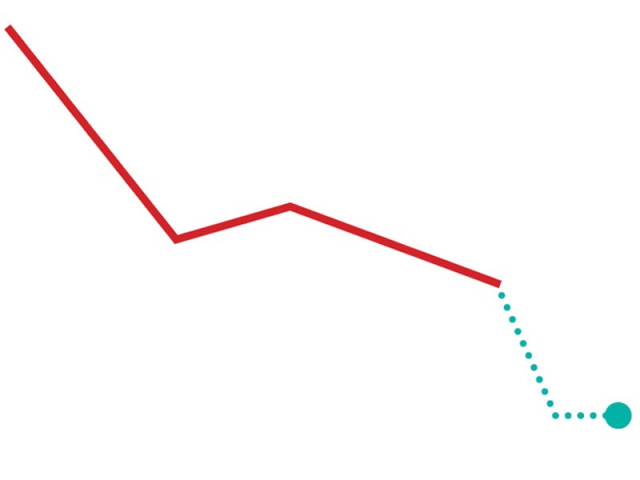

Trend remains upwards: Inflation falls to 23-month low

This is the first time in five months that the month-on-month increase in inflation slipped below one percent.

The change in calculation methodology continued to work for the statisticians in Islamabad as CPI inflation was recorded at 10.19% for the month of November, a figure last recorded in October 2009.

Most analysts were expecting it to be about 10.6 per cent or higher and according to the Federal Bureau of Statistics (FBS) the lower number was due to an overall slowdown of the economy.

The lower than projected CPI is primarily due to food and housing/fuel inflation at 10%YoY and 7.4%YoY, respectively, in Nov’11. These two components together constitute almost two-third of the CPI basket.

However, analysts warn that the trend may reverse in the second half of the current fiscal year (January-June) due to oil price shock and continuous devaluation of Pakistan’s currency against the US dollar.

“In addition to change in base year, an overall slowdown in economic activity, surplus of essential crops and resumption of supplies after devastating floods in Sindh have controlled inflation”, said Mazamal Aslam - an economist working for JS Global Capital Limited.

Aslam said the central bank’s decision to keep the discount rate - a rate at which it lends money to banks – unchanged, was prudent despite decelerating inflation. He said there was no cash in the system for investment and any reduction in discount rate would only serve the biggest borrower - the federal government.

The FBS reported that on month-on-month basis, inflation increased by 0.29. This is the first time in five months that the month-on-month increase in inflation slipped below one per cent.

Aslam said monthly figure was a more true representative as it was immune of base change. He said 0.29 per cent increase in monthly inflation was encouraging but warned that the trend may reverse in the months ahead. Crude oil prices have crossed $100 a barrel once again and sliding rupee may lead to imported inflation in the country, said Aslam.

The International Monetary Fund has recently advised Pakistan to adopt “cautious monetary policy” and “responsive exchange rate”. Analysts have interpreted the responsive exchange rate as one that would adjust to the difference between inflation of trading countries. Analysts say that at present the difference is about eight per cent. The market has reacted to the news and since then the rupee has been depreciating.

The FBS said that prices of food items and non-alcoholic beverages were increased one-tenth in November over a year ago. Non-perishable food items rates increased 11.8 per cent. Clothing and footwear became costly by over 15 per cent.

Housing, water, electricity, gas and fuel charges soared by 7.4 per cent, health services cost increased 10.7 per cent, transport 13.2 per cent, and charges of restaurant and hotels increased 13.2 per cent in November.

Average inflation in first five months of the current fiscal (July-November) surged to 11.1 per cent despite a change in the base year. For the current fiscal year the government has targeted average inflation at 12 per cent. Analysts say after recent change in base year the government may meet this year-end target for the first time in recent history.

Published in The Express Tribune, December 3rd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ