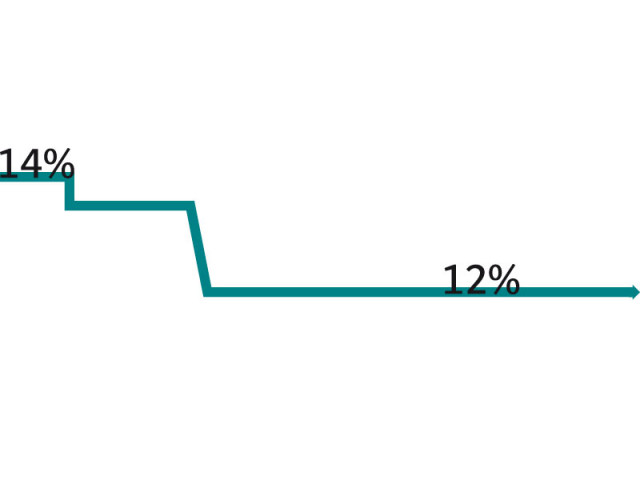

Monetary policy: Interest rate left unchanged at 12%

State Bank underscores need for fundamental reforms, particularly in energy sector.

The State Bank of Pakistan (SBP), while stressing the need for fundamental reforms to turn around the economy, has kept the benchmark interest rate – called the policy rate – unchanged at 12% in the face of high inflation and unchecked government borrowing from banks.

“The economy basically needs fundamental reforms to engineer a turnaround in its performance,” the SBP said on Friday in its monetary policy statement, which is released after every two months.

“Inflation expectations cannot be effectively anchored around single-digit targets without limiting fiscal borrowings from the banking system, particularly from the SBP,” the central bank said and noted that despite a sluggish GDP growth, inflationary pressures had not subsided.

The statement highlighted that the government borrowed Rs414 billion directly from the central bank during July 2011 to May 2012 and took the total borrowed stock level to Rs1,660 billion. “This contradicts the SBP (Amendment) Act 2012 that requires the government to maintain zero quarterly borrowing and retire the total stock in next seven years,” said BMA Capital analyst Nurali Barkatali.

Consumer Price Index (CPI) – the broadest measure of inflation – increased by 12.3% in May year-on-year. According to the SBP, a noteworthy aspect of inflation behaviour is its persistence at this high level alongside slack economic activity.

In financial year 2012-13 beginning July, the central bank is not expecting a sharp increase in inflation, but it may remain around current levels.

The central bank also highlighted the importance of private investment in the economy. “While managing the external and fiscal pressures remain more of an immediate concern, the real challenge lies in reviving private investment in the economy. At the same time, scheduled banks continue to avoid extending credit to private businesses, which are already suffering from energy shortages,” it said.

According to provisional data, private investment-to-GDP ratio has dropped to 12.5% in FY12, prompting the need for fiscal reforms. The SBP said absence of an enabling business environment due to persistent energy shortages and precarious law and order conditions had dampened the demand for fresh private credit.

The government, on the other hand, is accumulating short-term domestic debt at a rapid pace. All these have made the monetary policy ‘less effective’, the SBP commented.

It, therefore, underscored the need for urgent energy sector reforms to boost business confidence and arrest the declining investment-to-GDP ratio. The central bank also suggested that limiting and retiring budgetary borrowings from the banking system and implementation of consistent and credible policies would help in moving away from this undesirable equilibrium.

It also pointed to the unending debt and financial problems in the euro zone, which have increased uncertainty in the global economy, affecting somewhat Pakistan as well.

Current account deficit

Commenting on developments in the external sector, the SBP said the issue was not the size of the external current account deficit, but lack of sufficient external inflows to finance it. Cushioned by robust worker remittances of $10.9 billion, the current account deficit was $3.4 billion in the first 10 months (July-April) of FY12.

After calculating the estimated deficit for the remaining two months, it is likely to remain around 1.7% of GDP for FY12, which, according to the SBP, is not large for a developing country like Pakistan.

Dollar’s strength and oil prices

The US dollar, being a safe haven for investors, has strengthened significantly in the past few weeks against almost all currencies, especially the euro, and Pakistani rupee is no exception.

On the other hand, appreciation of the US dollar in international markets is probably one explanation why oil prices have eased somewhat, dropping from a peak of $130 per barrel (Saudi Arabian light crude) on April 3 to $97 per barrel on June 1.

“This, together with expected global slowdown, may keep oil prices softer compared to earlier projections. Given that almost one-third of Pakistan’s total import bill comprises oil payments, this would be a positive development,” the SBP commented.

Citing an example, it said that keeping in view the current quantum of crude and petroleum product imports at 21 million tons, a decline of $5 per barrel in international oil prices could save up to $700 million in import payments in FY13.

Published in The Express Tribune, June 9th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ