Betting on Disruption: How JazzCash Defied Collapse to Lead Pakistan’s Fintech Revolution

The writer is President of JazzCash and a member of the Forbes Finance Council.

Throughout business history, only a handful of companies have been able to successfully escape near-total collapse by transforming their business. The most legendary example is of course Apple which stood only 90 days away from bankruptcy when Steve Jobs negotiated a critical $150m investment from Microsoft and reimagined the entire product ecosystem to bring the world the iMac. Microsoft itself underwent a similar transformation under Satya Nadella, moving on from a rigid Window-centric operation to the powerhouse it is now.

But where you have Apple and Microsoft to fawn over, you also have cautionary tales like Blockbuster which faded off into obscurity after dismissing Netflix as a minor competitor or Nokia which fell so far behind in smartphone innovation that it is now used as an adjective to describe an outdated phone. Each of these narratives underscores a fundamental business truth: adaptability is not just an advantage, but a survival imperative.

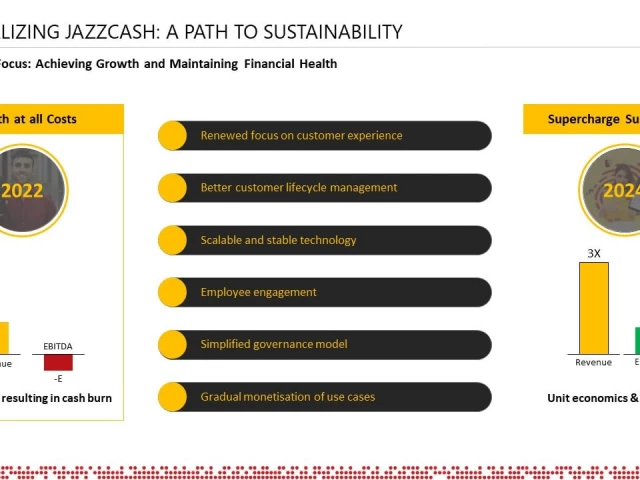

In 2022, JazzCash found itself at a similar crossroads, standing perilously close to organizational collapse. We were a cautionary tale of startup excess. Our employee attrition had hit 39%, with no Head of Business lasting more than two years. Our app's Google Play rating was dangerously close to 3 — a digital death sentence. We were chasing vanity metrics: giving cash incentives to dormant customers, paying agents for transactions, and celebrating monthly active user targets while hemorrhaging money.

So, it was no surprise that Aamir Ibrahim, CEO of Jazz found himself in a board meeting debating the possibility of shutting down the business. The irony wasn't lost on anyone when our app went down for 27 hours during that very discussion. So how did we go from almost shutting down to becoming Pakistan’s 1st profitable fintech by February 2023?

The path to transformation began with a fundamental restructuring of our organization. We simplified our governance structure, creating clear lines of authority and accountability that had been muddled by complex reporting relationships. Trust needed to be rebuilt at every level — with our employees, customers, and stakeholders. We introduced monthly town halls and brought all our employees on board with our strategic organizational roadmap, creating direct channels between leadership and staff. These weren't mere gestures; they were crucial steps in addressing our alarming attrition rate and fostering a culture of open communication.

The turning point came when the State Bank of Pakistan released its list of grantees for the digital banking license and JazzCash did not make the cut. Rather than let this setback demoralize our team, we used it as a catalyst for complete strategic reset. The leadership team of JazzCash locked ourselves in a room and asked ourselves a crucial question: what product could reach the masses, provide a competitive advantage, generate revenue, and simultaneously create a positive community impact?

The answer came in multiple parts. First was our pivot to digital lending. Leveraging our extensive user base and deep insights into customer spending patterns, we introduced ReadyCash, transforming our platform into a financial enabler rather than just a transaction facilitator. By 2024, we had become the largest digital loan issuer, with 80 million loans issued for productive purposes, disbursing approximately 120,000 loans daily, around 20% of which were issued to women.

But lending was just one piece of the puzzle. We fundamentally shifted from chasing vanity metrics to focusing on unit economics. Every product was evaluated for its contribution to our bottom line — a process that required both courage and precision. We made unpopular but necessary decisions, like introducing fees for previously free services and optimizing agent commissions. When we eliminated cash-in commissions — an industry standard — many predicted a customer exodus. Instead, we discovered that customers valued our service enough to adapt, while competitors realized they were essentially subsidizing deposits into JazzCash accounts.

Simultaneously, we drove engagement through an aggressive push on QR payments, eventually building Pakistan's largest QR payments network with over 360,000 merchants. This not only drove transaction volumes but also increased overall deposits. Our focus on online payments grew five-fold during the last two years, making us the largest e-commerce payment gateway in Pakistan by volume. The merchant ecosystem we built now processes a monthly average of transactions worth PKR 15 billion through QR codes and an additional PKR 14 billion in e-commerce payments.

We completely overhauled our technology infrastructure. The app, which had once been a pain point for customers, was redesigned to eliminate inefficiencies and enhance the user experience. Customer complaints were halved by 2024. In-app ratings soared as errors were minimized, and the overall user journey was streamlined. These changes were pivotal in regaining customer trust and cementing JazzCash's position as a reliable financial partner.

Our transformation extended to how we approached customer acquisition and retention. Instead of indiscriminately chasing new users, we focused on identifying and nurturing high-value customers who could drive sustainable revenue growth. This meant developing sophisticated data analytics capabilities to understand customer behavior and predict lifetime value. Our credit scoring systems processed vast amounts of data to ensure responsible and sustainable lending practices, transforming us from a low-margin payments platform to a profitable, high-impact financial ecosystem.

At the heart of JazzCash's mission remains a commitment to financial inclusion, particularly for women. Today, 13 million women rely on JazzCash for financial services, supported by targeted programs designed to empower female entrepreneurs. Partnerships with initiatives like UN Women have expanded these efforts, ensuring that women not only participate in but also lead economic transformation in their communities.

As the former CEO of InfoSpace, Naveen Jain, aptly said, "Philanthropy without scale and sustainability is like any other bad business that will simply wither and die on the vine." JazzCash has taken this philosophy to heart, demonstrating that profitability and social impact can coexist harmoniously.

The company's turnaround story underscores an essential truth: profitability is not the enemy of impact, but its enabler. By aligning its business model with societal needs, JazzCash has proven that a sustainable business serves the greater good. As Pakistan transitions towards a cashless future, JazzCash remains at the forefront—bridging divides, driving inclusion, and unlocking the nation's socioeconomic potential.

The writer is President of JazzCash and a member of the Forbes Finance Council.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ