PM announces incentives for top exporters, taxpayers

Announces issuance of blue passports to 66 winners of tax and export excellence awards

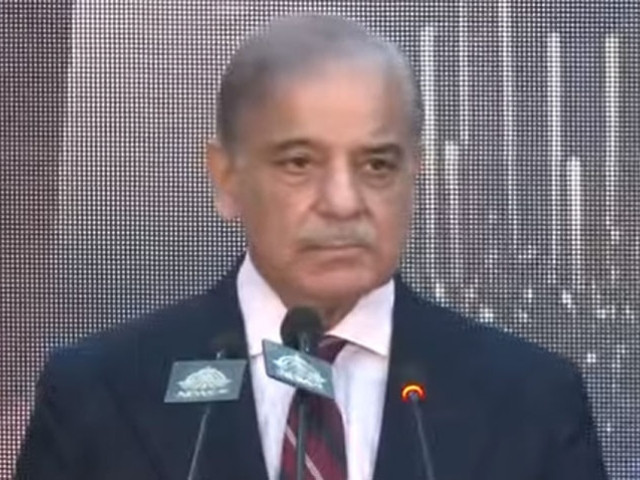

Prime Minister Shehbaz Sharif on Tuesday announced special incentives for the country’s leading exporters and taxpayers.

He announced the issuance of blue passports to 66 winners of tax and export excellence awards, a privilege typically reserved for state and government functionaries. These 66 winners would also receive the ‘Pakistan Honour Card’ in recognition of their services.

Out of the pool of 66 recipients, 38 were exporters, and 28 were taxpayers who received the awards from Prime Minister Shehbaz Sharif. The prime minister also announced the topper of each individual category of exporters and taxpayers as Pakistan’s honorary ambassadors.

The leading exporters and the highest taxpayers are the heroes of the nation, said Sharif. The list of the top taxpayers in all categories and the companies categories also reveals the shallowness of Pakistan’s economy.

The public sector companies and the commercial banks remain the largest tax contributors.

Finance Minister Muhammad Aurangzeb urged the business community to shun the import-led subsidies-driven business models and shift to export-led growth. The Minister said that the import-led business models were no longer sustainable.

The PM said that the chairman of the Muslim Commercial Bank (MCB) Mian Muhammad Mansha was the highest-income taxpayer with a Rs26 billion income tax contribution. The Style Textile was Pakistan’s single largest exporter that exported $522 million in goods in the last fiscal year, said the PM.

In the category of the ‘all the taxes’, state-owned Pakistan State Oil (PSO) was the highest taxpayer with Rs167 billion, followed by Pakistan Tobacco Company (PTC), Oil and Gas Development Company Limited (OGDCL), Pak-Arab Refinery (PARCO), Pakistan Petroleum Limited (PPL) and the Indus Motors.

The OGDCL in fact paid the highest income tax but since it was clubbed in all categories of taxpayers, the MCB became top-income taxpayers.

In the income tax category, Mian Mansha’s MCB was the highest taxpayer, followed by the United Bank Limited, Standard Chartered Bank, Habib Bank Limited and the National Bank of Pakistan.

In the category of individuals, Imtiaz Stores was the highest taxpayer with Rs683 million income tax contribution and Musadaq Zulqarnain of Interloop paid Rs458 million.

In the category of exporters, Style Textile was the leading exporter with $522 million in exports, followed by Interloop Prvt Limited and Nishat Mills. Former Finance Minister Miftah Ismail’s Ismail Industries was the highest exporter of the biscuit items. ICI Pakistan was the highest chemical exporter.

The Prime Minister said that the purpose of the ceremony was to recognize the heroes of the nation and those who honestly paid taxes and served the country through their talents, with the setting up of small and medium businesses, women entrepreneurs and those who had spurred the non-traditional exports.

Read PM directs swift action against tax defaulters, evaders

The exporters would be happier getting regionally competitive energy rates instead of receiving these rewards, said Bashir Dewan, the President of the Pakistan Business Council.

Shehbaz Sharif lamented about the poor reputation of Pakistan, saying that when we go abroad even without a begging bowl in hand, foreign countries think we have the begging bowl under our arms.

The PM said that the Special Investment Facilitation Council (SIFC) was working to address the issues of red tapism, delays and inefficiency to attract investment.

The PM said that he has instructed to shut down junk government-owned power generation companies, outsource the international airports and privatise Pakistan International Airlines.

The government on Monday constituted the PIA board in an emergency. The board met on Tuesday and approved the segregation of the PIA for filing a scheme of arrangement with the Securities and Exchange Commission of Pakistan, meeting one of the milestones for its privatisation.

It is expected that the SECP will approve the scheme of arrangement by Friday. The government plans to issue an expression of Interest on April 2 to invite bids for PIA privatisation. The tentative date for PIA bidding is June 11th.

The PM said that the FBR’s restructuring was in full swing and the government would appoint international consultants next month to digitise the tax machinery. He said that about Rs2.7 trillion in tax revenues were under litigation and he had requested the Chief Justice of Pakistan to timely decide these pending cases.

He underscored the need for the appointment of competent tribunal heads to expeditiously dispose of the pending litigation. He also appreciated the tax collectors and said that the good and competent tax collectors would also be given public recognition.

The prime minister also termed another IMF programme a requirement for the country’s economic stability. The premier once again said that he supports reducing the number of income tax slabs and increasing the narrow tax base.

He said that Pakistan enjoyed excellent ties with China and said that the second phase of the China-Pakistan Economic Corridor (CPEC) would expedite the economic development.

Chairman FBR Malik Amjad Zubair Tiwana highlighted different measures of FBR to increase tax net and revenue generation including facilities in payment and compliance of taxes by enhancing the use of technology.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ