Weekly review: Budget saves bourse from further slide

Volumes plummet as foreign investors divest from the market.

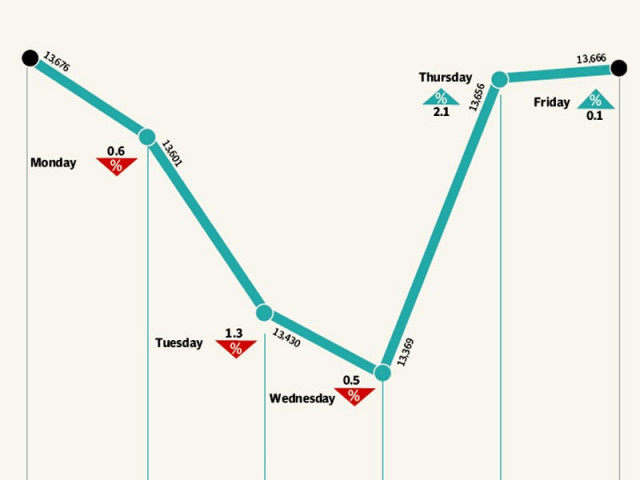

The approval of the budget for the 2013 fiscal year rescued the stock market from spiraling downwards, as the benchmark KSE-100 index ended the week with a modest gain of 107 points or 0.8% during the week.

The week started off on a negative note as investor participation remained low in the opening few days. The index dropped 1.5% in the opening three days of the week, before the National Assembly passed the bill for the fiscal year 2013.

The passing of the budget brought about renewed interest in the market. Investors responded by actively participating in the market on Thursday, when the KSE-100 index posted a gain of 2.1% to make up for its earlier losses.

Domestic politics were at the forefront during the week, as it emerged that the son of the Chief Justice of Pakistan was involved in taking huge bribes from real estate tycoon Malik Riaz, so that he could use his ties to resolve pending cases against the tycoon. As a result, the judiciary came under scrutiny and the news dominated headlines for the majority of the week.

The rally was led by local market participants as foreigners continued to offload their holdings in the country’s bourses, following the rapid depreciation of the rupee in May. Foreigners offloaded $17.6 million during the week, following the $16.8 million offloaded in the previous week.

The foreign offloading excluded the $83 million sale of the Hub Power Company (Hubco) shares by the National Power International Holdings B.V to the Dawood Group and Allied Bank Limited, which is also considered as a foreign outflow of funds. Hubco outperformed the market during the week, following the approval of the revised tariff for its Narowal project.

The automobile sector had news to rejoice as sales grew 26% during May. The strong performer of the week was Pak Suzuki Motor Company with share value climbing 5.4% during the week.

On the macro front, remittances continued their impressive run, clocking in at $1.2 billion, up 4% over the previous month.

Volumes dropped 9.3% during the week and stood at 86.4 million shares traded per day, following the 32.2% decline in the previous week. Volumes have again faded to double digits after an impressive showing in the first five months of the year.

Average daily value remained steady at Rs3.2 billion shares as investors focus shifted towards blue-chip stocks. The market capitalisation of the KSE increased 0.6% to Rs3.49 trillion by the end of the week.

Published In The Express Tribune, June 17th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ