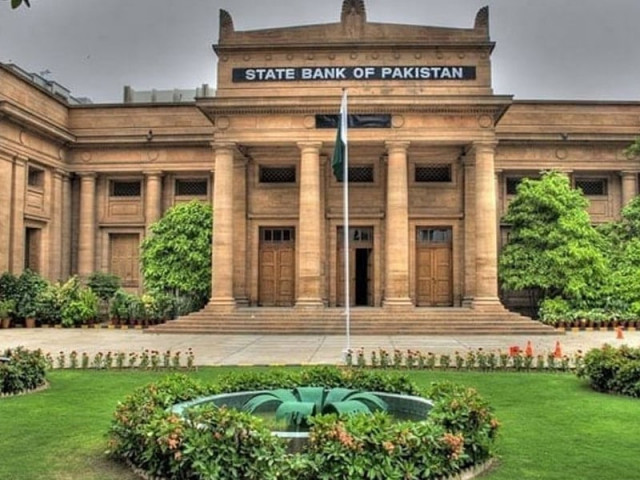

Geopolitical tensions a concern: SBP

Governor asks foreign firm to set up support centre for safety of banking system

The State Bank of Pakistan (SBP) has voiced serious concern over the continuity of safe banking in the country at a time of fast rising geopolitical tensions as around 20 financial institutions including the central bank itself are using the core banking systems of a top global banking software company, Temenos, which is operating from a foreign country.

Speaking at a conference titled "Bank of the Future Forum 2024", hosted by Systems Limited and Temenos, SBP Governor Jameel Ahmad asked the European IT firm to establish a support centre in Pakistan instead of continuing to operate from a foreign country. "This will ensure the continuity of services in times of geopolitical volatility and stress," he emphasised, adding that as a regulator "we do not only want to ensure this safety and robustness of our financial system, but also want to see local expertise developed not that in support systems only but also in designing and developing systems."

He highlighted the SBP's digital transformation, which started in 2002, when it implemented the Temenos banking system and an Enterprise Resource Planning (ERP) system for non-banking transactions and a data warehouse for massive data-related requirements.

Temenos is running 62 offices in 39 countries around the globe, including five offices in Pakistan's neighbouring country India, according to its official website.

Ahmad, however, praised Temenos for providing outstanding systems and services to Pakistan's robust financial sector, adding that the "adoption of its systems has helped transform the banking industry into a state where it is today the future of banking is the future of the economy." The SBP has adopted at least two core systems from the company – one for currency operations and the other for banking functions.

Ahmad said the SBP was the first client in Pakistan that adopted Temenos core banking systems in 2000. In 2015, the central bank upgraded its core banking systems to the advance level.

"Today, there are 20 financial institutions in the country that have opted for the solutions. Over the past two decades, a large number of Pakistani professionals have been trained in these systems."

First digital bank in three months

Speaking to media on the sidelines of the conference, SBP Governor Jameel Ahmad announced that the first digital bank was expected to start functioning with full-scale seamless banking in the next two to three months.

Telenor Microfinance Bank/Easypaisa is going to emerge as the first full-fledged digital bank in the country as it has already been in the business since long.

The remaining four, out of the total five digital banks, are close to completing their "operational readiness". They are expected to acquire pilot project licences from the State Bank in the first quarter (Jan-Mar) of calendar year 2025 and begin full-fledged digital retail banking by the middle of the year.

Forex reserves above $10.7b

The central bank chief also said that Pakistan's foreign exchange reserves, held by the SBP, rose above $10.7 billion after the receipt of the first International Monetary Fund (IMF) loan tranche of $1.03 billion last week. The reserves had last been at that level around 29 months ago.

Now, the reserves can cover over two months of import financing compared to less than one month in the recent past.

Responding to a question on the market talk of rupee depreciation in the near future, the central bank governor said "he does not comment on the future trajectory of rupee-dollar parity", but there was ample supply of dollars in the foreign exchange market.

It was reflected in the continuous growth of foreign currency reserves over the past nine consecutive weeks, robust worker remittances and increase in export earnings. "Imports and other requirements are being met easily."

Ahmad ruled out any pressure in the currency market with inflows remaining high including through the Roshan Digital Account (RDA), keeping foreign currency liquidity elevated in the market.

"This is building confidence in the economy. Such developments will impact the economy positively."

He stressed that there was adequate supply of local currency with the government, suggesting the state financing requirement had dropped significantly.

The availability of huge liquidity has allowed the government to return loans to commercial banks earlier than schedule through buying back the debt instrument, ie, T-bills. "All of this is going to cut the cost of borrowing for the government and leave a positive impact on the economy," he remarked.

The governor dismissed the notion suggesting that the government had planned to borrow Rs10 trillion from commercial banks over a period of three months from October to December 2024, mainly to repay the old debt. Instead, he said, the government was returning loans to banks, which may use the funds to provide credit to the private sector.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ