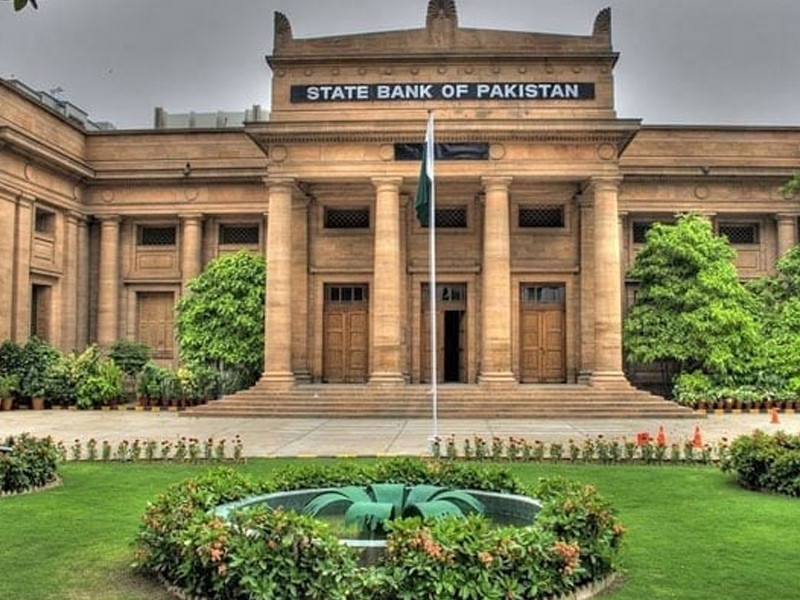

Leading industrialists and traders have urged the State Bank of Pakistan (SBP) to reduce the policy rate to single digits in its upcoming Monetary Policy Committee (MPC) meeting, arguing that high interest rates suppress private sector credit growth, stifle economic activity, and place Pakistan at a competitive disadvantage.

They have also called for a 5% cut in the upcoming monetary policy rate, citing the recent decline in inflation.

Eminent industrialist Muhammad Kamran Arbi stated that interest rates should be reduced to single digits to boost economic activity, as people require both long- and short-term financing. He explained that while a few individuals with large deposits currently benefit from higher yields, lowering the interest rate would reduce their returns, prompting them to explore alternative investment options. This, in turn, would bring idle cash back into circulation, which is currently constrained due to high interest rates.

Farooq Shaikhani, another industrialist and former president of the Hyderabad Chamber of Small Traders and Small Industry (HCSTSI), stated that current measures are insufficient to address the challenges faced by small traders and industries. "When the stock exchange is achieving historic highs, why aren't interest rates being brought down to single digits? This discrepancy raises concerns about the economic policies being implemented," he remarked.

He further noted that despite claims of record-low inflation at 4.9% and improved trade deficits, the benefits have yet to reach the common man or traders. "Inflation and the cost of living remain unbearable, and borrowing costs for small businesses are still prohibitive. If the government's economic figures are accurate, why aren't small traders and the public experiencing any relief? These statistics should translate into tangible benefits for everyone, not just a select few," he said.

He stressed that the government must ensure economic growth reflects the prosperity of small industries and ordinary citizens. Otherwise, it should stop presenting misleading statistics and instead focus on implementing policies that genuinely uplift the business community and the public. He urged the SBP and policymakers to address these concerns in the upcoming monetary policy discussions.

Another industrialist, Siraj Sadiq Monnoo, spokesperson for the Landhi Association of Trade and Industry (LATI), demanded a 400-basis-point reduction in the policy rate. Referring to the significant decline in inflation to 4.86% in November 2024the lowest level in recent yearshe argued that this adjustment would align real interest rates to sustainable levels, making borrowing more accessible for businesses and consumers.

"High interest rates continue to impede private sector growth by restricting access to credit and suppressing economic activity," Monnoo remarked. He highlighted that in January 2021, when inflation was 5.65%, the policy rate was just 7%, underscoring the need for a more responsive monetary policy.

He also pointed out that domestic debt servicing rose by 50.4% to Rs7.2 trillion in FY24, exacerbated by high interest rates, which have added fiscal pressure and widened budget imbalances.

Farazur Rehman, Patron-in-Chief of the Pakistan Business Group (PBGO), also called for an immediate 5% cut in the policy rate to stimulate the national economy.

President of the Karachi Chamber of Commerce and Industry (KCCI), Muhammad Jawed Bilwani, said in a statement, "In response, the MPC-SBP has reduced the policy rate from 20.5% to 15% since the beginning of the current fiscal year. Yet, the current rate remains relatively high compared to regional peers such as India (6.5%), Vietnam (4.5%), and Bangladesh (10%)."

1733729230-0/jay-z-(1)1733729230-0-405x300.webp)

1734135272-0/Jay-Z-(2)1734135272-0-165x106.webp)

1734130351-0/Elon-Musk-(2)1734130351-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ