PSX retreats from record on profit-taking

Early gains fade as geopolitical worries pull index down by 260 points

The Pakistan Stock Exchange (PSX) experienced a turbulent session on Thursday, where the benchmark KSE-100 index hit a record intra-day high at 126,718 before reversing course to close modestly lower.

The day saw intense swings, reflecting both optimism fuelled by post-budget clarity and renewed pressure from geopolitical tensions.

Early gains were supported by improved investor sentiment, driven by the budget announcement, robust remittances and monetary policy expectations. However, the rally lost steam as the session progressed, with profit-taking in overheated stocks and geopolitical uncertainty, surrounding the Middle East, undermining sentiment.

Global equity selloffs, a slump in crude oil prices and a weakening rupee added to investor concerns.

Arif Habib Corp MD Ahsan Mehanti stated that stocks closed under pressure on geopolitical uncertainty and post-budget profit-taking in overbought shares. "The rout in global equities on Middle East tensions, a slump in international crude oil prices and a weak rupee on contracting exports were among the key factors behind bearish close of the market," he added.

At the end of trading, the benchmark KSE-100 index lost 259.56 points, or 0.21%, and settled at 124,093.12.

KTrade Securities noted that the bourse experienced a volatile session as the KSE-100 index fluctuated between the high of 126,718 and low of 123,846, ultimately closing down 0.21% at 124,093.

Initial gains were driven by positive market sentiment following the FY26 budget, perceived as favourable for capital markets. However, rising geopolitical tensions involving Iran, Israel and the US prompted heavy profit-taking later in the day, it said.

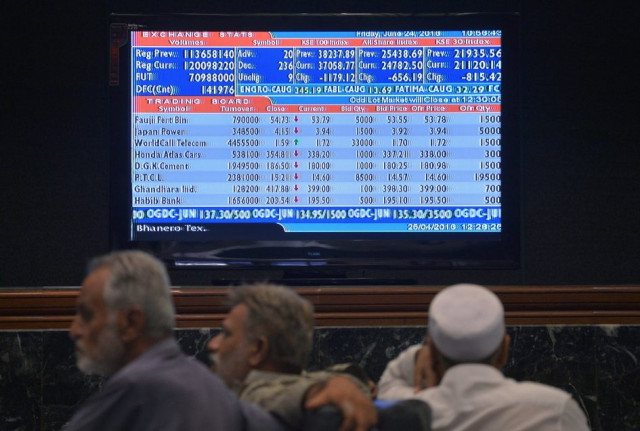

Negative contribution mainly came from sectors such as investment banks, oil and gas, and fertiliser, where notable contractions were seen in Engro Holdings, Fauji Fertiliser, Pakistan Petroleum and OGDC.

Cement stocks saw strong buying before profit-taking set in. Given the ongoing regional uncertainties, the market outlook is likely to remain cautious, added KTrade.

Arif Habib Limited (AHL) Deputy Head of Trading Ali Najib wrote that the PSX witnessed a dramatic session, which led to a lower close for the KSE-100 index after hitting a record intra-day high.

The market opened strong, building on the previous session's bullish momentum and breaking key psychological levels of 125,000 and 126,000. However, profit-taking in the latter half erased gains and dragged the index into the negative territory.

The pullback comes after several sessions of aggressive rallying, largely driven by improved macroeconomic indicators and declining cut-off yields in the T-bill auction, Najib said.

Topline Securities mentioned in its review that the stock market ended on a negative note, weighed down by cautious investor sentiment and profit-taking. It attributed the downtrend largely to declines in shares of Engro Holdings, Fauji Fertiliser, Pakistan Petroleum, OGDC and Bank Alfalah, which erased 401 points from the index.

In contrast, support came from Pakgen Power, United Bank, Bank AL Habib, Lucky Cement and DG Khan Cement, which added 347 points.

JS Global analyst Mubashir Anis Naviwala said that the index hit a high of 126,718 before profit-taking dragged it down by 260 points. The analyst advised investors to watch for key support levels and use dips to accumulate stocks with focus on fertiliser, cement and banking sectors for near-term opportunities.

Overall trading volumes decreased to 1.02 billion shares compared with Wednesday's tally of 1.04 billion. The value of shares traded was Rs50.5 billion. Shares of 474 companies were traded. Of these, 170 stocks closed higher, 270 fell and 34 remained unchanged.

Sui Southern Gas Company was the volume leader with trading in 55.9 million shares, rising Rs0.78 to close at Rs41.92. It was followed by Fauji Cement with 50.6 million shares, gaining Rs0.49 to close at Rs47.36 and WorldCall Telecom with 49.3 million shares, falling Rs0.08 to close at Rs1.37. Foreign investors sold shares worth Rs685.8 million, the National Clearing Company reported.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ