SBP cuts policy rate by 250bps

Central bank says reduction made on the back of faster disinflation in economy

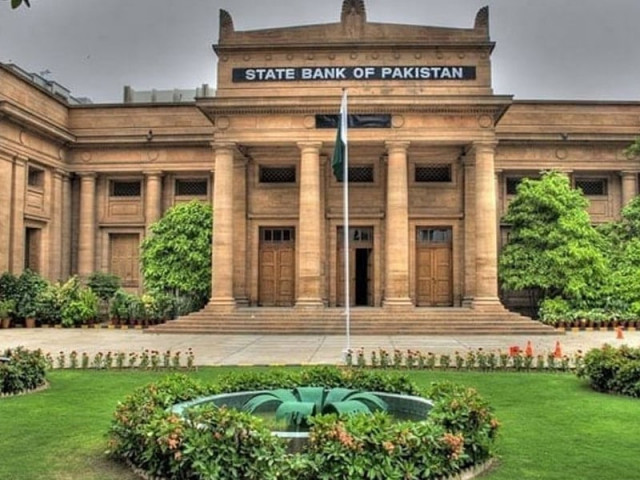

In a surprise move, the State Bank of Pakistan (SBP) made a historical 2.5 percentage point cut in the benchmark policy rate on Monday, slashing it to a two-year low of 15% effective from Tuesday (today).

The latest reduction meant the policy rate has gone down by 7 percentage points in just five months, which in turn has lessened the burden of interest payment on the total national debt by a staggering Rs1.3 trillion, or 1% of the Gross Domestic Product (GDP), in the current fiscal year, compared with the original target set at Rs9.3 trillion.

Speaking at an analysts briefing post the latest monetary policy announcement, SBP Governor Jameel Ahmad was quoted as saying that the country was expected to receive around half a billion dollars from the Asian Development Bank (ADB) next week which would boost the SBP’s foreign exchange reserves to $11.7 billion.

Besides, the inflow of remittances from overseas Pakistanis was projected to increase to over $3 billion in October compared to an average of $3 billion a month received in the first three months (July-September) quarter of fiscal 2024-25.

The robust remittances were expected to maintain the balance of the current account at break-even level for the month of October, as has been the case in the first three-month period of the current fiscal year, Ahmad was quoted as saying by analysts.

In its latest Monetary Policy Statement (MPS), the central bank said that the agricultural output for the current Kharif season had been better than earlier estimates. “Higher-than-targeted estimates of rice and sugarcane production have more than offset the estimated shortfall in maize and cotton output.”

The bank, however, stood by its original projection for economic growth in the range of 2.5 to 3.5% for FY25.

The central bank said that the rate reduction had been made on the back of a faster disinflation in the economy than projected earlier, bringing it down within the medium-term limits of 5-7% with the September reading coming in at 6.9% and 7.2% in October.

“The committee [Monetary Policy Committee (MPC)] assessed that the tight monetary policy stance continues to play an important role in sustaining the downward trend in inflation,” the central bank said in the statement.

“Moreover, a sharp decline in food inflation, favourable global oil prices and absence of expected adjustments in gas tariffs and petroleum development levy (PDL) rates have accelerated the pace of disinflation in recent months,” the SBP added.

“Taking into account the inherent risks associated with these factors, the MPC assessed that the near-term inflation may remain volatile before stabilising within the target range (of 5-7%).”

The accelerated disinflation supported the bank to make an aggressive cut of 2.5 percentage points. The move would support businesses to ramp up production activities and support economic growth to be better in the year compared to 2.5% in the previous fiscal year (FY24).

The latest drop of 2.5 percentage points in the policy rate is higher than the domestic financial markets’ consensus for 2 percentage points. This was the fourth consecutive reduction in the policy rate since June this year.

The bank noted that imports were gradually increasing with the softening of the monetary policy and projected the imports would further liberalise in the ongoing year. They, however, would remain in affordable range, limiting current account deficit in the range of 0-1% of GDP in the current fiscal year.

“The latest data showed a gradual pick-up in economic activity,” SBP said, adding that major Kharif crops had turned out to be better than the earlier expectations.

“Moreover, the pace of industrial activity is gaining further traction. In particular, textile, food, automobile and allied industries have recorded significant growth during July-August 2024, which is expected to gain further momentum in the coming months.”

This assessment is supported by increase in imports of raw materials and machinery, improvement in business confidence, and easing of financial conditions. Better prospects for the commodity-producing sectors and the easing of inflationary pressures are also expected to support the services sector.

“The average inflation for FY25 to be significantly lower than its previous forecast range of 11.5 – 13.5%. (The)...outlook is subject to multiple risks, such as escalation in the Middle East conflict, recurrence of food inflation pressures, ad hoc adjustments in administered (energy) prices and implementation of contingency taxation measures to meet shortfalls in revenue,” the bank said.

“Relatively higher workers’ remittances and exports will help keep the current account deficit within the projected range of 0-1% of GDP. This, together with the realisation of planned official inflows, is expected to increase the SBP’s foreign exchange reserves to around $13 billion by June 2025.”

Governor Ahmad was also quoted as saying that, in FY25, Pakistan’s total repayment and interest obligations were $26.1 billion. Out of this, $5.7 billion, including $2.3 billion rolled over, had already been serviced. The remaining $20.6 billion includes anticipated rollovers of $14.1 billion, leaving a net repayable amount of $6.3 billion in the year.

With the availability of additional funds worth Rs2.7 trillion to the government by the SBP from its net profit of Rs4 trillion in FY24, the local domestic debt now comprises 21% of T-bills (short tenor) which previously was 24% and expected to come down to less than 20% by end FY25.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ