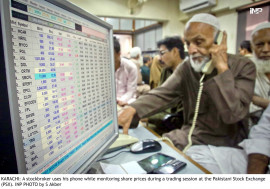

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed lower by 216 points on Thursday, as late-session selling erased earlier gains.

The index, which fluctuated throughout the day, settled at 85,453.22 points, marking a 0.25% decline. Trading volume on the all-share index fell to 503.75 million shares, with PTCL leading at 52.24 million shares traded.

Topline Securities noted a tug-of-war between bulls and bears, with the latter prevailing due to significant developments in the energy sector.

Two independent power producers (IPPs), Hub Power Company Limited (HUBCO) and Lalpir Power Limited (LPL), disclosed material information that shifted market sentiment, both announcing early termination of their contracts.

HUBCO, Pakistan’s largest IPP, revealed that it had reached a settlement agreement with the government and the Central Power Purchasing Agency to clear outstanding receivables by October 2024.

Meanwhile, the federal cabinet approved the termination of Power Purchase Agreements with five IPPs, part of broader reforms aimed at addressing the country's struggling power sector.

On the international front, Saudi Arabia's Minister for Investment, Sheikh Khalid Bin Abdul Aziz Al Faleh, announced that Saudi Manara Minerals would soon sign an agreement with Barrick Gold and Pakistan’s State-Owned Enterprises (SOEs).

The minister, leading a delegation of Saudi private sector companies, also met Pakistan’s Chief of Army Staff, General Asim Munir, to discuss initiatives to bolster bilateral cooperation.

Moreover, the Pakistani rupee weakened slightly, ending 0.02% lower against the US dollar at Rs277.79 in the interbank market. The World Bank, in its recent report, projected Pakistan’s real GDP growth at 2.8% for FY25, reflecting optimism amid ongoing economic recovery efforts.

1723101439-0/kanye-(2)1723101439-0-165x106.webp)

1728562807-0/milton-(2)1728562807-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ