Diverging trade strategies at ASEAN

As CAFTA 3.0 promotes multilateral growth, US pushes for bilateral deals

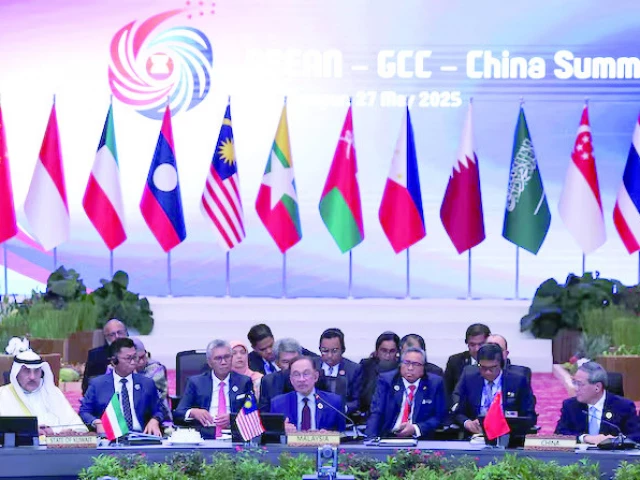

Two important developments took place on the sidelines of the 28th Summit of the Association of Southeast Asian Nations (Asean) in Kuala Lumpur, Malaysia, late last month. They involved the world's two largest economies and reflected their contrasting approaches to global trade.

China advanced its push for trade liberalisation and regional integration, upgrading its free trade agreement with the 11-member bloc to include areas such as supply chain connectivity and the digital and green economies. The United States, meanwhile, signed individual trade deals with four members of the grouping, though not offering them any tariff relief. Since its signing in 2010, the China-Asean Free Trade Agreement (Cafta) has greatly expanded Beijing's trade with the region, which has a collective GDP of $3.9 trillion. Bilateral trade has surged more than fivefold – from $192.5 billion in 2008 to $982 billion in 2024, according to Chinese data. Now, "Version 3.0" of Cafta seeks to expand it further, introducing nine new chapters covering areas such as the digital economy, green economy, and supply chain connectivity, according to China's commerce ministry.

Asean is also the fourth-largest trading partner of the United States, with bilateral trade reaching $571.7 billion in 2024, according to the Office of the US Trade Representative. The Cafta 3.0 signing coincided with President Donald Trump striking individual tariff deals with Malaysia and Cambodia, alongside framework agreements with Thailand and Vietnam. While Cafta 3.0 reflects China's pursuit of regional integration through multilateral, rules-based engagement within an inclusive framework, Trump's deals are transactional, designed to secure immediate commercial gains and to align Asean economies more closely with America's strategic and regulatory orbit.

The nine new areas included in "Version 3.0" make Cafta not just a tariff-cutting mechanism but an institutional platform for deep economic convergence, reflecting a strategic shift from trade liberalisation to regulatory harmonisation and supply chain interdependence. It builds on sustained momentum and institutionalises connectivity across infrastructure, data flows, and industrial standards. The design of Cafta 3.0 is multilateral and inclusive, treating ties with Asean as a bloc rather than as a collection of bilateral relationships. The deal is in consonance with the Regional Comprehensive Economic Partnership (RCEP) – the world's largest trade pact – which already includes China and all Asean states. In this sense, Cafta 3.0 represents a deepening layer within a broader Asian economic ecosystem oriented towards integration, resilience, and technological modernisation.

The upgrade has been widely hailed by both sides. Malaysia's Prime Minister Anwar Ibrahim, the current chair of Asean, called it a "milestone" that will "open a new chapter in Asean's strategic partnership with China and strengthen the region's collective economic resilience." So, how is it a milestone? Asean Secretary-General Kao Kim Hourn explains. "China, with its advances in AI, big data, cloud computing, and digital finance is a global leader in digital transformation," he says. "'Version 3.0' will elevate our economic cooperation, particularly in new areas such as e-commerce, digital trade, and payments. This is very important for Asean and China, particularly in the context of current global economic dynamics." Beginning in November 2022, negotiations for Cafta 3.0 concluded in May 2025 – well before Trump launched his tariff offensive. However, the talks gained greater importance after the US president shook the global trading system by imposing sweeping duties on many of his country's trading partners in an attempt to "boost US industry by curbing imports."

This protectionist agenda, driven by Trump's "America First" approach, disrupted the international trade order built and protected by the United States after World War II. The entire world has been affected by this unilateralism – and Southeast Asia is no exception. "We have a deep feeling that East Asia is faced with mounting difficulties and challenges in its economy, and growing instability and uncertainty in its development," Chinese Premier Li Qiang said at the Asean summit. He called for unity to "uphold free trade and the multilateral trading system, oppose all forms of protectionism, and continuously advance regional economic integration."

In the current global trade landscape, China and a Trump-led America represent two starkly different approaches. While Cafta 3.0 seeks to promote economic integration and interdependence with the entire region, Trump's agreements with Malaysia and Cambodia – along with framework deals with Vietnam and Thailand – reflect America's bilateral, security-focused approach to a region central to its broader Indo-Pacific strategy, given Asean's critical geostrategic position.

These deals came in the wake of Trump's tariff offensive, which levied up to 49% on imports from several countries, including Asean states. The new agreements – branded as "reciprocal" trade pacts – are designed to offer selective tariff relief in exchange for alignment with US economic and security priorities.

Structurally, these deals are asymmetric: they compel Asean states to reduce or eliminate tariffs on American goods, while the US maintains relatively high import tariffs – capped at 19% - on their exports. Unlike Cafta, Trump's agreements lack comprehensive rules of origin or dispute-settlement mechanisms, leaving Washington with the discretion to modify or suspend benefits unilaterally. There is more to these deals. They include economic security clauses requiring Malaysia and Cambodia to align their export controls, sanctions regimes, and investment-screening mechanisms with those of the United States. This, according to observers, effectively embeds US strategic objectives into the economic policies of its partners, limiting their flexibility in balancing ties with China.

Thus, while Cafta 3.0 institutionalises a shared development agenda, the US deals impose conditional access to the American market in exchange for strategic alignment – a reflection of the divergent philosophies underpinning the two powers' engagement with Southeast Asia. This shows that the American approach is rooted less in integration than in containment of China's economic reach and technological influence.

Trump's Asean deals combine tariff diplomacy with security-linked economic conditionalities. The intent, analysts say, is to create a network of compliant economic partners that complement US strategic objectives in the Indo-Pacific, particularly the "de-risking" of supply chains and the re-shoring of manufacturing. Philosophically, the contrast is unambiguous: while Cafta 3.0 embodies a cooperative, multilateral, and development-oriented model, the US bilateral approach embodies a security-driven and transactional framework aimed at maintaining influence through dependency rather than integration.

Economically, Version 3.0 reinforces Asean's role as the nucleus of Asia's production networks. Its provisions for digital trade, customs facilitation, and SME cooperation lower transaction costs and enable smaller economies to integrate more deeply into regional value chains. By embedding Asean's standards within China's rapidly expanding digital and green industries, Cafta 3.0 accelerates the creation of a "pan-Asian economic zone" relatively insulated from Western protectionism. In contrast, President Trump's bilateral deals risk fragmenting Asean unity by creating divergent obligations for individual member states. The absence of a collective framework dents the bloc's coherence, as each member negotiates separately with the United States under different terms. Moreover, the deals' asymmetrical tariff structures and the attached political strings could reinforce perceptions of "neo-colonial economic dependency" – especially if the United States unilaterally changes its commitments under the guise of national security.

In this contest between integration and fragmentation, Cafta 3.0 illustrates the enduring appeal of collective economic progress, whereas the US approach risks reinforcing the very fragmentation it seeks to prevent. As Southeast Asia becomes the gravitational force for the world's two largest economies, the choice between their paradigms will define the region's economic sovereignty. Asean's long-term prosperity will likely depend on maintaining a delicate balance, harnessing the full potential of China's multilateral openness while engaging the US without compromising its autonomy.

The writer is an independent journalist with special interest in geoeconomics

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ