ITFC to expand trade financing portfolio in Pakistan

Aurangzeb pledges full support, highlights positive economic indicators at roundtable

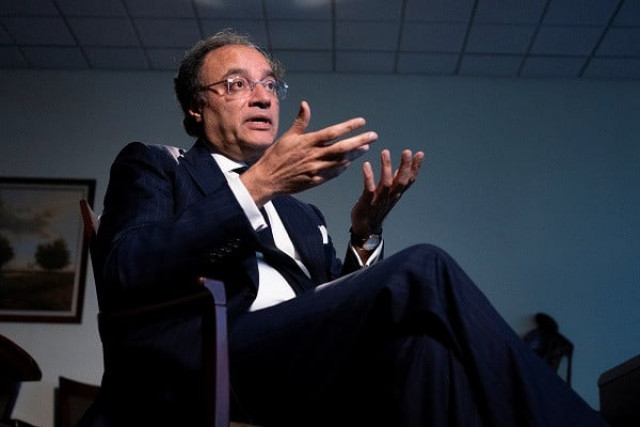

Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb, pledged his government's full support to the Islamic Trade Finance Corporation (ITFC) for diversifying its portfolio in Pakistan.

According to a press release issued by the finance ministry on Thursday, the minister met with an ITFC delegation led by CEO Engineer Hani Salem Sonbol in Washington. The minister appreciated the ITFC's ongoing support, including $3 billion in commodity financing through a framework agreement over the next three years, and the immediate provision of $269 million through a mix of direct financing and syndication.

"ITFC expressed its commitment to expanding its portfolio in Pakistan, and the finance minister assured full government support in this regard," the statement added.

Separately, the minister attended a roundtable with institutional investors organised by Jefferies International. He briefed investors on Pakistan's positive economic indicators, driven by the successful Stand-By Arrangement (SBA), and highlighted key reforms aimed at boosting the tax-to-GDP ratio, reducing energy sector losses, improving state-owned enterprise (SOE) governance, accelerating privatisation, and curbing government expenditures through right-sizing efforts.

The minister also attended a meeting with the Managing Director of the International Monetary Fund (IMF) alongside finance ministers, central bank governors, and heads of financial institutions from the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region. In his remarks, he emphasised the importance of embedding social protection measures into IMF lending frameworks and urged the Fund to expand climate resilience financing. He also welcomed IMF initiatives focusing on debt relief and concessional financing for vulnerable nations.

During a meeting with Amy Holman, Assistant Secretary of State for Economic and Business Affairs at the US Department of State, the minister stressed the importance of the Pak-US economic partnership. He highlighted investment opportunities in Pakistan's agriculture, IT, energy, and mining sectors, inviting US enterprises to explore these areas.

The minister also held talks with Deutsche Bank, where he expressed satisfaction with Pakistan's recent credit rating upgrades by Fitch and Moody's. He noted the development of a Sustainable Finance Framework (SFF) to enable Pakistan's access to the green international capital market.

Additionally, at a roundtable organised by the Coalition of Finance Ministers for Climate Action, the finance minister participated in discussions on scaling up nature finance and addressing the biodiversity finance gap. In meetings with Standard Chartered Bank and Fitch Ratings, he expressed confidence in Pakistan's economic outlook and discussed further partnerships in trade and climate financing.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ