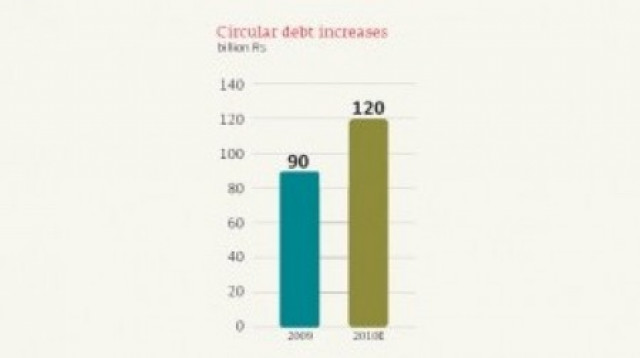

Circular debt increases to around Rs120b

The size of circular debt was close to Rs90b as of December 2009, according to annual accounts of different companies. The analysts predict that major losers will be refining companies, mainly Pak-Arab Refinery Company (PARCO), and the oil exploration and production sector.

Energy companies still face liquidity constraints affecting their business operations despite gradual payments by the government through term finance certificates (TFCs). The repercussions of the oil price shock seen in 2008 are still being felt within energy sector companies of Pakistan in the shape of circular debt even though the oil shock has subsided.

Driven by power sector

Circular debt usually refers to the situation where one company’s funds get stuck with other company, thereby resulting in non-payment to its creditors. If the company’s receivables are rising, it tries not to pay causing payables to increase.

This has been happening among energy firms in Pakistan for the last two years. This circular debt crisis is generated mainly from WAPDA, which is the largest generator with a 52 per cent share in electricity supply to the country.

As per latest energy statistics, WAPDA produces 24 per cent of electricity by using gas and 17 per cent through furnace oil as fuel. Gas is mainly supplied by Sui Southern Gas Company and Sui Northern Gas Pipelines whereas Pakistan State Oil and other oil marketing companies supply furnace oil directly to WAPDA. WAPDA also purchases costly power from Independent Power Producers like Hubco, Kapco and a few others.

Whenever WAPDA delays payments, the entire energy chain gets affected. As at December 2009, the overdue amount to be paid by WAPDA was Rs5b to Rs6b to gas marketing companies, Rs20b to Rs22b to PSO for direct furnace oil sales and Rs58b to power plants including Hubco and Kapco.

Burden largely borne by OGDC & Parco

OMCs and gas marketing companies mostly pass on their receivables to exploration and production companies as far as the sector wise impact is concerned. Around 66 per cent of the circular debt is absorbed by exploration production companies whereas OGDC’s overdue receivables stand at Rs42b.

Refineries specially Pak Arab Refinery (PARCO) and Byco Petroleum Pakistan (formerly Bosicor Pakistan) both of which process almost 92 per cent of the imported crude will be the major losers, according to Topline Securities, analyst, Furqan Punjani.

Impact on energy companies

Drilling activity of E&P companies declined by 22 per cent and refinery capacity utilization declined to below 80 per cent during the last one year. This has already taken its toll on indigenous production of energy resources and with 2500MW power plants expected in next few years. This issue needs to be resolved before it magnifies this debt according to Topline analysts.

Energy companies may get paid on times, because of the consistent increases in power rates under the IMF programme, according to Topline analysts. This should reduce the risk of circular debt piling up further at the same pace according to Punjani.He added that according to their estimates the electricity subsidy has gone down to Rs2b to Rs3b per month against Rs14b to Rs15b per month a few months back.

However, the only risk would be the addition of expensive electricity to the national grid once these rental power plants become operational

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ