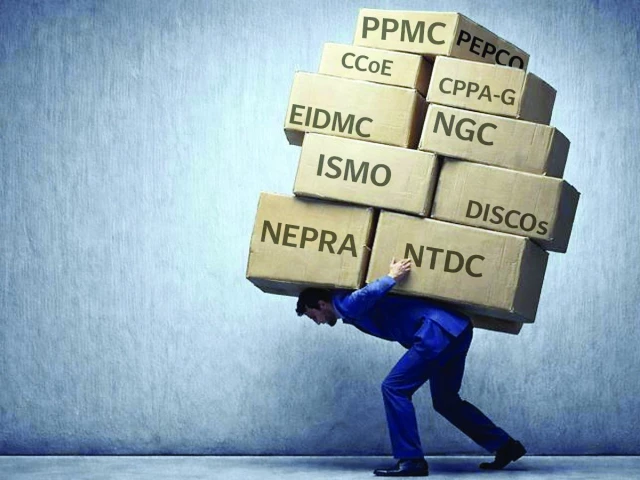

Power sector: too many regulators

Despite web of institutions, sector remains financially, operationally weak

Pakistan's power sector does not suffer from a lack of oversight; it suffers from too much of it – poorly aligned. More regulators are not the answer to put the house in order. This is what is happening in the energy sector.

Every rupee on an electricity bill is shaped by a maze of regulators, auditors, market operators, cabinet committees and state-owned companies. Yet despite this dense web of institutions, the sector remains financially broken, operationally weak and riddled with data inconsistencies. The latest addition – the revival of Pakistan Electric Power Company (Pepco) as Power Planning and Monitoring Company (PPMC) - raises a critical question: does Pakistan need another watchdog or does it need to fix the ones it already has?

Under the Power Division – the main, responsible federal division – fall distribution companies (DISCOs), the National Transmission and Despatch Company (NTDC) – now divided into the Independent System and Market Operator (ISMO), National Grid Company and Energy Infrastructure Development and Management Company – and the Central Power Purchasing Agency-Guarantee (CPPA-G).

Add to that, the Cabinet Committee on Energy, provincial cabinet committees, PPMC and above all an independent regulator that sets prices and monitors the entire power sector – the National Electric Power Regulatory Authority (Nepra). Pepco's revival via the establishment of PPMC is a move that should worry an already scrutinised sector. Regional peers, while having multiple bodies, have clearly defined functions which are adhered to, creating a strategy where all players act according to their role.

In Bangladesh, regulation is handled by the Bangladesh Energy Regulatory Commission with separate renewable energy and power procurement arms. Similarly, in the Philippines, the Department of Energy sets policy with separate market regulatory, trading and state power asset arms.

The Power Division presents PPMC as a step towards transparency and better coordination across the power sector, but its creation has sparked debate. The company tasked with planning, performance monitoring and oversight across the value chain – from generation to distribution – naturally carries expectations of more coordinated decision-making. It leaves a broader policy question: is PPMC a meaningful step towards structural reform or does it risk adding complexity to an already crowded governance landscape?

Pakistan's power sector already has several institutions performing functions similar to those that PPMC now aims to centralise. Planning, oversight, performance assessment and sector monitoring are currently distributed across Nepra, CPPA-G, ISMO, Private Power and Infrastructure Board (PPIB), provincial energy departments, cabinet committees and boards of DISCOs.

While international models do feature specialised institutions, their mandates are typically well delineated, unlike Pakistan's overlapping setup. With the regulator already empowered to set tariffs, monitor licence operators, audit performance and penalise inefficiencies, the introduction of another entity stokes concerns of mandate clarity, institutional overlap and diluted accountability – concerns further reinforced by issues flagged in the Auditor General's recent audit of the company's early operations.

According to official invoices reviewed during the Multi-Year Tariff (MYT) hearings held by Nepra for ex-Wapda DISCOs in November, PPMC charged all DISCOs a "management fee" without prior regulatory approval. The fee – 0.053% of each DISCO's distribution margin – was deducted through official CPPA-G invoices without prior nod from Nepra – the sole authority empowered to modify tariffs. In the first quarter of financial year 2025-26, the fee amounted to Rs209 million. DISCOs requested clarity on whether such charges should ultimately be borne by consumers, prompting further regulatory examination.

Questions around PPMC's creation revolve around procedure and legal clarity as officials indicate it was formed through the Statutory Regulatory Order 1358-I/2025, issued by the Power Division rather than explicit federal cabinet approval, with no dedicated budget allocation for FY26. This has prompted queries from the regulator over PPMC's role, particularly given that DISCOs already operate under their own boards and management structures.

These concerns have reignited debate on institutional design and regulatory independence. Critics argue the move risks sidelining the statutory regulator and creating a parallel authority without clear legal grounds, while supporters contend PPMC could aid long-term planning if properly aligned with existing mandates. However, adding another bureaucratic layer without resolving core governance issues, and amid reported plans to bring the regulator under ministerial control, triggers questions about accountability and independence.

The Power Division maintains that PPMC is merely a renamed Pepco, registered with SECP and approved by the cabinet in 2021; however, the absence of publicly available documentation demonstrating compliance with the State-Owned Enterprises Act, 2023 and Cabinet Division procedures has added to legal uncertainty.

Ultimately, the debate around PPMC reflects a broader governance question: how should Pakistan structure the relationship between the policymaker, the regulator and sector operators? To improve sector performance, it is essential to simplify the governance framework by clarifying roles, ensuring that each entity operates within a defined mandate and reducing redundancy.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ