Should Islamic banking be our Plan B?

Islamic banks have been aggressively marketing their products in an attempt to expand their client base.

Disillusioned by the meltdown of the global financial system, people have become more critical of the conventional banking sector, which is seen as being responsible for the global financial crisis.

This disillusionment and hostility has in turn provided an excellent opportunity for Islamic banks to provide an apparent alternative to the current banking system. Particularly in Pakistan, Islamic banks have been aggressively marketing their products in an attempt to expand their client base. According to the SBP, only ten per cent of Pakistan’s population use banking services, but with a population of over 180 million people, that adds up to quite a few customers.

Islamic banking has definitely come of age in Pakistan. Currently there are over 800 bank branches and sub-branches countrywide that offer Islamic banking. Some are full-fledged Islamic banks and others are conventional banks which also offer Islamic banking services.

With interest in Islamic banking increasing, these numbers are likely to rise, and another factor fuelling growth is investor interest. Foreign investors from the Middle East and Southeast Asia continue to invest heavily in these local financial institutions, despite sluggish economic growth and poor security in the country.

Islamic banking initially started in Malaysia during the 1960s to cater to Hajj pilgrims, who were not willing to avail the services of commercial banks which are based on interest or riba.

Since then, Islamic scholars and financial institutions in Muslim countries have made a concerted effort to develop and propagate a Shariah-compliant Islamic financial system, specifically for people who want to avail riba-free banking.

Islamic banking started in Pakistan in the 1980s during General Ziaul-Haq’s military regime in the 1980s, but was merely a cosmetic initiative. Subsequently in 1991, the Federal Shariah Court declared conventional banking un-Islamic. Yet the critical juncture in the movement to ‘Islamicise’ banking came on December 23 1999, when the Supreme Court gave a verdict ordering the government to overhaul the interest-based banking system along Islamic guidelines, and set up an interest-free economy by 2001.

Though the time frame given by the Supreme Court was unrealistic by any means, the verdict served as a wake-up call for the State Bank to initiate Shariah compliant banking. The central bank at that time wanted to follow the model of Islamic banking in Malaysia and GCC countries, especially in Bahrain, where Islamic banking had made considerable progress since the 1960s.

Even though Islamic banking has gained currency over the decades, it never became the predominant banking system in Pakistan. Nevertheless, the perceived success of Malaysian and GCC countries’ financial models encouraged the State Bank of Pakistan to re-launch Islamic banking in 2002. The global financial crisis in 2008 also boosted the mainstream importance of Islamic financial institutions, which due to their asset-based model of financing, remained relatively safe compared to conventional banks which fell like a house of cards.

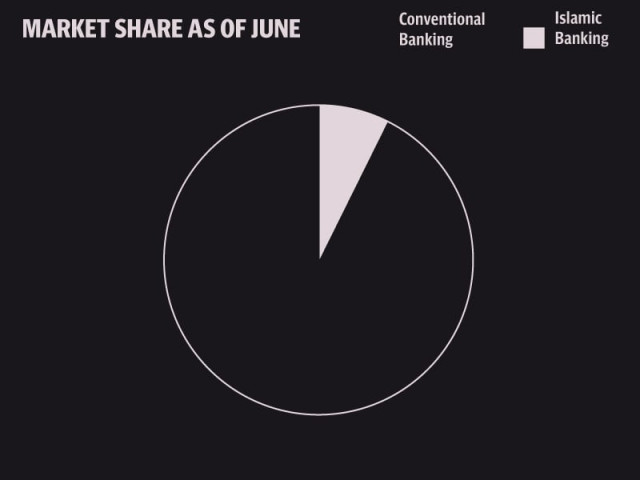

Thus over the decades, Islamic banking in Pakistan gained popularity and credibility. The share of Islamic banks in the total banking sector of the country was just 4 per cent in 2008, but now has jumped to 8per cent.

“The way the deposit base of Islamic banks is growing, we will easily capture the market share of 12 per cent by the end of 2012,” says Pervez Said, the President of the Burj Bank. He pointed out that despite the sluggish performance of the economy, the ratio of non-performing loans of Islamic banks is in the range of 8 to 10 per cent – considerably lower than the 12 per cent of conventional banks. In the financial year ending June 2011, the deposit base of Islamic banks grew by 37 per cent, reaching Rs460 billion, while their assets rose by 36 per cent to Rs560 billion.

Despite their impressive performance the biggest challenge that Islamic banks face is the lack of avenues for investing their surplus liquidity. The ongoing power crisis and the worsening law and order situation have caused a drought in availability of credit for the private sector, thus causing Islamic and commercial banks to attract government borrowing instead.

Even though the government has already raised roughly Rs200 billion through Ijarah Sukook (Islamic bonds) and has also increased the investment limit for Islamic banks in the sukook bonds, from 25 per cent to 35 per cent of the total deposit base, problems continue to plague Islamic banking. “Because of the restrictions of Shariah, we have very few avenues of investment whereas the commercial banks can invest in treasury bills, PIBs, corporate finance, running finance etc,” says a senior banker in Bank Islami.

He added that the dismal economic situation of the country also adversely affects private investment in the financial products of Islamic banks. “There are clear instructions from the State Bank that our priority should be to protect depositor money and then gauge the rate of return we can offer to depositors,” he said.

Pervez Said, who previously headed the Islamic banking department of SBP, echoed the same concerns. “We already have limited avenues of investment even for the existing deposit base of over Rs400 billion, so how can we lure more depositors?” he asked. However, he predicted that once the share of Islamic banking rises to 20-25 per cent of the entire banking industry, the sector will be able to offer competitive deals to depositors and lenders.

Dr Shahid Hassan Siddiqui, former senior banker and expert on Islamic banking, says that the SBP is currently developing the Islamic banks on the lines of commercial banks. Siddiqui argues that Islamic banks don’t cater to individuals and that their deposit base is a meager 9 per cent compared to the 15 per cent of commercial banks. “The commercial banks are serving the economy better as compared to Islamic banks,” he asserted.

He also expressed doubt in the shariah-compliant credentials of Islamic banking. “Islamic banks place 87 per cent of their investments in Ijarah and Murabahah products, which are least preferred options of investment according to Islamic principles.”

The share of musharka financing—the most favoured option in Islamic banking—is merely 3 per cent of the total deposit base of Islamic banking, explains Siddiqui . Moreover, Siddiqui points out that, in the case of musharka financing, banks typically share half the loss with the investors, yet in case of profit, the depositor gets merely the return prevailing in the financial markets. “Islamic banking in Pakistan may be Riba free, but it is not completely Islamic either,” asserted the former banker.

However, despite its share of problems and limitations, Islamic banking is moving forward in Pakistan. Yet for the sector to expand, Islamic banks have to understand the needs of Pakistan’s economy and come up with innovative products which can be availed by the common man.

Published in The Express Tribune, November 2nd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ