Arbitrage opportunities: ‘Pakistan should buy cheaper gas from US’

Planning Commission recommends cancelling current LNG import plan.

As natural gas prices soar in the Middle East and plummet in the United States, the Planning Commission in Islamabad has suggested that, rather than go through with the current plan of importing liquefied natural gas from places like Qatar, the petroleum ministry should try to start buying gas from the US instead.

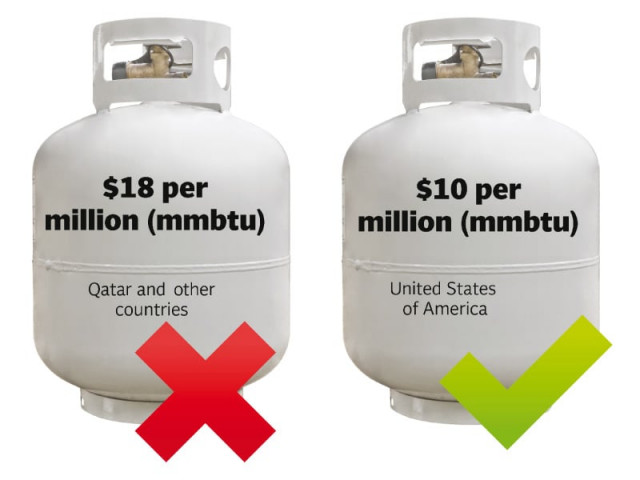

The Oil and Gas Regulatory Authority (Ogra) has issued LNG terminal construction licences to three companies and is expecting those companies to begin importing gas from Qatar and other places in the Middle East at about $18 per million British thermal unit (mmbtu), or about four times the price of domestically produced gas.

The Planning Commission, however, points out that average spot prices of LNG in the United States, as measured at Henry Hub, are around $10 per mmbtu. In a policy recommendation sent to the petroleum ministry, a document made available to The Express Tribune, the commission lays out a strategy for the country to minimise its gas import costs.

“Potential suppliers have indicated LNG import prices linked to oil at $18 per mmbtu, which is close to furnace oil prices. However, with increasing trade, global LNG buyers are seeking contract flexibilities based on lower prices in western markets, Asian Spot quotations (Japan, Korea marker), and new exports emanating from United States and Australia,” reads the document.

The Wall Street Journal reports that US natural gas production rose by 10% last year, despite a 32% drop in US domestic prices and is expected to expand a further 4% this year. Indeed, natural gas in the US has become so cheap that some oil companies in the US are not even bothering to put the gas they find close to their oil fields into a pipeline, simply burning it as it comes out of the well.

This is in sharp contrast to Pakistan, where natural gas production is expected to plummet by 61% over the next eight years to 2,500 million cubic feet per day (mmcfd), according to estimates compiled by the petroleum ministry and cited by the Planning Commission. The government estimates the current shortage – heightened due to winter heating requirements by domestic consumers – at about 2,000 mmcfd.

The commission rubbished the idea that security concerns alone were responsible for a lack of exploration of oil and natural gas within the country. “Oil and gas production does not stop due to security concerns provided the policies and incentives are right,” reads the document.

The Planning Commission estimates that much more gas beyond its 29 trillion cubic feet (tcf) of conventional natural gas reserves. It is estimated that there may be as much as 50 tcf of tight gas, as well as another 50 tcf of shale gas in the Indus River Basin. Total reserves are estimated at 150 tcf in the Indus region alone, not counting any gas that may exist in Balochistan and Khyber-Pakhtunkhwa.

Sources in the petroleum ministry said that the Planning Commission also suggested a tariff plan and regulatory mechanism to Ogra for LNG imports and terminals. The commission is sceptical of the ability of private sector parties to begin LNG imports, and urged the petroleum ministry to consider getting the state-owned Interstate Gas Systems – a joint venture between Sui Northern Gas Pipelines and Sui Southern Gas Company – to enter the LNG import business.

“Funding support and technical assistance can be requested from international donors to expedite the pipeline to tie the LNG terminals to [the gas grid],” says the commission in the document.

A significant impediment to the import of LNG is the fact that most suppliers are demanding sovereign guarantees of up to $700 million of rolling letters of credit. International suppliers now view the Pakistani market with suspicion due to the circular debt problem that has financially crippled the energy sector.

Published in The Express Tribune, January 17th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ