Weekly review: Healthy corporate results fail to sustain rally

KSE-100 index climbs 0.2% as volumes take a plunge.

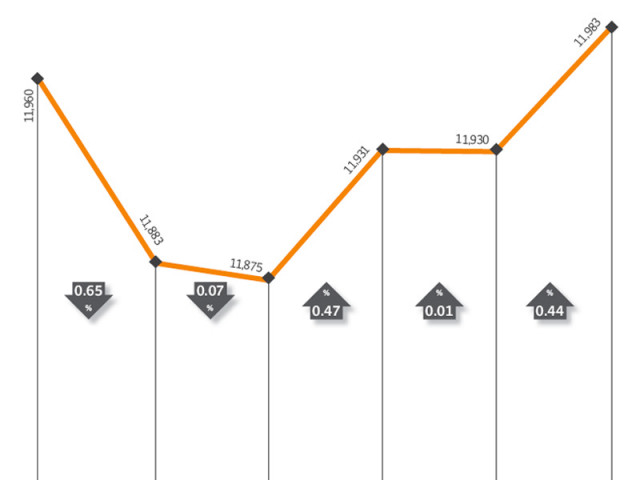

The two-week stock market rally, sparked by the relaxations in the capital gains tax regime, finally came to a halt as the benchmark KSE-100 index remained flat, managing to climb only 0.2% or 22 points during the week ended February 4.

The last two weeks saw the KSE-100 index shoot up by 8.5% following relaxations announced in the CGT regime by finance minister Abdul Hafiz Shaikh during his visit to the bourse. The announcement had also resulted in a revival in trading volumes and it was expected that the rally would continue with the onset of the corporate earnings season.

However, that was not the case, as the rally finally fizzled out despite healthy earnings announcements from two major sectors, fertilizer and the cement industry. Volumes plunged 37% as investors took a cautious approach, in the backdrop of political tensions in the country.

During the week, Fauji Fertilizer Company (FFC) announced earnings per share doubling to Rs26.5 on a yearly basis, healthily beating market expectations. The company announced a cash dividend of Rs5.25 per share for the quarter, taking its full year cash dividend to Rs20. Furthermore, the company also announced a 50% stock dividend, which took the market by surprise.

However, the markets response was muted and the share closed the week with a modest decline. Similarly, Lucky Cement also announced its half yearly result, with EPS of Rs.9.3, up 106% over the previous year. Again, the markets response was silent as Lucky closed with a slight gain.

Pakistan Oilfields and Attock Petroleum Limited, the star performers of the Attock Group of Companies, also posted EPS growth of 19% and 27% respectively, with healthy cash dividends. Overall, the healthy earnings announcement had little bearing on the market and failed to sustain the bullish sentiments.

The negativity was triggered primarily by the ongoing political tensions in the country, as the Supreme Court issued an order, summoning the Prime Minister on February 13 to charge him in the contempt of court case. Furthermore, lack of clarity about the CGT relaxations also affected investor sentiments.

Inflation numbers for January were also revealed during the week, inching into double digits at 10.1%. The numbers have kept hopes alive of a possible discount rate cut in the policy announcement on February 11. Foreigners were again net buyers during the week, purchasing a net of $2.2 million worth of equities.

With lower volumes, average daily value also fell 26.7% to Rs. 4 billion traded per day. The market capitalisation of the KSE increased 0.4% to Rs. 3.11 trillion.

What to expect?

The ongoing earnings season will result in continued stock-specific activity. The markets focus will also shift towards monetary policy announcement at the end of the week, where a rate cut will be a positive trigger for the market.

Monday, January 30

The stock market started the week on a negative note as investors opted to sell despite corporate giants posting healthy profits. Investors booked profits at higher levels after record profit announcements by Lucky Cement and Fauji Fertilizer, said Arif Habib Corporation Director Ahsan Mehanti.

Tuesday, January 31

The stock market wandered along the neutral line as lack of triggers and no major corporate announcement pushed investors to the sidelines. Despite considerable decline in political noise and court hearing over NRO case played its part in keeping investors away and glued to developments.

Wednesday, February 1

The stock market witnessed healthy activity amid higher volumes. Relaxation in margin trading rules acted as a catalyst at the bourse, said Topline Securities Equity Dealer Samar Iqbal.

Thursday, February 2

The stock market closed flat in a volatile session with energy sector companies pulling the strings of the index. Pakistan Oilfields earnings announcement in morning trade was not well received by investors as half year earnings per share of Rs26.08 was below estimates.

Friday, February 3

The stock market ended the week on a positive note amid healthy volumes. The rally was supported by rumours of promised conversion of circular debt into Term Finance Certificates by the government, said JS Global Capital analyst Shakir Padela.

Published in The Express Tribune, February 5th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ