To be or not to be: Does Pakistan stand a chance to climb the ladder?

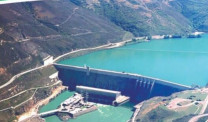

Pakistan is one of the very few countries which has the potential to become self-sufficient in energy, food & water.

To be or not to be: Does Pakistan stand a chance to climb the ladder?

Outside the US, Pakistan is one of the very few countries which has the potential to become self-sufficient in energy, food & water. Punjab province was the breadbasket of pre-partition India while Balochistan region is home to large, mostly unexploited reserves of oil, gas, gold, copper and other minerals. The public face however is, of people dying in terror related incidents at average of 10 per day or 20% of world total. So why discuss Pakistan now? After all, its $200 billion economy is less than US state of Massachusetts, and its capital market depth of $36 billion (1/1000th of world) is hardly significant in a global investment context.

For a start, ‘growth’ is what the world revolves around. I want a salary increase every year, every company wants to profits to grow and even rich countries take it as a slight if standards of living do not keep on increasing. So, as consumers in the developed world de-leverage –paying personal debt and affecting demand – many well-known investors based on historical trends, are projecting low equity (business) returns over the next 7 to 10 years. With interest rates at lows, bonds are expected to fare even worse. Hence, developed world capital will actively seek new opportunities.

Emerging markets (EM), such as India and China have been a fad for more than a decade but their investment valuations are almost twice the frontier markets (FM), which include Pakistan. The latter is technically a subset of the former in terms of growth potential.

Back to Pakistan, bad news first and this is a double header, religious extremism and a bad state of the economy and governance. The former has been fuelled by 1980s global support for non-state actors during the Afghan-Soviet War while the recent years upsurge in violence is a reaction from unpopularity of the country’s role in the war on terror. The resultant crippling of foreign direct investment has left industrial development stunted, with IMF programmes and $10 billion of foreign remittances having become critical in plugging the import-export gap.

The clouds are not all dark though. The media is remarkably independent having created political awareness. Result is the rise of third political force under cricketer-turned politician Imran Khan whose campaign on corruption, increasing tax collection (by taxing all including the ruling feudal elite) and a strategy to tackle extremism (by bailing out of war on terror) have gained wide traction. Whether he succeeds or not in the 2012/13 general elections, it is clear that the populace have been made aware of the issues that matter.

For foreign investors, Pakistani governments have always been welcoming. Overseas capital can own 100% of equity and can be freely repatriated. Corporate disclosures of listed companies are one of the best in Asia, while according to Frontaura Capital, an upcoming frontier market equity fund, ‘most of the companies are well managed’. Even for locals, corruption and bureaucratic red-tape aside, economic freedom and ability to pursue range of business activities, has always been high.

Another big advantage is that Pakistan, unlike many frontier markets is not commodity dependant. Its major export is textiles, but it has a significantly diversified manufacturing sector, ranging from chemicals, consumer goods, car assembling and others, combined with a vibrant services industry led by banking, advertising and telecom. This is not the result of a vacuum but rather the entrepreneurship ability of its people which took Pakistan from literal bankruptcy at birth to an Asian Tiger within 20 years of its existence. Presently there are more than three million skilled expatriates whose brains and money can be cashed by any new government with popular trust.

Recommendation: It is currently difficult to pitch Pakistan as a tourist destination, so investment certainly cannot be for the faint-hearted. However, this country of 180 million should be kept a frequent tab on. A recent advance is an increase in trade ties with historical adversary and neighbour India, which if not rolled back can potentially double exports over time. Nonetheless, Pakistan’s stumbling block has been political instability due to low level of mass political participation cowed out by feudal and military governments, which has left the education and health sectors in tatters. Hence, development on the political and governance side is what is really needed to be monitored and as was mentioned, the seeds for a turnaround may have been sown.

The writer works as an economist and portfolio manager.

Published in The Express Tribune, May 7th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ