Bourse eyes over 27% return in FY26

Despite rally forecast, market faces external, fiscal challenges

Pakistan's benchmark KSE-100 Index is projected to deliver a robust 27.4% return in FY26, underpinned by expectations of lower interest rates, earnings recovery, and improved macroeconomic stability. However, despite the bullish outlook, key structural and external challenges continue to weigh on investor sentiment. Persistent foreign outflows, fiscal slippages, and Pakistan's dependence on International Monetary Fund (IMF) reforms may dampen the pace of market re-rating. Additionally, sector-specific risksranging from regulatory delays in E&P payouts and low cement sector utilisation to inconsistent export incentives in textiles and techhighlight the fragile nature of the recovery.

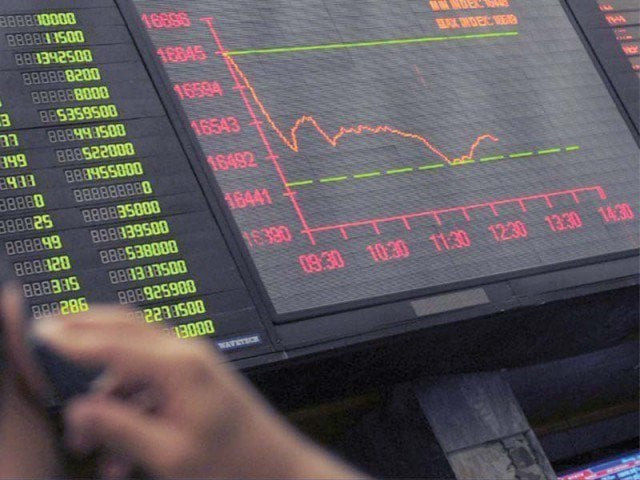

Pakistan's equity market is poised for a strong year ahead, with the benchmark KSE-100 Index projected to deliver a 27.4% return in FY26, according to a comprehensive strategy report released by Arif Habib Limited (AHL) titled "Strategy FY26 – Emerging Stronger." The optimism is anchored in expectations of a low interest rate environment, steady corporate earnings growth, and improved macroeconomic indicators.

"We expect KSE 100 to reach 160,000 Index level by Jun 2026, a return of 29%. Out of this, 11% is through PE re-rating, 9% earnings growth and 9% dividend yield," Topline Securities report said.

The projected return on the KSE-100 Index in FY26 is largely driven by expectations of lower interest rates, following a shift in monetary policy due to easing inflation, according to AHL. The State Bank of Pakistan (SBP) has already begun rate cuts, bringing the policy rate down to 11%, with a further reduction anticipated. This softening of interest rates is expected to boost equity valuations and encourage a shift in liquidity from fixed income to the stock market.

Another key driver is improving corporate earnings, particularly in cyclical sectors such as cement, banking, and oil and gas. Earnings growth is projected at 14% excluding banks and E&Ps, and around 9.2% overall. This reflects a rebound in demand, improved margins from cost efficiencies, and better operating leverage in key industries. Financial institutions like MCB, Meezan Bank, and NBP are expected to benefit from strong deposit bases and better spreads.

The forecast is further supported by macroeconomic stability anchored in continued engagement with the IMF. With expected disbursements of over $2.6 billion and progress on reforms, economic fundamentals such as inflation, the current account deficit, and exchange rate management are stabilising. This reduces uncertainty for both domestic and foreign investors, enhancing overall market sentiment.

Lastly, attractive valuations and rising domestic participation are critical contributors. The KSE-100 index is trading at a forward P/E of 6.8xwell below its 10-year average and regional peersoffering strong upside. Domestic investors now drive 93% of market volumes, led by mutual funds, companies, and individuals. Anticipated inflows from IPOs, right issues, and insurance funds are expected to support future gains.

Arif Habib Limited (AHL) projects the KSE-100 to reach 168,000 by June 2026, implying a forward P/E of 7.4x on FY27 earnings. However, analysts warn that external and structural headwinds could temper this momentum.

Pakistan's GDP growth for FY26 is forecast at 3.3%, inflation at 5.4%, and the rupee at Rs293/$. The current account deficit is projected at $1.6 billion. Yet, IMF dependence remains a concern, with two reviews and $2.6 billion in disbursements at stake. A revenue shortfall may push the fiscal deficit to Rs5.8 trillion (5.2% of GDP).

Meanwhile, foreign outflows of $304 million in FY25 reversed FY24's inflows. FY26 may see only modest inflows. Despite Rs4.4 billion raised via IPOs in FY25, the expected Rs1418 billion pipeline for FY26 may not sufficiently deepen market participation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ