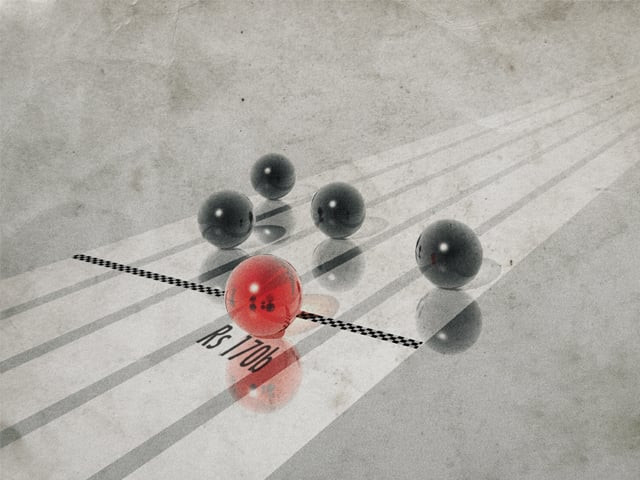

Circular debt of Rs280b to get a face change

Debt to be settled by issuing Pakistan Investment Bonds of the same amount.

The government has decided to settle the power sector circular debt that currently stand around Rs280 billion by issuing Pakistan Investment Bond (PIB) to the banking industry. The banks will then be required to issue a letter confirming that the outstanding amounts have been settled and there is no obligation on the borrowing entities, according to a BMA Capital research note.

It has been revealed that the cumulative participation amount of each bank will be distributed in different periods of long-term bonds, says the note. Under the subscription, 20% loan will be adjusted in 3-year PIBs, 30% in 5-year PIBs and 50% through 10-year PIBs, adds the note.

The banking sector is expected to benefit from the mark-up of around Rs10 billion from the bonds, particularly National Bank of Pakistan, Habib Bank, United Bank and Bank Alfalah, says AKD Securities analyst Raza Jafri.

The move will reduce short-term debt and finance costs of Independent Power Producers and Oil Marketing Companies, improving their profitability. For this to happen, the government plans to pick up all the advances extended to Water and Power Development Authority, National Transmission & Despatch Company and the distribution companies. Hence issuance of PIBs will enable these institutions to borrow more from the banking system and improve their short-term liquidity in the energy chain.

Pakistan State Oil (PSO) and Shell, the country’s largest oil market companies, cited the energy sector debt as a hurdle in operations during annual result announcement.

The plans seems to be a positive move but the energy chain still needs medium to long term structural reforms to resolve the inter-corporate debt from its roots.

Published in The Express Tribune, September 27th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ