Weekly Review: Gilani’s ouster casts shadow over bourse

Macro numbers, foreign selling keep investors on the sidelines.

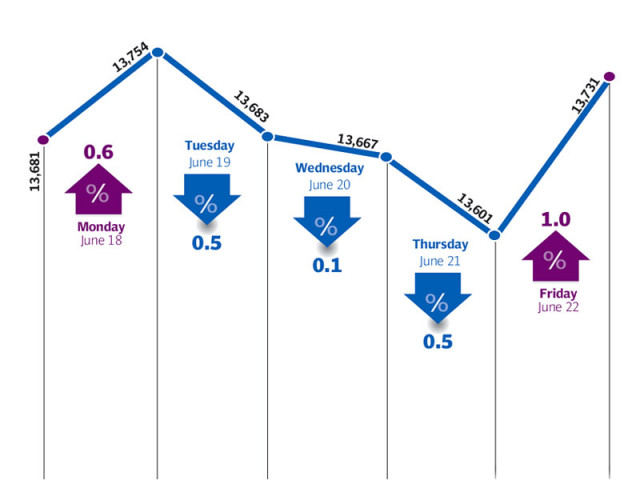

Politics dominated the proceeding at the country’s stock market, as investors were left wondering after the disqualification of Yousuf Raza Gilani as prime minister. The KSE-100 index remained range-bound and closed with a nominal gain of 65 points or 0.5% during the week ended June 22.

The tussle between the judiciary and the federal government had long played on investors’ minds and the disqualification of the prime minister was no different.

The Supreme Court declared that the prime minister stood disqualified from April 26, the day when it announced its hearing on the contempt of court proceedings. Since then, the prime minister oversaw the passing of several legislations, including the budget for fiscal year 2013. The legality of all such legislation is now ambiguous as the Gilani was not the prime minister when they were passed.

The budget for FY2013 had made official the reformed Capital Gains Tax regime, which had brought renewed life in the stock market. The budget will not come under scrutiny as it was also passed by Parliament, however, for the time being it stands nullified. Investors will now wait for the detailed judgement of the apex court.

The week opened on a positive note, albeit with low investor interest. However, the decision of the prime minister’s disqualification had an immediate impact as the KSE-100 index witnessed three consecutive days in the red. On Friday, the index climbed by 1% to close the week on a positive note.

Foreigners continued to be net sellers in the equity market and offloaded $6.3 million during the week. Foreign interest wasn’t helped by the fact that Pakistan’s was not even mentioned in the MSCI Frontier Markets report. On the flipside, the positive news in this was that the country’s rating remained unchanged.

Macro numbers painted a grim view of the economy, with the current account deficit surging to $3.77 billion during the 11 months of fiscal year 2012 compared with only $79 million in the previous fiscal year. A 47% increase in the trade deficit and a 61% dip in net foreign investment have been the main culprits in the high current account deficit.

Volumes continued to drop during the week and stood at a lowly 69 million shares traded per day on average, down by 20% over the previous week. Similarly, average daily value also dropped by 22% and stood at Rs2.5 billion traded per day. The market capitalisation of the KSE increased 0.4% to Rs. 3.50 trillion by the end of the week.

What to expect?

The disqualification of the prime minister will see the resumption of the struggle between the government and the judiciary, as the Supreme Court is likely to ask the next premier to reopen cases against the President, who is also the co-chairman of the ruling party. Hence politics are likely to play an important role in the coming weeks.

Published In The Express Tribune, June 24th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ