Weekly review: Bulls return to the helm

Benchmark index gains 215 points while activity almost doubles at the Karachi Stock Exchange.

After dropping 9.2% in the month of Ramazan, bulls returned to the helm as the stock market rose for four of the five sessions during the outgoing week.

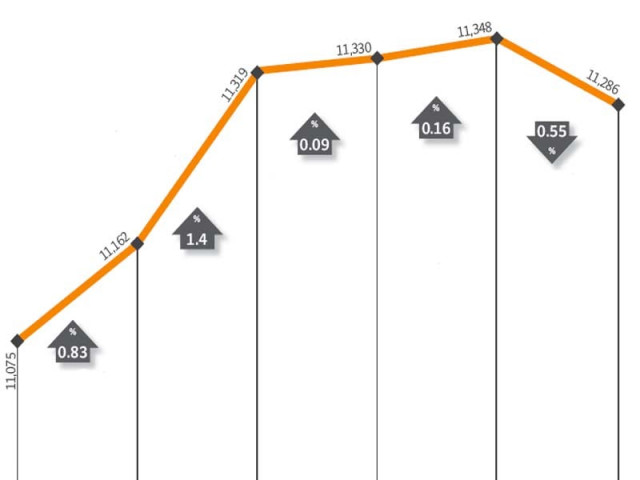

The Karachi Stock Exchange’s benchmark 100-share index gained 215 points or 1.95% on a weekly basis to stand at 11,286 points.

Foreign portfolio inflows of $1.7 million and improvement in law and order situation provided additional support and kept investor interest high, according to a KASB Securities research note. Another bright spot in the market was average daily volumes rising 83 per cent to stand at 82.2 million shares.

For corporate results, the week was a mixed as Pakistan’s major independent power producers (IPPs) Kot Addu Power Company and Hub Power Company announced robust set of numbers, increasing investor interest. On the other hand, smaller IPP Nishat Power encountered substantial selling pressure due to lack of dividend announcement, resulting in the stock falling 11.7% during the week.

As the result reason is at its peak, investors are taking more interest in the scrips which are providing upward potential.

Earnings of DG Khan Cement declined by 27% in fiscal 2011 owing to higher tax rate while Nishat Mills profits grew 66%.

Bank and chemical stocks led the way as they outperformed the benchmark index by 3.6% and 2.7% respectively, while the oil and gas sector underperformed by 0.7%, according to JS Global Capital.

Among individual stocks National Bank of Pakistan outperformed the index by 18% as attractive dividend yield lured investors. Another banking giant MCB Bank also remained active and outperformed the index by 3% on the back of news that the bank has initiated the process of getting its shares enrolled for American Depository Receipts, a way for making the bank’s shares available for trading at the New York Stock Exchange.

Engro recovered by 13% during the week due to resumption of gas supply for Qadirpur gas field before expectation.

Outlook

Attock Group companies are due to announce results early next week, which will act as a catalyst in keeping investors interested. However, investors will also be mindful of developments on the macro landscape, says the KASB note. Pakistan-IMF talks are scheduled for late September along with central bank’s monetary policy decision where expectations of further easing are gaining traction as evident from the latest T-bill auction, adds the note.

Monday, September 5

Renewed investor interest after a five-day break helped the Karachi stock market close higher. Continued buying from local institutions helped National Bank of Pakistan and Engro Corporation rise five per cent to their upper circuit breaker.

Tuesday, September 6

The stock market continued its upward trend amid rumours of healthy foreign activity. National Clearing Company of Pakistan Limited data, released after the trading session, confirmed these rumours as foreign institutional investors were net buyers of shares worth Rs150 million.

Wednesday, September 7

After gaining more than 150 points in two days, the market witnessed profit-taking to close in the same range. Investors preferred to play it safe as profit-taking was witnessed at different levels due to the uncertain political scenario.

Thursday, September 8

The stock market continued its upward trend and rose 19 points on continued local institutional support amid healthy activity. Pakistan State Oil gained 1.7% over news that the finance ministry will borrow Rs100 billion from commercial banks to help settle the circular debt.

Friday, September 9

After gaining for the entire week, the stock market fell amid profit taking in the last trading session before the weekend break. The downward trend was in line with Asian and European markets.

Published in The Express Tribune, September 11th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ