Power consumers poised to get Rs1.03 relief

NEPRA reviews petition for fuel cost adjustment for Dec 2024

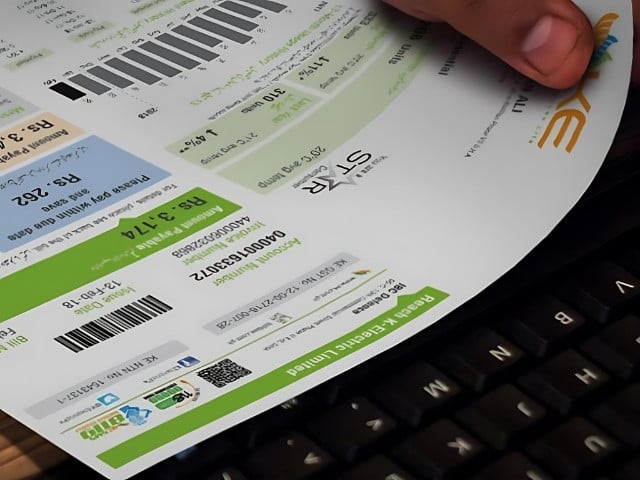

Power consumers are set to receive a relief of Rs1.03 per unit on account of fuel cost adjustment for the month of December 2024.

At the same time, it has been revealed that the closure of 969-megawatt Neelum-Jhelum hydropower plant for months is hitting the consumers as they have not been provided cheap electricity from the plant.

A government official revealed this at a public hearing held by the National Electric Power Regulatory Authority (Nepra) to consider a petition of Central Power Purchasing Agency-Guarantee (CPPA-G), which sought approval for a reduction of Rs1.03 per unit in electricity prices under fuel cost adjustment for December.

If Nepra approves the release of refund, it can provide some financial relief to electricity consumers in February. However, the tariff adjustment will not apply to lifeline consumers, electric vehicle charging stations and K-Electric customers.

According to CPPA-G, the positive impact of winter package is being felt, with electricity prices being lower due to seasonal measures. However, it also highlighted the negative impact of non-functioning of the Neelum-Jhelum hydropower project.

CPPA-G officials stated had the project been operational, electricity prices could have been even lower.

Another issue raised during the hearing was the non-operation of 747MW Guddu power plant. CPPA-G was questioned as to why the plant was not running, which contributed to a rise in electricity costs. The agency did not give a clear response.

Electricity consumers expressed concern and called for taking further steps to reduce electricity prices. A consumer pointed out that system's inefficiency was exacerbated by weather conditions, adding that "when it rains, lines go down, and when it's hot, lines go down."

According to data submitted by CPPA-G, in December 2024, nuclear energy provided 2,065 gigawatt hours (GWh), or 26.48% of total electricity generation.

It was followed by hydroelectric power that produced 22.8% at zero cost and re-gasified liquefied natural gas (RLNG)-based power plants, which contributed 20.7% of electricity.

As the cost of fossil fuel sources, such as natural gas and local coal, stays higher, nuclear power remains a cornerstone of Pakistan's energy strategy due to its lower cost and environmental benefits.

In January too, nuclear energy generation was the top source, contributing 20.78%, or 1,728 GWh, to the grid. The milestone was first achieved in December 2022, when nuclear power contributed more than 27% (2,284.8 GWh) to the country's energy mix.

In December 2024, nuclear power comprised 26.48% of the energy mix, outpacing hydroelectric power and RLNG-based electricity.

Earlier this month, Nepra also announced a reduction in electricity tariff of up to 75 paisa per unit for consumers of ex-Wapda distribution companies (DISCOs) and K-Electric on account of fuel charges adjustment.

The regulator cut tariff up to Rs0.7556 per unit for DISCOs due to variations in fuel charges in November 2024. For K-Electric consumers, it slashed power price by Rs0.4919 per kilowatt-hour (kWh) for October 2024. The reimbursement was due to be made in electricity bills for January 2025.

Discussing a tariff application of DISCOs, the regulator said that National Transmission and Despatch Company (NTDC) reported provisional transmission and transformation (T&T) losses of 244.158 GWh, equivalent to 2.946%, based on energy delivered to NTDC system during November 2024.

Additionally, NTDC reported T&T losses of 19.528 GWh, or 3.391%, for Pak Matiari-Lahore Transmission Company's (PMLTC) high-voltage, direct-current line.

NTDC is allowed T&T losses of 2.639% at 500-kilovolt and 220kV levels. For PMLTC, the permitted T&T losses are up to 4.3%.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ