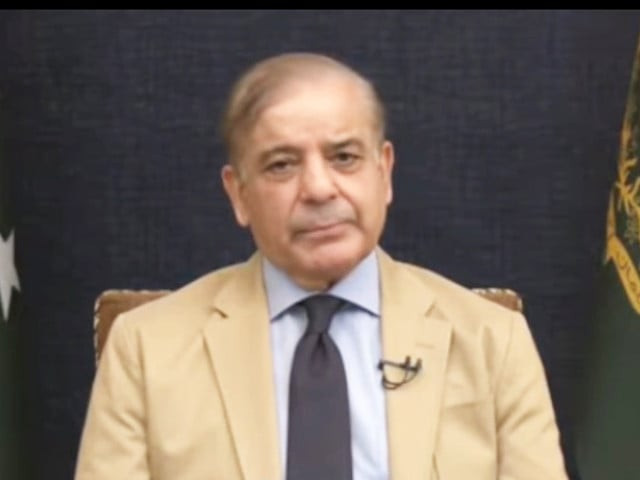

PM Shehbaz orders FBR to revamp revenue strategy to combat national debt

Premier advised against harassing traders, investors; advocated for their facilitation, directed timely tax collection

Prime Minister Shehbaz Sharif has directed the Federal Board of Revenue (FBR) to reassess its revenue collection strategy to help reduce the country's debt burden.

During a meeting at the FBR headquarters on Saturday, the premier stressed the need to bring sectors that are not currently paying taxes into the tax net. He emphasized the importance of digitizing the FBR's processes, ensuring the implementation is comprehensive and coordinated.

The prime minister pledged full support to the revenue collection body in acquiring the latest technology.

PM Shehbaz commended the FBR for achieving a 30% increase in tax collection during the last financial year and highlighted the goal of reaching the 13 trillion rupees tax collection target for the current fiscal year.

However, he advised against harassing traders and investors, advocating instead for their facilitation and ensuring taxes are collected where due.

PM Shehbaz lauded the finance team for securing a staff-level agreement with the International Monetary Fund (IMF) and expressed confidence that the IMF board would approve it. He called for swift and tireless efforts to ensure this program would be the last of its kind for Pakistan.

The premier also emphasized the need for structural changes to improve macroeconomic indicators and set the country on a development path.

He also directed the immediate release of two billion rupees to modernize the Web-based One Customs System (WeBOC).

The meeting was informed that 4.9million taxable individuals have been identified using modern technology.

The premier instructed the FBR to expand the tax base and bring these identified individuals into the tax net promptly.

PM Shehbaz was briefed on the FBR's trader-friendly mobile application, which automates processes from registration to tax submission, facilitating ease of use for taxpayers.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ