at a dismal 69 million shares.

The fertiliser sector was in the spotlight amid both good and more bad news. Fertiliser sales in May posted their best performance of 2012 while Competition Commission of Pakistan (CCP) questioned the pricing mechanism of the industry.

CCP following its initial inquiry report on ‘unreasonable increase in the price of fertiliser urea’ issued show cause notices to all fertiliser manufacturers. On the other hand, State Bank of Pakistan urged the government to eliminate the price gap between locally produced and imported urea.

As a result, key fertiliser stocks Fauji Fertilizer Company, Fauji Fertilizer Bin Qasim and Engro plummeted by 1.4%, 1.0% and 3.0%, respectively.

Indus Motor and Honda raised car prices to compensate for the Euro-II compliance and saw its stock value drop by 2.9% and 6.4%, respectively.

KSE’s immediate concerns on the fiscal 2013 budget were partially addressed as a Presidential Ordinance was promulgated last weekend, validating the measures undertaken by the former premier during the span of April 26 to June 19. However, the legality of the Ordinance has been challenged in the Supreme Court.

Foreigners were net sellers again, this time $5.6 million was pulled out from the bourse against $6.3 million in the preceding week.

Outlook for the future

As proceedings for fiscal 2013 kick off, the spell of corporate results due to begin mid-July are the next important catalyst to inject some life into the market, says a KASB Securities research note. The detailed verdict of the apex court on disqualification of former prime minister Yousaf Raza Gilani is also still awaited.

On the international political front, Pak-US dialogue keeps alternating between conflicting reports, although some hope can be drawn from the US administration’s proposal to Congress for securing $1.1 billion in aid to Pakistan in fiscal 2013. Pakistan is also expected to repay the final loan installment to the International Monetary Fund valued $107.5 million, resulting in a slump in foreign exchange reserves.

Other than this, Fatima Fertilizer and Engro Foods also warrant closer attention given sound business profiles and attractive upsides, adds the note.

Published in The Express Tribune, July 1st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ