Despite challenges such as slow internet, Pakistan’s increasing digitalisation and vast customer base are attracting foreign fintechs. With the financial sector poised for transformation, Egyptian fintech leader Halan Microfinance Bank is expanding its operations in the country, further fuelling this evolution.

The fintech sector in Pakistan is witnessing rapid growth, driven by advancements in digital banking, microfinance, and mobile payments. The country’s payment systems infrastructure has expanded significantly, with 32 banks, 12 microfinance banks (MFBs), five payment system operators (PSOs), 16 branchless banking service providers (BBs), and three electronic money institutions (EMIs) supporting financial inclusion, according to i2i.

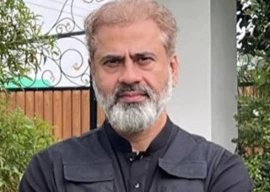

Despite challenges, Pakistan’s financial sector bears striking similarities to Egypt’s economy. Both countries share cultural and economic parallels—large populations, informal economies, and low access to financial services, said Mounir Nakhla, Founder and CEO of MNT-Halan, the parent company of Halan Microfinance Bank. “With household loans to GDP at just 3-4%, there’s immense untapped potential. Our mission is to bridge this financial gap through technology-driven banking.”

When asked why they chose Pakistan, where people have limited savings and incomes, the CEO highlighted misconceptions about the country’s economy. “Pakistan is a cash-driven economy with significant informal lending. The official size of the economy is underestimated. It’s a much larger market than perceived, with a huge population and strategic geography,” he stated. “Providing small and micro-loans will not only help businesses grow but also be a profitable venture for us.”

With a population of 241.5 million and Rs9.4 trillion in circulation, the need for digital financial solutions has become more crucial than ever. In major business hubs, daily cash transactions sometimes reach Rs50 million. “That’s an enormous amount of money,” the CEO exclaimed. “We are motivated to digitise payments and reduce cash reliance over time.”

Digital payment adoption is accelerating, evident in the growing number of users across various channels. Branchless banking mobile app users have reached 60.3 million, while mobile banking users stand at 19.9 million, and internet banking users at 12.4 million. Additionally, 40.9 million people use call centres or IVR banking services, and 55.6 million payment cards are in circulation, according to i2i. The presence of 4.2 million EMI/e-wallet users highlights the shift towards cashless transactions and digital financial services.

Microfinance has emerged as a key driver of financial inclusion in Pakistan, with the gross loan portfolio growing steadily from Rs275 billion in 2018 to Rs565.8 billion in 2024. The sector’s penetration has increased from 15% in 2018 to 23% in 2024, reflecting greater access to financial resources for small businesses and individuals. The number of active microfinance borrowers has also risen significantly, from 6.94 million in 2018 to 10.78 million in 2024, indicating an increasing reliance on micro-loans for economic empowerment.

Halan Microfinance Bank has already entered the Pakistani market by acquiring Advance Microfinance Bank. “It was a complex process—we had to restructure, bring in new talent, upgrade back-end systems, and redefine policies and strategies,” the CEO shared. The fintech is launching its digital app this year while also expanding its physical presence with 100 new branches. It is awaiting a national banking license to scale operations further.

The company’s approach will be a mix of physical and digital banking services, ensuring accessibility for all segments of society, with a strong focus on women, the agricultural sector, the auto market, and livestock farmers. “Our goal is to become the go-to financial institution for the masses, prioritising financial inclusion for underserved communities,” he said.

Halan Microfinance Bank has pledged to invest $10 million over the next year, in addition to the acquisition cost, the CEO informed. The company aims to build a $500 million loan portfolio within five years. “Currently, we serve 50,000 customers in Pakistan, and we plan to double that soon,” he revealed. “Globally, we have served 8 million people and disbursed $11 billion across Turkey, Egypt, the UAE, and now Pakistan.”

The CEO emphasised that while Turkey has a larger and more advanced banking sector, Pakistan’s market structure closely resembles Egypt’s. “Egypt has a more developed consumer and small business lending ecosystem, while Turkey focuses on micro-manufacturing and invoice factoring.”

Contrary to the belief that Pakistanis avoid taking loans, the CEO believes there is strong demand. “If you stand on the street and ask who wants a loan, everyone will come forward. The challenge isn’t demand—it’s determining who is creditworthy and ensuring repayment,” he added. Credit scoring, profiling, and collection strategies are crucial in this process, he stated.

The company is leveraging its experience in Egypt to overcome credit challenges in Pakistan. “We’ve learned valuable lessons from Egypt, and we see an opportunity to implement them here,” he said.

The decision to acquire Advance Microfinance Bank was strategic. “The bank’s owners had global operations and were looking to exit. While it was a loss-making entity, we saw an opportunity to restructure it efficiently,” he explained.

“Having a microfinance banking license saved us time and allowed us to enter the market quickly,” he said. Initially, Halan Microfinance Bank will focus on microfinance products but plans to introduce various loan products tailored to different demographics, said the CEO. It is targeting women entrepreneurs and vehicle financing, with a major emphasis on unsecured lending. “Unlike traditional banks that focus on secured loans, we believe the majority of people are honest and willing to repay. Our challenge is identifying those with the ability to pay,” he noted.

Understanding the demand for Islamic finance in Pakistan, the CEO confirmed their commitment to providing Shariah-compliant options and said they will offer both conventional and Islamic banking choices, allowing customers to decide what suits them best.

Halan Microfinance Bank is also exploring partnerships with local companies for embedded financing solutions such as advance salary and payment of instalments to third parties on competitive interest rates. “Interest rates are just one part of the equation. We are keen to integrate financial services into various sectors, making financing more accessible to businesses and individuals alike,” he said.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ