Wall Street’s hottest stock celebrated in style, but Nvidia’s earnings leave investors mixed

Nvidia’s 'Super Bowl' earnings party draws tech and finance enthusiasts, but the stock slide dampens the mood.

The anticipation was palpable at the Store House in Chelsea on Wednesday afternoon, where around 60 tech enthusiasts and investors gathered to watch Nvidia’s quarterly earnings report—a spectacle that felt more like a New Year’s Eve celebration than a financial briefing.

Decorated with black, green, and white balloons and buoyed by floating bubbles, the event was the brainchild of Lauren Balik, whose spur-of-the-moment tweet had brought finance and tech fans together to witness what many considered the "most important stock on planet Earth" reveal its latest numbers.

Nvidia, a titan in the computer-chip industry, has been at the center of Wall Street’s attention, skyrocketing past a $3 trillion market value this year and tripling in value over the past 12 months.

The company's meteoric rise has turned it into a symbol of hope and success in an otherwise uncertain economy, drawing a loyal following of investors and fans alike.

As the clock ticked down to 4:20 p.m., the crowd swelled, and the excitement reached a fever pitch.

CNBC even broadcast the event with a countdown clock, treating it like a major holiday.

The room was filled with investors, many in their 20s, eager to see how their shares had performed.

One attendee, who has been investing in Nvidia since 2017, revealed that the profits from his investments had allowed him to purchase a studio apartment in Hudson Yards and plan for early retirement next year.

But when Nvidia’s earnings were finally announced—$30 billion in revenue from April to June—the atmosphere quickly deflated.

While the earnings were better than some estimates, they fell short of the lofty expectations set by Wall Street’s most ardent supporters.

The stock price initially traded sideways before dropping around 7%, leaving some attendees visibly disappointed.

Balik, who had hoped to play the earnings call over the bar’s speaker system, watched as the crowd thinned out soon after the announcement.

"I was pulling for Nvidia to go down a bit. I thought it would be funnier," she remarked, adding, "But I don’t want anybody to lose their shirt!"

Quarterly earnings results are typically routine check-ins for public companies in the U.S., rarely generating such fanfare.

But Nvidia is not just any company. As the best-performing stock in the S&P 500 this year, Nvidia has more than doubled in value in 2024 after tripling in 2023.

With a market value exceeding $3 trillion, Nvidia is one of the world’s most valuable companies, wielding an outsized influence on market benchmarks and investor sentiment.

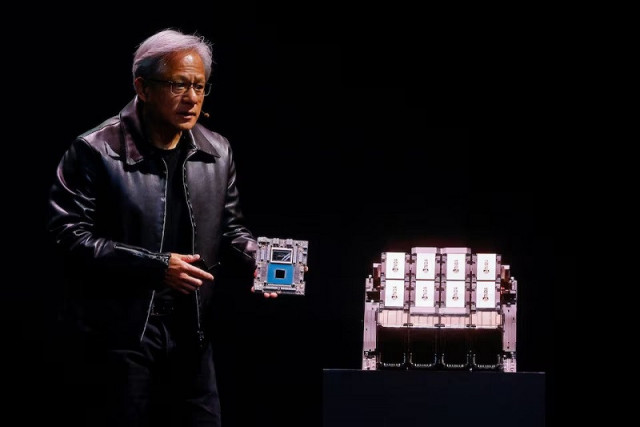

Leading up to the earnings release, some market watchers speculated that Nvidia CEO Jensen Huang’s comments during the earnings call might have a more significant impact on the market than even Federal Reserve Chair Jerome Powell’s address in Jackson Hole, Wyoming.

Powell’s speech laid out plans for a monumental shift in interest-rate policy in the coming months, but Nvidia’s earnings report remained a major focal point.

In prior quarters, Nvidia's earnings results have triggered market reactions comparable to those seen after major economic reports, such as the monthly labor report or inflation figures, according to Deutsche Bank.

Ahead of this week’s release, traders were betting on a potential swing of around $300 billion in Nvidia’s market value following the report. However, the expected dramatic reaction did not materialize.

"There are people putting the entire U.S. stock market on the shoulders of Nvidia," said Michael Antonelli, a managing director at Baird. "Which seems absurd."

The hype surrounding Nvidia’s earnings extended beyond the financial community, with social media buzzing with memes and predictions.

Shareholders and market enthusiasts on X (formerly Twitter) shared various greetings, such as "Happy Nvidia earnings day to all who celebrate."

Some took a more poetic approach, like financial writer Christopher Robb, who posted a 14-line rhyming poem on X and LinkedIn, beginning with, "’Twas the night before Nvidia earnings, / And all over Wall Street, / So many were hoping for a sweet bullish beat."

The excitement even led to merchandise offerings, with the social-media platform Stocktwits selling an "$NVDA Day ‘Bought the Dip’ Snapback" hat for $33 and a beanie featuring the ticker symbol for $23.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ