Remittances hit record $4.1b

Eid, migration bring in billions; SBP chief urges growth via exports

Driven by the economic migration of approximately 2.4 million Pakistanis amid the worsening state of the domestic economy, workers' remittances to Pakistan surged past the $4 billion mark for the first time in March 2025.

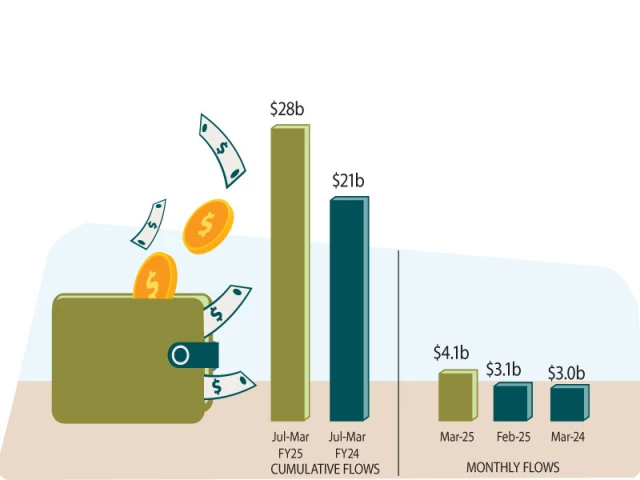

Workers' remittances have reached an unprecedented $4.1 billion, said the State Bank of Pakistan (SBP) in a press release. This reflects a strong year-on-year growth of 37.3% and a month-on-month increase of 29.8%.

Cumulatively, remittances rose to $28.0 billion during the first nine months of FY25 (July-March), representing a 33.2% increase compared to the $21.0 billion received during the same period last year. The bulk of March inflows came from Saudi Arabia ($987.3 million), the United Arab Emirates ($842.1 million), the United Kingdom ($683.9 million), and the United States ($419.5 million), underscoring the critical role of the overseas Pakistani community in supporting the national economy

"We believe, higher remittances are due to Ramazan/Eid effect," said Topline Securities.

"Remittances have hit a record high, driven by growing confidence in the stability of the Pakistani Rupee due to a narrower gap between interbank and open market exchange rates," said Head of Research at JS Global, Waqas Ghani Kukaswadia. This stability is largely credited to stricter foreign exchange regulations. Additionally, a recent surge in immigration, particularly to Gulf countries, has boosted remittance inflows.

With an increasing number of people attempting to get out of the country, Pakistan's monthly remittances have shown a strong upward trend over the past year. The remittance inflows had largely remained within the range of $2.8 to $3.2 billion, with notable peaks in May 2024 ($3.24 billion) and June 2024 ($3.16 billion). Inflows dipped slightly during the summer months but remained stable, with $3 billion in July, $2.94 billion in August, and $2.86 billion in September 2024. October saw a rebound to $3.05 billion, followed by $2.92 billion in November and $3.08 billion in December.

The start of 2025 saw a steady climb, with $3.00 billion in January and $3.12 billion in February 2025, leading up to the sharp rise in March. This surge marks a significant jump from February 2024's low of $2.25 billion, indicating renewed momentum in overseas inflows.

SBP Governor Jameel Ahmad, while attending the gong ceremony at the Pakistan Stock Exchange (PSX) on Monday, highlighted noticeable progress made by Pakistan on the macroeconomic front.

Reflecting on the country's recent economic journey, Ahmad emphasised that Pakistan has successfully transitioned from a period marked by macroeconomic instabilitycharacterised by high inflation, low reserves, and fears of defaultto one of stable macroeconomic conditions, renewed confidence, and recovery in economic growth.

He pointed to significant improvements across multiple economic indicators, signalling a much-needed revival of economic growth. He highlighted that inflation has come down substantially, external current account balance has turned into a surplus, FX buffers have been rebuilt, and public debt indicators have improved considerably during the past couple of years. He highlighted that workers' remittances reached an all-time high level of $4.1 billion in March 2025 – partly reflecting the result of government and SBP efforts to incentivise the channelling of inflows via formal channels, as well as the smooth functioning of the domestic FX market. He said that total remittances for FY25 are expected to be around $38 billion.

The SBP governor noted that with a sound macroeconomic base and renewed investor confidence, we have the opportunity to set Pakistan on a trajectory of broad-based, inclusive prosperity.

He emphasised that this macroeconomic stability has been achieved through difficult policy decisions. "Now, it is crucial to focus on sustainable growth."

He pointed out that enhancing productivity and boosting exports must become central to Pakistan's growth model, as export activity directly contributes to greater productivity, innovation, and foreign investment.

Ahmad urged stakeholders to come together and commit to long-term strategies that ensure sustainable and inclusive growth for Pakistan. While the country is on the path to recovery, he underscored the need for reforms to address structural issues to avoid boom-bust cycles and economic stagnation. He reaffirmed the SBP's commitment to creating a resilient and inclusive financial ecosystem, supported by an enabling regulatory environment, as the foundation for Pakistan's economic prosperity.

The SBP governor also emphasised the need for financial literacy to achieve true financial inclusion. He highlighted that the SBP is holding the Pakistan Financial Literacy Week from April 14 to 18, where various activities are planned across the country to engage different segments of society in financial literacy efforts.

Ahmad reaffirmed that enhancing financial inclusion remains a top strategic goal within the SBP's Strategic Vision 2028, alongside building an innovative and inclusive digital financial ecosystem. Ahmad shared key initiatives under the National Financial Inclusion Strategy (NFIS) 2024-28, including efforts to increase financial inclusion from 64% to 75% by 2028 while reducing the gender gap in financial services from 34% to 25% by 2028.

The SBP governor also expressed his appreciation to the PSX management for their continued efforts to provide a vital platform for the country's capital market. Ahmad highlighted the importance of the PSX in enabling corporations to raise capital and offering investors the opportunity for substantial returns on their savings.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ