Production at big industries slows down

LSM index contracts 4.14% in Feb as compared to previous month

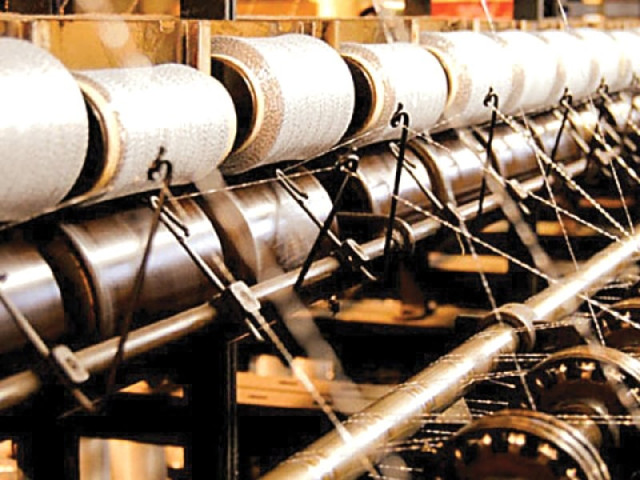

The production of goods at large-scale manufacturing industries (LSMI) such as food, textile, fertiliser and construction material dropped for the second consecutive month, contracting to around 126 on the Quantum Index of Manufacturing (QIM) for February 2024.

Pakistan Bureau of Statistics (PBS) reported on Tuesday that the LSMI reading dropped 4.14% to 126.1 in February when compared with January 2024. The heavy industrial sector, however, managed to grow 0.6% in the month under review as compared to the same month of last year.

“Overall, the large-scale manufacturing sector recorded a negative growth of 0.51% during July-February 2023-24 compared with the same period of last year,” the PBS reported.

Data breakdown showed that the production of goods in food, wearing apparel, coke and petroleum products, chemicals, fertiliser, pharmaceutical, machinery and equipment, and furniture sectors increased in FY24 while the output of tobacco, textile, paper and board, non-metallic mineral products, iron and steel products, electrical equipment, automobiles and other transport equipment decreased.

Experts said the large-scale manufacturing sector would continue to remain sluggish in the remaining four months of FY24 in the current economic scenario, when there were not too many driving factors that could significantly fuel activity in major industries.

They pointed out that the elevated inflation reading and high interest rate were not letting the big industries perform better as the two major factors undermined aggregate demand from consumers in the country.

Experts, however, remained divided whether the central bank would slash its policy rate in the monetary policy announcement in late April amid increase in international crude oil prices, caused by the deepening Middle Eastern crisis.

Secondly, Pakistan has begun talks with the IMF to secure a new, larger loan package to continue to repay the maturing foreign debt and get the much-needed financing to shore up economic activities. Pakistan aims to win the IMF’s programme by the end of June 2024, while the global lender has urged the government to keep a tight monetary policy.

Published in The Express Tribune, April 17th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ