Weekly review: KSE-100’s slump continues as volumes dwindle further

Benchmark index drops 2.4% during a dull week for traders.

Weekly review: KSE-100’s slump continues as volumes dwindle further

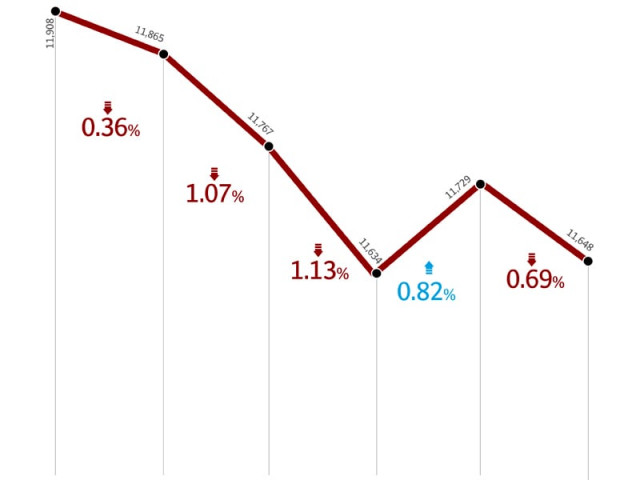

Starved of triggers, the stock market suffered another lacklustre week as the benchmark KSE-100 index slumped 2.4% (290 points) during the week ended November 25. Volumes fell sharply by 17% to extremely low levels of 34 million shares traded per day.

The KSE-100 index closed negative in four out of the five trading sessions during the week, following a 0.8% (99 points) decline in the previous week. Political uncertainty along with the International Monetary Fund’s bleak outlook for the country’s economy contributed to the index’s woes.

Political issues again returned to the forefront after the revelation of the memo written by Pakistan’s ambassador to the United States, which stated that the government felt threatened by an impending military coup in the country. The fallout resulted in the resignation of the ambassador and an escalation in political noise, with some parties calling for fresh elections.

The ongoing talks between the government and the IMF also ended in a deadlock, with the lending institution painting a bleak picture of the economy. It observed that Pakistan faces tough challenges due to fiscal pressures, debt servicing and the ongoing energy crisis. It also said that the country will achieve GDP growth of 3.5%, instead of the 4.2 targeted by the government.

The outflow of foreign funds relentlessly continued as foreigners were again net sellers during the week, offloading USD 3.8 million during the week. The outflow has become a major source of concern for local investors and has been a major factor in the declining volumes at the bourse.

The fertiliser sector also came under pressure during the week as the government announced the sale of imported urea at Rs1,480 per bag, as compared to the Rs1,580 per bag price of local manufacturers. The local manufacturers hinted towards dropping the price by Rs100 if 80% supply of gas was ensured by the government. However, this did not materialise.

The only positive session of the week came on Tuesday, after the announcement of the wheat support price at Rs1,050 per 40 kg, as compared to Rs950 in the previous year. Furthermore, reports of the discovery of gas in the Zin block also surfaced, which provided a boost to the market.

On the macro front, the current account for the first four months of the current fiscal year widened to $1.55 billion as compared to $0.54 billion in the previous year. This was primarily due to the surge in global oil prices, which resulted in a 54% growth in the oil import bill.

Average daily volumes stood at 34 million shares per day, dropping 17% over the previous week. Average daily value fell 28%, and stood at Rs1.54 billion as most of the activity was restricted to lower tier stocks. The KSE’s market capitalisation fell 2.3% to Rs3.03 trillion by the end of the week.

What to expect?

The only upcoming trigger is the monetary policy announcement by the State Bank of Pakistan, where the central bank is expected to maintain status quo on the discount rate. Hence, the coming week can be expected to be dull due to lack of stimulating factors in the market.

Monday, November 21

The stock market witnessed yet another lacklustre trading session with minimal local and foreign participation. Many blame current local politics and lack of triggers for the sluggish sessions being witnessed these days, said Elixir Securities equity dealer Faisal Bilwani.

Outflow: Rs113m, was the amount of foreign selling during the trading session

Tuesday, November 22

The stock market seemed to be in another fix as the benchmark index took another beating amid low volumes. Stocks fell amid a raging controversy over a mysterious memo in which the country’s civilian government allegedly sought US help to prevent what was described as an imminent coup.

Outflow: Rs17m, was the amount of foreign selling during the trading session

Wednesday, November 23

Resignation of Pakistan’s Ambassador to the US, the ISI and CIA blame game, fluctuation and global market debt pressure weakened investor’s sentiments, said JS Global Capital analyst Mujtaba Barakzai. Investors opted to sell as negative triggers prevailed in the market.

Outflow: Rs20m, was the amount of foreign selling during the trading session

Thursday, November 24

The stock market finally ended the dull phase that marred trading for two weeks as investors got into the act and bought stocks. Oil and Gas Development Company alone contributed 45 points to the total 95 points gain.

Outflow: Rs128m, was the amount of foreign selling during the trading session

Friday, November 25

The stock market fell on the last trading session of the week as volumes plummeted to an alarming level. Fall in global equity markets and local political issues kept investors on the sidelines.

Outflow: Rs55m, was the amount of foreign selling during the trading session.

Published in The Express Tribune, November 27th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ